PancakeSwap Price Prediction: Will CAKE Coin Hit $10?

The price prediction is something many crypto beginners are curious about. If you’re just starting out, you might wonder whether CAKE still has room to grow or if its best days are gone. To find the answer, we need to look at what PancakeSwap is, how its token works, and what experts think about the future.

Right now, the price of CAKE is $4.15. Over the past month, the token has shown strong momentum. In early September, it fell to a monthly low of $2.41. By the end of September, it had already surged to $3.11, marking the Maximum point of that month. In early October, CAKE continued its climb, showing growing investor confidence but also underlining the volatility that makes it both attractive and risky.

This article will guide you through the essentials of PancakeSwap. You’ll learn how it started, why people use it, and what makes the CAKE token different from other coins. We’ll also look at its price history and check the CAKE price predictions for the coming years, from 2025 to even 2050.

If this is your first time reading about crypto, don’t worry. The language here is simple and clear, so you can follow along without any technical background. By the end, you’ll have a much better idea if CAKE is just another token or if it could be a smart long-term Funding.

| Current CAKE Price | CAKE Price Prediction 2025 | CAKE Price Prediction 2030 |

| $4.15 | $4.3 | $24 |

PancakeSwap is a open finance (open finance) protocol built on the Binance Smart Chain (BSC). It was launched in September 2020 as a fork of Uniswap v2, but with a focus on faster and cheaper transfers. The project was created by an anonymous team of developers, often referred to with playful nicknames like Chef Hops, Chef Cocoa, and Momo. The choice of anonymity is not unusual in open finance, as it reflects the community-driven and decentralized nature of the ecosystem.

At its core, PancakeSwap allows users to swap BEP-20 tokens without relying on traditional order books. Instead, it uses an Automated Market Maker (AMM) model. This means trades happen against liquidity pools, which are filled by other users rather than centralized marketplaces. Those who provide liquidity are known as Liquidity Providers (LPs). In return for depositing token pairs, LPs receive special tokens called FLIP. These can be staked to earn CAKE or later redeemed for a share of the pool plus transfer fees.

is the native token of PancakeSwap and plays many roles in the ecosystem. It is used as a reward for liquidity providers, as a governance token for voting on proposals, and as an entry ticket to unique features such as lotteries. For example, every six hours, users can join a lottery by spending 10 CAKE. There are also Syrup Pools, where users can stake CAKE to earn more CAKE or even tokens from other projects.

Beyond its core swapping and staking functions, PancakeSwap has expanded into several areas of open finance. Users can participate in yield farming, buy tickets for lotteries, join Initial Farm Offerings (IFO) for new projects, try prediction markets, trade NFTs on its marketplace, and even explore cross-chain swaps. This wide range of features has made PancakeSwap one of the largest and most popular decentralized marketplaces in the world.

| Current Price | $4.15 |

| Market Cap | $1,408,604,816 |

| Volume (24h) | $667,834,423 |

| Market Rank | #69 |

| Circulating Supply | 343,909,666 CAKE |

| Total Supply | 359,191,327 CAKE |

| 1 Month High / Low | $4.15 / $2.4 |

| All-Time High | $44.1 Apr 30, 2021 |

CoinGecko, October 7, 2025

Understanding the past performance of PancakeSwap (CAKE) gives investors important context for future price predictions. Like most altcoins, CAKE has experienced sharp rallies followed by deep corrections, often moving in line with the wider crypto market.

PancakeSwap launched in September 2020 as a fork of Uniswap on Binance Smart Chain. CAKE began trading at very low levels, often under $1, with little market attention at first. Early adoption came mostly from BSC users attracted by its fast and cheap transfers compared to ETH. Initial liquidity programs and farming rewards helped bootstrap activity, but volumes were still modest.

The 2021 bull run brought PancakeSwap into the spotlight. As interest in open finance surged, CAKE soared from under $1 at the start of the year to an all-time high of around $44 in April 2021. The token became one of the leading open finance assets, benefiting from Binance Smart Chain’s rapid Rise. However, the May 2021 market crash hit hard, and CAKE fell back toward the $10–$12 range by mid-year. By December, it had recovered slightly, holding around $12–$14.

The global crypto bear market of 2022 had a major impact on CAKE. Prices slipped through the year, with CAKE losing over 80% of its value from the peak. By June 2022, it was trading between $3 and $4, and by year-end, it reached lows near $3. Despite the decline, PancakeSwap continued expanding features like NFT trading and prediction markets.

In 2023, CAKE showed signs of recovery as the crypto market gained strength. The price moved upward from $3 in January to around $5–$6 by April. It stabilized through the rest of the year in the $4–$5 range, supported by steady platform usage and token burns.

CAKE remained relatively stable in 2024, trading mostly between $2.5 and $4. Small rallies occurred during announcements of new features or token burn updates, but the coin did not revisit earlier highs. Still, the token’s utility in farming, staking, and governance kept demand consistent.

By 2025, PancakeSwap has settled into a range-bound pattern. For most of the year, CAKE has traded between $2 and $3. On October 7, 2025, the token stood at $4.15, reflecting a cautious but stable phase. User activity on PancakeSwap remains solid, with CAKE continuing to serve as the key reward and governance token of the ecosystem.

| Year | Minimum Price | Maximum Price | Median Price | Price Change |

| 2025 | $2.36 | $6.33 | $4.3 | +5% |

| 2026 | $3.77 | $14.25 | $9 | +120% |

| 2030 | $12.51 | $35.52 | $24 | +500% |

| 2040 | $76.11 | $1,437 | $750 | +18,500% |

| 2050 | $1,587 | $1,876 | $1,700 | +41,500% |

analysts forecast that CAKE could climb as high as $5.76 (+50%) in 2025, with a possible dip to $2.36 (-40%).

experts expect CAKE to move between $2.65 (-30%) and $2.90 (-25%), showing a more cautious Rise curve.

Meanwhile, is more bullish, projecting a surge up to $6.33 (+65%), while maintaining a base support near $2.49 (-35%).

According to DigitalCoinPrice, CAKE may reach $6.83 (+80%) in 2026, with downside protection around $5.66 (+50%).

PricePrediction suggests a range between $3.77 (-5%) and $4.62 (+20%), highlighting moderate gains.

Telegaon gives a stronger outlook, predicting CAKE between $6.38 (+60%) and $14.25 (+270%) by year-end.

DigitalCoinPrice estimates CAKE could rise to $14.23 (+255%), while its low sits near $12.51 (+210%).

PricePrediction models place the coin between $14.80 (+270%) and $18.34 (+370%).

Telegaon, however, offers the most aggressive view for 2030, with CAKE ranging from $28.42 (+610%) to $35.52 (+800%).

PricePrediction.net outlines an ultra-bullish scenario, with CAKE trading between $1,182 (+28,500%) and $1,437 (+36,000%) by 2040.

Telegaon is far more conservative, suggesting values between $76.11 (+1,800%) and $91.13 (+2,200%) as the market matures.

By 2050, PricePrediction analysts envision extraordinary valuations, with CAKE possibly ranging from $1,587 (+39,600%) to $1,876 (+47,000%).

Analysts in the crypto space have started to turn more optimistic on PancakeSwap, pointing to technical patterns and broader market strength as signs of recovery.

On September 20th, on-chain analyst Crypto Kartha that CAKE had broken out from a descending channel that had weighed on its price since August. According to him, the shift from lower highs and lower lows toward a fresh higher high suggests the bearish phase may be over.

He underlined a support zone between $2.75 and $2.8, with secondary levels at $2.6–$2.65 and $2.4–$2.45. On the resistance side, $3–$3.05 is the first key level, followed by $3.2–$3.25. If momentum holds, Kartha’s long-term target is between $3.8 and $4. His analysis shows how liquidity levels and order flow play a role in guiding price, giving traders clear points to watch.

Moe Trading, a well-followed strategist, another layer of bullish sentiment on the same day. He noted that CAKE’s move above its yearly open price marks a psychological and technical shift.

He tied this directly to in the $118,000–$119,000 range, explaining that as long as BTC holds firm, altcoins like CAKE can thrive. Moe Trading’s immediate resistance level is $3.05, which overlaps with Kartha’s short-term view.

However, he looks further ahead, setting a mid-term target of $5.24 and even outlining a scenario where CAKE could push toward $8.38. His perspective highlights how PancakeSwap’s trajectory is not only about its internal fundamentals but also heavily linked to broader market sentiment and the performance of BTC.

Two days later, on September 23rd, trader Crypto Patel his own strategy for CAKE, describing it as a “high-probability long setup.” His analysis identified a fair value gap near $2.68, which he marked as an ideal retracement entry point.

Patel’s approach suggests that a dip to this level would help remove weak hands before a strong upward move. His primary target is $3.145, which corresponds to a recent swing high and a clear liquidity pocket. He emphasized that strong buying interest on dips confirms the shift from bearish to bullish conditions.

For traders seeking open financened entries and exits, Patel’s clear use of magnet levels and liquidity zones makes his setup both actionable and disciplined.

Together, these expert opinions paint a picture of cautious optimism. All three analysts agree that PancakeSwap is showing early signs of a market reversal.

While short-term targets cluster around $3–$3.2, the more ambitious CAKE price predictions see room for a move toward $5 or higher if the broader market supports it.

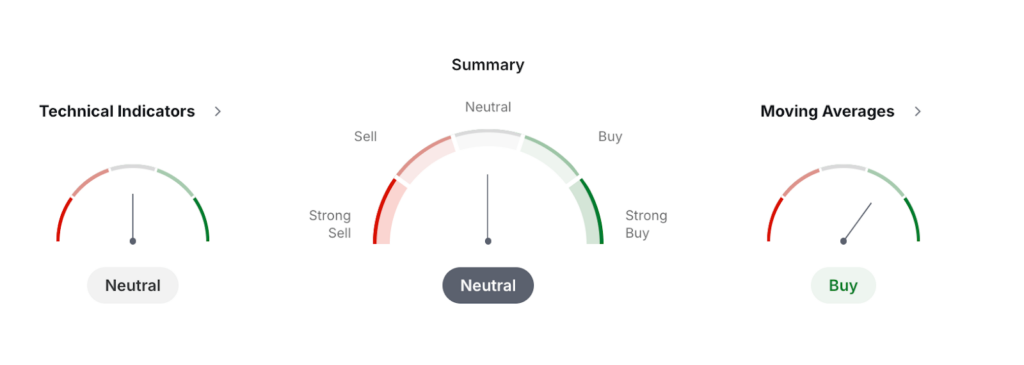

Based on monthly data from , PancakeSwap (CAKE) shows mixed technical signals. The overall summary is Neutral, with technical indicators split between buy and sell, while moving Medians lean more positive.

Investing, October 7, 2025

The technical indicators reflect a balanced picture: four buy signals, four sell signals, and two neutral. The Relative Strength Index (RSI 14) stands at 42.62, suggesting mild bearish momentum. The MACD (12,26) sits at -0.42, also giving a sell indication. However, the ADX (14) reading of 33.68 shows a strengthening trend, marked as a buy. Other oscillators paint a similar picture: Williams %R indicates a sell, while CCI (14) and ROC both signal buy. This mix reveals indecision in the market, where momentum remains weak but trend strength hints at recovery potential.

The moving Medians provide a clearer direction. Out of twelve readings, eight are in buy territory and four in sell. Short-term moving Medians such as MA5, MA10, and MA20 all point to bullish momentum, supporting CAKE’s current trading above $2.6. In contrast, the longer-term MAs such as MA50, MA100, and MA200 highlight bearish trends from earlier cycles, with levels well above current prices. This divergence between short- and long-term signals suggests that while CAKE may be forming a bottom, long-term resistance zones remain strong.

Pivot point analysis highlights $2.66 as the central level. Nearby support lies between $2.18 and $2.35, while resistance sits around $2.98–$3.16. These zones will likely open financene CAKE’s next move. A break above $3 could encourage buyers and open the path to higher ranges, while a dip below $2.4 might confirm further weakness.

Overall, the monthly technical view shows CAKE consolidating after a volatile period. Buyers are slowly regaining control, but the token still faces significant resistance. Traders may treat the $2.6–$3 area as a key battleground that will determine whether PancakeSwap enters a stronger uptrend or falls back toward lower supports.

The price of PancakeSwap (CAKE) is shaped by many different factors, both inside the platform and across the wider crypto market. Because CAKE is a utility and governance token, its value is closely tied to how much people use PancakeSwap itself. The more activity the marketplace generates, the stronger the demand for CAKE.

One of the key drivers is liquidity and trading volume. PancakeSwap runs on an automated market maker model, which means that liquidity providers add tokens into pools. Higher liquidity attracts more users, boosting trading fees and, in turn, demand for CAKE as a reward token.

Another important element is staking and farming incentives. Users can stake CAKE in Syrup Pools or use it in yield farming strategies. When rewards are attractive, more investors lock up tokens, reducing circulating supply and supporting price Rise.

External conditions also play a major role. CAKE’s performance is often correlated with the overall health of the BNB Chain ecosystem. If BNB activity grows, CAKE usually benefits. Similarly, BTC’s price trends often set the tone for altcoins. A strong BTC rally can lift CAKE, while a market downturn usually drags it lower.

Other factors influencing the price include:

- Token burns: Regular burn events decrease total supply, creating scarcity that can drive price higher.

- Market sentiment: News about regulation, open finance Rise, or hacks can quickly change investor confidence.

- Competition: PancakeSwap competes with other decentralized marketplaces like Uniswap and SushiSwap. Its ability to maintain users depends on offering low fees and unique features.

- Innovation: Adding new tools such as prediction markets, NFTs, or cross-chain swaps can attract new users and increase CAKE’s utility.

PancakeSwap has grown into one of the most complete ecosystems in open finance. It combines advanced trading technology with community-driven features that give users multiple ways to earn, trade, and engage.

- Automated Market Maker (AMM) Model: Instead of using traditional order books, PancakeSwap allows users to trade directly against liquidity pools. This creates smoother and faster transfers without requiring centralized marketplaces.

- Multichain Support: While PancakeSwap started on BNB Smart Chain, it has expanded to support ETH, Polygon, Arbitrum, Base, Solana, and more. This makes it a truly cross-chain platform and opens the door for a much wider user base.

- Smart Router Technology: The platform’s router scans liquidity across V3, V2, and StableSwap pools to give traders the best possible prices and minimize slippage.

- PancakeSwap V3 Concentrated Liquidity: Liquidity providers can focus funds within specific price ranges, allowing them to earn more fees with less capital. This system maximizes efficiency compared to earlier versions.

- Multiple Fee Tiers: PancakeSwap V3 lets providers and traders select fee levels between 0.01% and 4%. The flexibility means traders can adapt based on volume, strategy, and risk.

- Limit Orders: Just like centralized marketplaces, users can now set target prices for their trades. Orders are executed automatically once the market hits those levels, giving more control to traders.

- Market Maker Integration: PancakeSwap integrates directly with professional market makers on ETH and BNB Chain, which improves liquidity depth and ensures smoother execution.

- Non-Fungible Liquidity allocations: Each liquidity allocation in V3 is represented as an NFT, which makes managing funds easier and even allows transfers of these allocations between wallets.

- Zap Feature: This tool enables users to add or remove liquidity using just one token in a single click, saving time and lowering complexity.

- Yield Farming Ecosystem: By staking LP tokens, users can earn CAKE rewards through an extensive farming system that has been one of PancakeSwap’s core attractions.

- Syrup Pools (CAKE Staking): Single-asset staking pools offer attractive yields, with some rewards reaching up to 55% APY depending on conditions.

- Initial Farm Offerings (IFO): Users can join early-stage token launches directly through PancakeSwap by committing CAKE tokens.

- Perpetual Trading: The platform has expanded beyond spot trading into derivatives, including crypto perpetuals and even stock perpetuals for companies like Apple, Amazon, and Tesla, with leverage up to 25x.

- NFT Marketplace: Under “Pancake Collectibles,” PancakeSwap offers an integrated NFT trading hub where digital assets can be bought and sold.

- Prediction Markets: Users can bet on the price direction of assets within short timeframes to win rewards, adding gamified speculation.

- Lottery System: Regular lottery rounds allow users to spend CAKE tokens for a chance to win large prizes.

- Gaming Integration: PancakeSwap collaborates with external developers to bring gaming features into the ecosystem, blending entertainment with finance.

PancakeSwap has strong use cases as one of the most popular decentralized marketplaces. It offers low fees, multichain support, and advanced trading features. While it faces competition from Uniswap and SushiSwap, CAKE’s token burns and staking programs add value. For long-term investors, it may be a good option if open finance adoption continues to expand.

CAKE is the utility and governance token of PancakeSwap. It is used for staking in Syrup Pools, farming rewards, and entering Initial Farm Offerings (IFOs). Holders can also join lotteries, prediction markets, and NFT trading while participating in governance by voting on platform proposals.

PancakeSwap was launched in September 2020 on the Binance Smart Chain. It quickly became popular thanks to lower fees compared to ETH-based marketplaces. The launch timing aligned with the open finance boom, helping PancakeSwap capture significant market share.

Yes, PancakeSwap has a strong future if it maintains user adoption and continues innovating. With features like cross-chain swaps, perpetual trading, and NFT integration, it remains competitive. The long-term outlook depends on the health of open finance markets and sustained demand for decentralized marketplaces.

The project was developed by an anonymous team of developers, often nicknamed with playful chef-inspired titles like Chef Hops and Chef Cocoa. This anonymity is common in open finance, where decentralization and community governance are core values.

CAKE has a fixed maximum supply capped at 450 million tokens. This cap was reduced from 750 million as part of PancakeSwap’s Tokenomics 3.0 upgrade to strengthen scarcity and curb inflation.

CAKE’s all-time low was recorded shortly after its launch in 2020, when it traded around $0.19. Since then, the token has grown significantly, reaching much higher valuations during the open finance bull run.

CAKE reached its all-time high in April 2021, when it traded near $44. This peak occurred during the height of the open finance rally and reflected strong user Rise on Binance Smart Chain.

Revisiting the all-time high of $44 will depend on market conditions and PancakeSwap’s ability to innovate. If open finance adoption grow, CAKE could aim for that level again. However, it would require a strong bull cycle.

CAKE’s price will likely rise if demand for decentralized marketplaces grows and token utility expands. Technical analysis shows it is trying to break key resistance zones, while expert forecasts predict gradual gains. Still, the token’s performance remains tied to overall crypto trading dynamics.

CAKE reaching $10 is possible, but it would require a strong market recovery and higher adoption of open finance platforms. The token has traded much higher in the past, so $10 is not unrealistic. A combination of token burns, increased liquidity, and user Rise could help CAKE reach this milestone in the next bull cycle.

A $50 price target would mean PancakeSwap not only retests its all-time high but also surpasses it. This would require massive adoption across multiple blockchains and strong Rise in trading volumes. While ambitious, it cannot be ruled out if open finance enters another explosive Rise phase.

For CAKE to reach $100, its market cap would need to grow significantly, placing it among the top altcoins. While this is an optimistic scenario, it depends on long-term open finance dominance and PancakeSwap’s ability to stay relevant against competitors like Uniswap. It is possible, but highly challenging.

A $1,000 CAKE price is highly unlikely under current market conditions. It would require PancakeSwap to capture global dominance of decentralized marketplaces and open finance services. Such a valuation would push its market cap into the trillions, which is unrealistic without radical shifts in global finance.

Analyst forecasts suggest CAKE could trade between $2.13 and $6.33 in 2025, with an Median near $4. This would be around a 70% increase from today’s price of $2.63. The exact outcome will depend on overall market sentiment and CAKE’s continued platform usage.

If CAKE reaches its projected Median of $23 by 2030, a $1,000 Funding today could grow to around $8,800. In a more bullish scenario where prices hit $35, the same Funding could be worth over $13,000.

PancakeSwap can be a good buy for investors who believe in open finance Rise and Binance Smart Chain’s ecosystem. It offers real utility through staking, farming, and trading. However, like all cryptocurrencies, CAKE carries risks, and its future depends on adoption, competition, and overall market cycles.

is here to help you buy CAKE coin if you’re looking for a way to invest in this digital currency. You can and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 different coins and you can do wallet-to-wallet transfers instantly and problem-free.

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to marketplace — for instance, .

- Press the “Start marketplace” button.

- Provide the to transfer your crypto to.

- Process the transfer.

- Receive your crypto coins.

Follow us on , , , , and to stay updated about the latest news on and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

The post first appeared on .