VeChain Price Prediction: Is VET Crypto a Good Investment?

price prediction is one of the most common questions among new crypto investors. Many people see VeChain as a simple supply-chain project, but the ecosystem has grown far beyond that. Today, VET supports real-world businesses, improves product tracking, and helps companies build trust with their customers. This mix of blockchain and real utility makes VeChain an interesting option for long-term analysis.

The current price of VET sits near $0.017. The token has moved within a clear range this month, dropping to around $0.015 on October 11 and reaching a monthly high close to $0.024 on October 4. These swings show how sensitive VET is to market sentiment, BTC moves, and global crypto trends. Many beginners ask if these fluctuations signal a future recovery or only short-term noise.

In this guide, you will learn everything needed to understand VeChain. You will discover how the blockchain works, what makes the project unique, and why large companies use it. You will also see price history highlights, expert forecasts, and long-term VET price prediction data for 2025–2050.

By the end, you will know what influences VET’s value, how analysts view the token, and whether VeChain might be a good long-term Funding. If you want a clear and friendly explanation of this project, you are in the right place.

| Current VET Price | VET Price Prediction 2025 | VET Price Prediction 2030 |

| $0.017 | $0.05 | $1 |

VeChain is a public platform created for businesses. It focuses on supply-chain management and real-world process automation. The project launched in 2015 and quickly became one of the leading examples of how blockchain can support industries outside the crypto world. VeChain uses the VeChainThor blockchain as its core infrastructure. This network provides tools that help companies track products, confirm authenticity, and improve transparency at every stage of production. The system connects blockchain with IoT devices, using QR codes, NFC chips, and RFID tags to give each physical item a unique digital identity. This mix of hardware and software helps companies prevent fraud, reduce losses, and build trust with customers.

VeChain was created by two founders with strong backgrounds in technology and enterprise operations. Sunny Lu, the CEO, previously worked as CIO at Louis Vuitton China. His experience in luxury supply chains helped shape VeChain’s mission to bring clarity and trust to complex logistics systems. Jay Zhang, the CFO, spent more than 14 years at Deloitte and PwC. He built the project’s financial structure and contributed to the design of its governance model. Their combined experience allowed VeChain to target businesses with real needs and long-term challenges.

The project first operated as a subsidiary of Bitse, one of China’s largest blockchain companies. In the early years, VeChain focused on product authentication and shipment tracking. In 2017, the project went through a rebranding process. One year later, it launched the VeChainThor blockchain. This new chain uses a Proof of Authority consensus model with 101 Authority Masternodes. These nodes validate transfers, maintain network security, and support stability.

VeChain originally issued VEN tokens on the blockchain. After the launch of VeChainThor, the project swapped VEN for VET at a 1:100 ratio. VET became the main token used for value transfers, while powers transfer fees. This dual-token model helps businesses use the blockchain without facing unpredictable gas costs. It also makes the system more stable and easier for companies to integrate into their existing processes.

VeChain continues to expand its network of partners. It works with companies in luxury goods, food safety, logistics, energy, and environmental management. The project aims to build simple tools that allow enterprises to adopt blockchain without technical barriers. This vision allocations VET as a long-term player in the market.

| Current Price | $0.017 |

| Market Cap | $1,495,471,422 |

| Volume (24h) | $25,679,021 |

| Market Rank | #86 |

| Circulating Supply | 85,985,041,177 VET |

| Total Supply | 85,985,041,177 VET |

| 1 Month High / Low | $0.024 / $0.015 |

| All-Time High | $0.281 Apr 19, 2021 |

CoinGecko, October 29, 2025

VeChain entered the public market in 2017 as an ERC-20 token under the ticker VEN. The token launched on marketplaces on August 22, 2017, at around $0.24. During the ICO phase, investors bought 3500 VEN for 1 ETH, which placed the token near $0.11. By September, VEN traded between fractions of a cent and climbed over +200% in one month. October became the turning point. VEN surged from $0.0016 to $0.212 and even touched $0.284 at its peak. This jump marked an incredible +13,000% rally. Rise continued in November with a moderate +18% rise. In December, the entire crypto market exploded. VEN jumped from $0.25 to $2.29, reaching a peak at $2.31. This move delivered an +816% increase in a single month.

The year started with VEN reaching its historical peak as an ERC-20 token. On January 22, 2018, the price topped around $9.7. Soon after, the team announced the rebrand to VeChainThor. Partnerships expanded, including a major collaboration with DNV GL. The VeChainThor mainnet launched on June 30, 2018. VEN tokens were swapped to VET at a 1:100 ratio. VET started trading near $0.013 but fell sharply as the broader bear market took over. Between July and December, the token declined heavily, falling to about $0.004 by year-end. VeChain lost around −80% in 2018.

In 2019, VET traded in a narrow range between $0.003 and $0.009. The year opened at $0.0039 and closed at $0.0052, delivering a modest +35% gain. June was the strongest month with a +20% jump, followed by a sharp −40% correction in July. November added +55%, helping the token end the year with a +30% performance.

March 2020 brought VeChain’s all-time low around $0.00168–$0.00191 during the COVID-19 crash. From that moment, VET entered a steady recovery. April and May brought +40% and +45%. June and July added +40% and +95%. By the end of the year, crypto markets turned strongly bullish. November added +60%, and December +15%. VET ended 2020 with a massive +260% yearly surge.

The first months of 2021 pushed VET into a strong rally. January delivered +35%. February added +55%. March increased by +120%. The peak arrived in April. VeChain reached its all-time high near $0.278–$0.281. This was followed by a sharp sell-off. May and June dropped −40% and −30%. July bottomed near $0.058. A brief rebound came in August, but the final months remained mixed. VET closed 2021 near $0.08, still up +340% for the year.

VeChain entered 2022 with a −35% January drop. A short recovery came in March with +50%, but the bear market dominated the rest of the year. April, May, and June fell by −40%, −30%, and −30%. October traded near $0.023, more than 90% below the ATH. The year closed around $0.0158. Overall, 2022 ended with a dramatic −80% loss.

The start of 2023 brought strong moves. January rose +45%. February jumped +15% and briefly pushed VET above $0.03. Then a multimonth correction followed. March through August showed continuous declines. June set a yearly low near $0.0134. The market recovered slowly from September, with three positive months in a row. December closed with a powerful +60% rise, and the year ended near $0.034, a +120% gain.

VET opened 2024 with a −20% dip but rebounded in February with +70%. Early in the year, the token touched $0.0495 and later spiked to $0.0775 during peak bullish sentiment. The following months were volatile, with several double-digit declines. The final quarter brought recovery in September and a huge +115% rally in November. The year ended with a mild decline, and VET closed around $0.04, up +25%.

2025 began with +10% Rise. However, February and March brought severe corrections of −40% and −20%. April showed a short recovery, but May and June returned to red territory. By September, VET traded between $0.021 and $0.026. October showed strong volatility. After reaching $0.02 mid-month, the price dropped again. As of the end of October 2025, VET trades near $0.017, around 95% below its ATH. The token is down −40% year-to-date and −20% over the last 12 months.

| Year | Minimum Price | Maximum Price | Median Price | Price Change |

| 2025 | $0.015 | $0.084 | $0.05 | +200% |

| 2026 | $0.038 | $0.37 | $0.2 | +1,100% |

| 2030 | $0.083 | $2.13 | $1 | +5,800% |

| 2040 | $12.23 | $18.16 | $15 | +88,000% |

| 2050 | $20.11 | $23 | $20 | +117,500% |

expects VeChain to trade between $0.0155 (-10%) and $0.0379 (+120%) in 2025. Their forecast suggests moderate Rise with possible short-term dips below today’s value.

According to , VET may reach a yearly low of $0.025 (+45%), while the Maximum target sits at $0.0273 (+55%).

is much more bullish for 2025. Their minimum projection is $0.026 (+50%), and their maximum is $0.084 (+380%), which suggests a strong rally if market sentiment improves.

DigitalCoinPrice forecasts that VeChain could climb to $0.0443 (+155%) at its Maximum point in 2026. The minimum expected price is $0.0373 (+115%), showing confidence in continued Rise.

PricePrediction analysts believe the lowest price for 2026 may be $0.0362 (+110%), while the top of the range may hit $0.0434 (+150%).

Telegaon provides the most aggressive outlook. They predict a minimum of $0.085 (+390%) and a maximum of $0.37 (+2,050%), reflecting a possible major expansion of the VeChain ecosystem.

DigitalCoinPrice believes that in 2030, VET might trade between $0.0826 (+375%) and $0.095 (+445%), suggesting steady long-term appreciation.

PricePrediction forecasts a minimum of $0.1631 (+840%) and a maximum of $0.1954 (+1,050%), indicating a possible 10× Rise from today’s price.

Telegaon delivers the most explosive outlook once again. Their 2030 targets range from $1.51 (+8,600%) to $2.13 (+12,150%), which would place VeChain among the Maximum-performing assets of the decade.

PricePrediction projects that VET might reach a minimum of $14.93 (+85,700%) by 2040 and potentially soar to $18.16 (+104,500%).

Telegaon forecasts slightly lower but still astronomical long-term values: $12.23 (+70,500%) at the low end and $14.25 (+82,000%) at the high end.

PricePrediction offers an ultra-long-term forecast for 2050. Their minimum estimate is $20.11 (+115,500%), while their maximum reaches $23 (+132,500%).

Various analysts highlight several scenarios for the next stages of the market cycle. , a creator with over 14,000 subscribers, notes that October often brings strong gains. Using Fibonacci levels from the 2021 high to the 2023 low, the analyst identifies the 0.136 level as a realistic short-term target near $0.04.

He also points to falling BTC and stablecoin dominance as early signs of altseason. During these periods, altcoins like VET often outperform. Under stronger market conditions, VeChain could reach the golden pocket between $0.17 and $0.18.

provides a cycle-focused perspective. The analyst expects a major rally as BTC enters its final upward phase. For VeChain to repeat a move similar to 2021, BTC dominance must fall and Tether dominance must weaken. These conditions started forming in late 2025 and increased the chances of VET retesting its all-time high near $0.27.

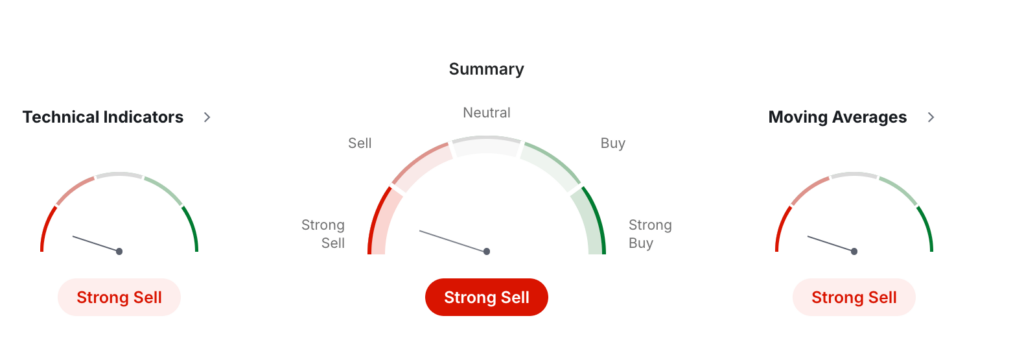

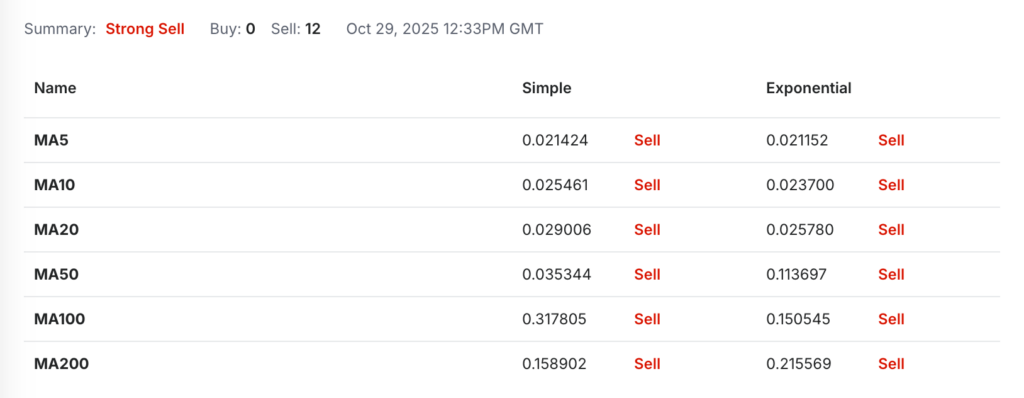

Monthly technical data from shows a clear bearish trend for VeChain as of the end of October 2025. The overall summary signals Strong Sell, with both technical indicators and moving Medians pointing in the same direction. No buy signals appear on the monthly chart, which highlights the weakness in market momentum.

Investing, October 29, 2025

The RSI sits near 44.8, placing VET below the midline and indicating continued downward pressure. Momentum oscillators such as Stochastic and Stochastic RSI show oversold conditions, but this alone does not confirm a reversal. MACD remains negative at −0.004, supporting the bearish picture.

The Median Directional Index (ADX) at 26.5 suggests a strengthening trend. Most indicators, including Williams %R at −90.36 and CCI at −96.32, signal selling conditions. The Ultimate Oscillator at 38.97 adds another bearish confirmation. ROC at −20.30 indicates strong negative momentum. Bull/Bear Power also remains negative, showing sellers control the market structure on a monthly scale.

Moving Medians reinforce the negative sentiment. All tracked simple and exponential Medians—from MA5 to MA200—give Sell signals. Short-term MAs like MA5 and MA10 sit above current price levels, showing immediate weakness. Mid-range Medians such as MA20 and MA50 point lower as well, confirming a persistent downtrend. Long-term MAs highlight the broader picture: MA100 and MA200 remain far above the current trading zone, signaling that VeChain has not yet begun a sustainable recovery phase.

Monthly pivot points place the key support levels at $0.0179 and $0.0147, with the first major resistance at $0.0249. The Fibonacci pivot structure shows a similar balance, suggesting VET must reclaim $0.023–$0.025 to shift momentum. For now, the chart remains firmly bearish, and the price sits closer to support than resistance. This setup implies limited upside unless strong buying pressure returns.

VeChain’s price depends on a mix of market sentiment, real-world adoption, and global crypto trends. The token reacts strongly to changes in liquidity, investor confidence, and economic conditions. When fear enters the market, VET usually drops faster than BTC. When optimism grows, it often recovers at a slower but steady pace. The project is tied to enterprise use cases, so long-term Rise depends on onboarding new partners and expanding adoption across industries. Clear demand from businesses usually strengthens the price structure.

VET also moves with general altcoin trends. When BTC dominance rises, altcoins lose capital, and VeChain usually experiences weaker price action. During altseason, the opposite happens. Lower BTC dominance allows liquidity to flow into utility-focused projects, which can accelerate VET’s Rise. Stablecoin dominance also plays a role. When stablecoin dominance declines, more traders are moving money into riskier assets, creating room for upside pressure on tokens like VeChain.

Several direct factors influence the token’s performance:

- Real-world adoption across supply-chain, logistics, and environmental sectors.

- Enterprise partnerships and long-term corporate integrations.

- Network activity and demand for VTHO, which affects the overall ecosystem use.

- Market cycles, especially BTC’s halving-driven phases.

- Global economic events such as interest rate cuts or liquidity injections.

Regulation also shapes price movement. Positive regulatory clarity usually benefits enterprise-focused chains like VeChain. Negative regulatory news, especially from major markets such as the U.S., China, or the EU, often leads to temporary declines. Investor confidence rises when governments support blockchain innovation, creating a more stable environment for corporate adoption.

Speculation remains an important factor. Many traders follow technical patterns, Fibonacci levels, and moving Medians. Sharp moves often come from momentum trading rather than fundamental developments. Whale behavior can also create volatility, especially during low-liquidity periods. Social media sentiment is another amplifier. Positive narratives around supply-chain innovation or upcoming partnerships can influence short-term movement even without major news.

At its core, VeChain’s long-term value depends on real utility. As more companies anchor data on VeChainThor, demand for the ecosystem grows. This long-term use case supports price resilience. However, short-term moves will continue to mirror broader crypto trends until adoption reaches a larger scale.

VeChain offers a wide set of technical features designed for real-world business adoption. Its core layer is VeChainThor, a Layer 1 public blockchain built for enterprise-grade performance. The chain supports , offers high throughput, and keeps transfer fees extremely low. Developers can deploy ETH-based applications thanks to full EVM compatibility and JSON RPC support. Blocks are produced roughly every 10 seconds, and the network has maintained zero downtime since its launch in 2018, which makes it one of the most reliable chains in the market.

The network uses a Proof of Authority consensus model with 101 Authority Masternodes. These nodes validate transfers and secure the chain with low energy usage. The upgraded PoA 2.0 SURFACE model enhances security by combining Byzantine Fault Tolerance and Nakamoto-style mechanisms. This hybrid approach reduces the chance of forks and provides adaptive safety for enterprise needs. The integration of Verifiable Random Function technology improves randomness in validator selection, strengthening protection against manipulation. The overall consensus design consumes far less energy than traditional Proof of Work systems.

VeChain also includes several advanced protocol features that support flexible transfers. These include Multi-Party Payment, where smart contracts can pay fees on behalf of users, and Multi-Task transfer, which lets several actions run in a single transfer. Users can control transfer lifecycles by setting expiration windows or linking transfers together with dependency requirements. Meta-transfer tools further expand flexibility by allowing tailored fee mechanisms. These features make VeChain more accessible to businesses that require predictable and scalable operations.

IoT integration is another core part of VeChain’s architecture. The network supports hardware such as RFID tags, NFC chips, and QR codes. These devices collect data across supply chains, capturing information about product origin, conditions, and compliance. All data is stored on the blockchain, ensuring it cannot be tampered with. This approach creates trust between companies and customers while improving transparency and safety across industries.

VeChain ToolChain brings blockchain-as-a-service capabilities to enterprises of all sizes. It includes pre-built modules that help companies deploy blockchain solutions without writing code. The platform supports product lifecycle management and allows end users to verify authenticity with the ToolChain Pro mobile app.

The Renaissance Upgrade in 2025 introduces Delegated Proof of Stake. This transition increases decentralization and allows broader participation in validation. It also brings dynamic gas fees and a three-phase rollout through Galactica, Hayabusa, and Intergalactic, shaping VeChain’s next stage of evolution.

VeChain can be a good Funding for people who believe in real-world blockchain adoption. The project has strong enterprise use cases and long-term partnerships. Its price, however, depends heavily on market cycles, so it carries risk. Beginners should view VET as a long-term play rather than a quick-profit asset.

VeChain currently trades near $0.017, with the price moving between $0.015 and $0.024 this month. The token remains far below its all-time high, which may offer long-term opportunities. Market volatility, however, can still push the price lower in the short term, so caution is required.

VeChain reached its all-time high in April 2021 at around $0.28. This peak occurred during the strongest phase of the bull market. Since then, VET has dropped over 90% from its ATH, which reflects the impact of the bear cycle and reduced liquidity across altcoins.

VeChain’s potential depends on adoption, market conditions, and liquidity. Analysts believe a return to the $0.27 range is possible in a strong bull cycle. More aggressive forecasts even predict values above $1 in the long term. These targets require a full altseason and major ecosystem Rise.

Reaching $0.5 would require a strong macro bull market and significant enterprise adoption. It is not impossible, but it is not realistic in the short term. Long-term models suggest it could happen only if VeChain delivers major global integrations and crypto liquidity expands.

Some analysts believe VeChain could touch $1 in the far future if enterprise demand increases. This scenario requires a massive expansion of the VeChainThor ecosystem. Most conservative forecasts, however, place VET below $1 by 2030, so this target depends on long-term Rise.

The $2 target appears only in very bullish long-term predictions. Telegaon places VeChain above $2 by 2030 in its most aggressive scenario. This level would require exponential adoption and a major shift in global blockchain usage. It is possible but highly speculative.

A move to $5 is considered extremely unlikely under current conditions. It would require VeChain to become one of the world’s top blockchain platforms by real usage. Only ultra-long-term projections include such values, and even those depend on perfect market conditions.

A $10 price for VET is far beyond any realistic near-term projection. This would require trillions in market cap for VeChain. Analysts do not expect this level unless the entire crypto market experiences unprecedented global adoption and decades of Rise.

No credible forecast places VET anywhere near $75. Such a price would require a shift in global finance beyond anything currently expected. This level is not seen in any expert predictions and should not be considered realistic even in long-term scenarios.

VeChain reaching $100 is not supported by any expert model or long-term forecast. This price would imply a market cap larger than most global corporations. It is far outside realistic expectations and should be viewed as an unrealistic scenario for the foreseeable future.

VeChain has recovered from major crashes in past cycles, including deep lows in 2020 and 2022. Recovery is possible during strong bull markets, especially when liquidity shifts toward altcoins. The pace of recovery, however, depends on market sentiment and enterprise adoption.

VeChain has a future as long as businesses continue adopting blockchain for tracking, verification, and supply-chain automation. Its partnerships and enterprise focus support long-term relevance. Market cycles may slow Rise, but the project still holds a clear use-case advantage.

Most predictions place VeChain between $0.015 and $0.038 in 2025 based on analyst data. More bullish forecasts extend toward $0.08 if market conditions improve. Higher targets require altseason-level liquidity, which is not guaranteed.

Forecasts for 2026 range between $0.036 and $0.044, with extremely bullish models projecting up to $0.37. These higher values depend on major ecosystem expansion. Most conservative models remain below $0.05 for the year.

Most reputable forecasts place VeChain between $0.083 and $0.195 in 2030. More aggressive models extend above $2, but these predictions rely on rapid global adoption. A 10× gain from the current price is possible, but not guaranteed.

VeChain’s price depends on supply-chain adoption, enterprise partnerships, network activity, and overall crypto market cycles. BTC dominance, liquidity trends, regulation, and global economic events also influence movement. Strong adoption from corporations can improve long-term value.

Analysts remain mixed. Some expect moderate Rise tied to adoption and market cycles. Others believe VeChain could repeat a strong rally similar to 2021. Ultra-bullish analysts project multi-dollar targets, while conservative models expect slow but steady appreciation.

VeChain is used by companies in logistics, luxury goods, food safety, energy, and sustainability. Businesses use VeChainThor to track products, verify authenticity, and manage supply-chain data. The project’s IoT integration makes it valuable for industries that need transparency.

VeChain was founded in China, but it now operates as a global blockchain project. It maintains international offices and partners with companies around the world. The team works across multiple regions to support enterprise adoption and regulatory compliance.

VeChain was founded in 2015, which makes the project around a decade old. It began as part of the Bitse blockchain company before evolving into its own ecosystem. Over the years, it has expanded into a global enterprise-focused blockchain network.

The CEO of VeChain is Sunny Lu, one of the project’s co-founders. He previously served as CIO of Louis Vuitton China. His background in luxury supply-chain systems helped shape VeChain’s mission of bringing transparency and trust to global logistics.

VeChain competes with blockchain projects focused on supply-chain tracking and enterprise solutions. Key competitors include IBM Blockchain, , Chainlink (for data verification), and IOTA. The degree of competition depends on the specific industry and use case.

VeChain and serve different purposes. VeChain focuses on supply-chain tracking and enterprise adoption, while Chainlink specializes in decentralized data oracles. Neither is strictly “better”; they operate in different sectors. In some cases, they can even complement each other.

VeChain originally launched as an under the ticker VEN. After the mainnet launch in 2018, it migrated to its own blockchain called VeChainThor. Today, VET is not an ETH token, although developers can deploy ETH-compatible smart contracts on VeChain.

is here to help you if you’re looking for a way to invest in this digital currency. You can buy VeChain privately and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 coins, and you can do wallet-to-wallet transfers instantly and problem-free.

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to marketplace — for instance, .

- Press the “Start marketplace” button.

- Provide the recipient address to transfer your crypto to.

- Process the transfer.

- Receive your VET coins.

Follow us on , , , , and to stay updated about the latest news on and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

The post first appeared on .