BTC Price Prediction: Can BTC Coin Reach $1,000,000?

The question on everyone’s mind right now is simple: where is heading next? With the crypto market heating up again, many are searching for a fresh BTC price prediction. And it makes sense. On October 5, 2025, BTC hit a new all-time high of $125,500. Just a week earlier, it dipped to $108,800. Today, BTC is sitting around $124,800, showing how quickly things can move.

But what drives these wild swings? And more importantly, could BTC actually reach one million dollars someday?

In this article, we’ll break it all down. You’ll learn what BTC is, how it works, and how its price has changed over the years. We’ll explore expert BTC price predictions, key events, and what might influence BTC’s next big move. If you’re just getting started in crypto, this guide was made for you. Let’s get started.

| Current BTC Price | BTC Price Prediction 2025 | BTC Price Prediction 2030 |

| $124,800 | $175,000 | $750,000 |

BTC is the world’s first and most well-known digital currency. It was created in 2009 by a mysterious figure using the name . To this day, no one knows who Satoshi really was — a single person, a group of developers, or something else entirely. But their invention changed the financial world forever.

BTC started as an experiment. The idea was simple but powerful: create digital money that works without banks or governments. No middlemen. No permission needed. Instead, BTC runs on a network called — a shared public database that records every transfer.

Each time someone sends BTC, the transfer is verified by a global group of computers. This system is called . It’s designed to prevent fraud, double-spending, and any single person from taking control. That’s one reason why people often describe BTC as decentralized.

But BTC is more than just tech. It became a movement. Early users saw it as a way to escape inflation, censorship, and traditional banking. Over time, the community grew. By 2011, people started trading BTC on small online marketplaces. In 2013, BTC crossed $1,000 for the first time — and that was only the beginning.

Unlike regular money, BTC has a limited supply. Only 21 million coins will ever exist. This makes it similar to gold, which is why many now call it “digital gold.” As demand rises and supply stays fixed, the price tends to go up — sometimes sharply.

Today, BTC is used in many ways. Some buy it as an Funding. Others use it to send money across borders. A few even use it to shop or pay bills. Major companies, from Tesla to PayPal, have helped push BTC into the mainstream.

BTC’s journey from a whitepaper to an over $2 trillion asset was anything but smooth. It faced bans, crashes, hacks, and endless criticism. Yet it survived. And in 2025, it remains the most valuable and trusted crypto in the world.

| Current Price | $124,800 |

| Market Cap | $2,487,746,763,612 |

| Volume (24h) | $54,470,850,411 |

| Market Rank | #1 |

| Circulating Supply | 19,928,203 BTC |

| Total Supply | 19,928,203 BTC |

| 1 Month High / Low | $125,500 / $108,800 |

| All-Time High | $125,500 Oct 5, 2025 |

In the next section, we’ll take a closer look at the features that make BTC unique — both under the hood and as a digital asset.

BTC is not just a coin you can trade. It’s a full system built with rules, code, and a powerful design that keeps it running 24/7. Let’s break down what makes BTC special — both technically and economically.

One of BTC’s most important features is its scarcity. Only 21 million BTC will ever be created. This limit is written directly into the code. No one can change it — not even the developers. This gives BTC a strong edge over fiat currencies, which governments can print endlessly. Many investors see this fixed supply as a reason why BTC could keep rising in value.

BTC is fully decentralized. That means no single person, company, or government controls it. Instead, it’s run by thousands of independent computers (called nodes) all over the world. These nodes follow the same rules and help keep the system honest. If one goes down, the rest keep working. That’s why BTC is still alive after more than 15 years.

Every BTC transfer is public. Anyone can check the blockchain and see the full history of each coin — when it was created, moved, or received. This transparency builds trust and helps fight fraud. But don’t worry, it’s also pseudonymous — don’t show your real name.

BTC uses advanced cryptography to protect every transfer. Once a block is added to the blockchain, it can’t be changed without redoing the work for all the following blocks — an almost impossible task. This system is why BTC has never been hacked at the network level.

New BTCs are created through a process called . producers use powerful computers to solve complex math problems. When they succeed, they add a new block to the chain and earn BTC as a reward. This system, known as proof-of-work, secures the network and ensures fairness.

One BTC can be divided into 100 million units, called satoshis. This means you don’t need to buy a whole BTC — even a few dollars’ worth is enough to get started. And since it’s digital, you can send it anywhere in the world within minutes.

Anyone with internet access can use BTC. You don’t need to open an account at a bank or get approval from a third party. This open-access model makes BTC especially attractive in countries with unstable economies or limited banking options.

Together, these features make BTC a unique asset — both as a technology and a store of value.

BTC’s price history is a rollercoaster of epic highs and painful crashes. But it’s also a story of Rise, adoption, and resilience. Let’s take a closer look at how BTC has evolved over the years.

When BTC launched in 2009, it had no real value. The first ever known transfer was in May 2010, when someone paid 10,000 BTC for two pizzas — now a legendary moment. By October 2010, the price hit $0.1. It climbed to $0.3 by year-end. Then came the first big jump. In June 2011, BTC spiked to $29.6 before crashing back down, closing the year at around $5.

In 2012, BTC stayed quiet but slowly gained trust. In 2013, that changed. It started the year at $13, hit $100 in April, and then $200 by October. By November, BTC broke through $1,000 for the first time. It later pulled back and ended the year at $732, but BTC had officially entered mainstream conversation.

The early days of 2014 saw BTC hovering above $1,000. But the Mt. Gox marketplace collapse crushed confidence. By April, BTC hit $111.6. In 2015, the price moved mostly sideways, slowly recovering. It closed the year at $430, setting the stage for the next cycle.

BTC gained more attention in 2016, thanks to growing adoption and fewer extreme swings. It stayed below $1,000 for most of the year but ended just under that mark. Interest began building ahead of the 2017 bull market.

2017 was the year BTC went viral. It broke $2,000 in May. Then came a vertical surge. By December 16, BTC reached $19,188. Millions of new investors joined in. But as fast as it went up, it also crashed. That hype cycle introduced crypto to the masses — and showed how volatile the market could be.

After the 2017 high, the bubble popped. BTC dropped below $4,000 in 2018. In 2019, the price slowly climbed back up. By June, it hit $10,000, but ended the year at $6,612. BTC was still standing, but excitement had faded.

2020 started with BTC around $7,161. Then the COVID-19 pandemic hit. Global money printing and low interest rates pushed investors to look for hard assets. BTC surged to $18,383 in November and closed the year at $28,993, gaining over 400% in 12 months.

In January 2021, BTC passed $40,000. By April, it smashed through $60,000. Then came a huge correction — dropping to $30,829 in July. A second rally brought BTC to $52,956 in September. But volatility struck again, and it ended the year around $40,597.

BTC dropped hard in 2022. It closed Q1 at $47,459, then plunged to $29,000 in May. By June, it fell below $23,000 — the lowest since 2020. This was one of the toughest years for crypto.

BTC started 2023 at $16,530. The price rose slowly but steadily all year, closing at $42,258. It was a major comeback, showing BTC’s long-term staying power.

In March 2024, BTC hit $73,750, thanks to spot ETF approvals and halving excitement. On December 17, it reached $108,000, another high. Investors once again saw BTC as a hedge against inflation and financial instability.

In January 2025, BTC hit $109,114. After a short pullback to $75,000 in April, it exploded to a new all-time high of $125,500 on October 5. As of now, it’s hovering near $124,000-125,000, keeping traders and investors on edge.

CoinGecko, October 6, 2025

| Year | Minimum Price | Maximum Price | Median Price | Price Change |

| 2025 | $107,825 | $264,210 | $190,000 | +50% |

| 2026 | $185,402 | $311,832 | $250,000 | +100% |

| 2030 | $571,315 | $1,097,825 | $850,000 | +580% |

| 2040 | $1,904,543 | $6,382,616 | $4,000,000 | +3,100% |

| 2050 | $4,051,278 | $8,496,340 | $6,500,000 | +5,100% |

BTC’s future in 2025 is looking promising across all major forecasts. According to , BTC might dip to $107,825 (-15%), but it could also surge to $264,210, which would be a massive +110% increase from today’s price of $249,175.

offers a more conservative view. They see the price ranging between $138,839 (+10%) and $155,225 (+25%), signaling a steady rise throughout the year.

Meanwhile, predicts BTC could trade between $109,078 (-13%) and $185,360 (+50%), with an Median price close to current levels.

In 2026, expectations climb higher. DigitalCoinPrice forecasts BTC reaching a minimum of $258,412 (+105%) and possibly peaking at $311,832 (+150%).

PricePrediction.net analysts predict a low of $205,017 (+65%) and a high of $242,128 (+95%), pointing to solid long-term Rise.

Telegaon is slightly more bullish. They estimate BTC could fall to $185,402 (+50%) or hit a top of $272,026, which would be an impressive +115% gain.

By 2030, the numbers get even more exciting. DigitalCoinPrice expects BTC to fluctuate between $571,315 (+375%) and $655,323 (+450%).

PricePrediction.net is far more optimistic. Their data suggests a low of $924,929 (+670%) and a potential peak at $1,097,825 (+815%). That’s nearly a tenfold increase.

Even the more moderate forecast from Telegaon shows BTC ranging between $618,330 (+415%) and $714,504 (+500%).

Long-term projections become sky-high by 2040. PricePrediction.net predicts a jaw-dropping range from $5,595,150 (+4,550%) to $6,382,616 (+5,200%).

Telegaon offers more grounded figures, yet still impressive: BTC could trade between $1,904,543 (+1,500%) and $2,518,512 (+2,000%).

Looking even further, PricePrediction.net sees BTC reaching between $7,874,656 and $8,496,340 by 2050 — that’s a staggering +6,500% to +7,000% from today.

Telegaon projects a more cautious future, with BTC possibly ranging from $4,051,278 (+3,300%) to $5,212,324 (+4,250%).

When it comes to bold BTC price predictions, a few familiar names always stand out. These experts — from hedge fund managers to macro analysts — have closely followed BTC’s rise and believe it still has room to grow. Let’s look at what the top minds are forecasting for BTC in the coming years.

Tom Lee is known for his long-term bullish stance on BTC. He recently doubled down on his prediction that BTC could reach $250,000 by the end of 2025. According to Lee, we are still in a mid-cycle phase, with big institutions slowly accumulating BTC behind the scenes.

In a , he emphasized that a change in U.S. monetary policy could accelerate BTC’s Rise. If the Federal Reserve starts lowering interest rates, liquidity could flood into risk assets — and BTC would likely benefit first. For Lee, macro conditions and institutional flows are the two biggest drivers of the next leg up.

Anthony Scaramucci, the founder of SkyBridge Capital, . His 2025 BTC price prediction is $200,000, which would be nearly double the current price. That level would push BTC’s market cap to around $4 trillion, placing it in the same league as Apple and Nvidia.

But for Scaramucci, this is just the beginning. He argues that BTC could eventually grow to a $15–20 trillion asset, rivaling gold as a global store of value. He believes more investors will begin treating BTC as a digital alternative to precious metals.

PlanB, the anonymous analyst behind the famous Stock-to-Flow model, continues to stand by his bold targets. This week, , noting that BTC’s Relative Strength Index (RSI) is approaching levels last seen in earlier bull markets. He expects BTC to remain in “overbought” territory (RSI > 80) for at least four months — a common feature of past parabolic rallies.

If the market behaves like it did during prior cycles, PlanB believes we could see monthly gains of 40% or more. That would push BTC to $400,000 within months. For the long term, his ultimate price target remains $1 million, which he sees as realistic by the end of 2025.

Michael Saylor, perhaps BTC’s most vocal corporate supporter, took things to another level this year. At the BTC Prague 2025 conference, his new long-term target: $21 million per BTC by the year 2046.

This wild figure is based on a combination of hyperBTCization, institutional adoption, and what he calls BTC’s inevitable role as a monetary base layer for the future. While his previous estimate was $13 million by 2045, Saylor says his optimism has grown thanks to regulatory clarity and ongoing corporate interest in BTC as a treasury reserve asset.

Cathie Wood, founder of ARK Invest, has also kept her sky-high forecasts intact. Her firm $1.5 million within five years. She points to the shrinking supply and rising demand as key factors. With less than 1 million BTC left to be mined, Wood argues the scarcity of BTC is now clearer than ever.

At today’s prices, that represents over $100 billion of value still to be unlocked. She believes institutional investors will continue to buy aggressively, especially as regulatory frameworks become clearer and traditional finance opens the door to crypto assets.

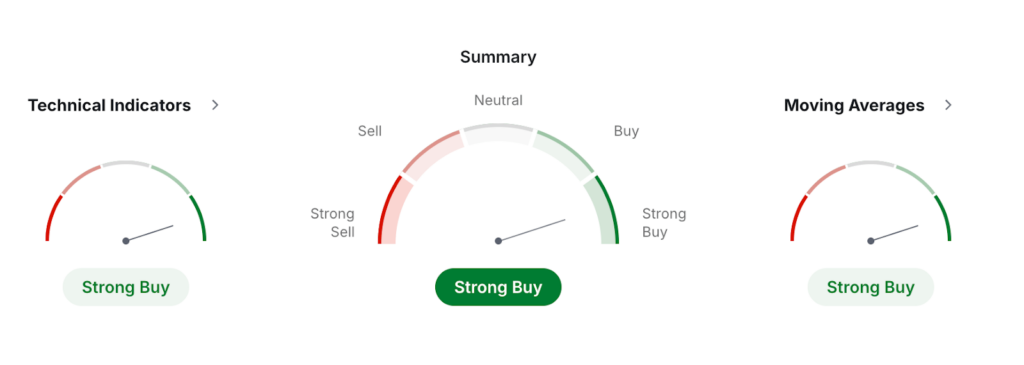

As of early-October 2025, the monthly technical analysis for BTC against USDT on shows a clear and consistent bullish signal.

Investing, October 6, 2025

The overall market sentiment is marked as a strong buy, supported by both trend-following tools and momentum indicators. According to the summary, all major indicators recommend buying, with zero sell signals recorded. This rare level of alignment across all tools suggests confidence in the ongoing upward trend.

The Relative Strength Index (RSI) sits at 62.7, indicating strong buying pressure. Although this places BTC in slightly overbought territory, it also shows persistent demand. Other oscillators like the Stochastic RSI and Williams %R also confirm an overheated market, but in bull cycles, these signals often remain elevated for extended periods. The MACD value of 278,7 also flashes a buy signal, reinforcing the strength of current momentum. Similarly, the ADX at 30.5 confirms the trend is not only upward, but strong and likely to continue.

Volatility remains high, as seen in the ATR reading of 461.4, while the ROC and Bull/Bear Power indicators both show aggressive upward movement, reflecting continued investor confidence. The CCI at over 124 and the Ultimate Oscillator at 68 both add further evidence that bullish momentum is still dominant.

The moving Medians tell the same story. From the short-term MA5 to the long-term MA200, every single moving Median — simple and exponential — indicates a buy. Notably, the MA20 sits far below current price levels, suggesting that BTC remains well above its medium-term support. With MA200 values still near the $117,000–118,000 range, the trend’s longer-term strength remains firmly intact.

Pivot points suggest key support sits between $119,626 and $120,240, while potential resistance lies around $120,390 and above. If BTC breaks through those upper ranges, technical patterns suggest a move toward $132,000 or even $142,000 could follow. For now, all indicators point to one conclusion: the bull run is not over yet.

BTC’s price might look random at times, but it actually moves based on a mix of factors — both inside and outside the crypto world. Understanding these can help anyone make better decisions, whether you’re investing, trading, or just watching from the sidelines.

One of the biggest drivers is supply and demand. BTC has a fixed supply of 21 million coins, which makes it scarce by design. As more people want it — but the supply stays the same — the price usually goes up. This basic economic rule plays a huge role in BTC’s long-term value.

Another key factor is market sentiment. News headlines, social media trends, and even influencer opinions can move prices fast. When people feel optimistic, they tend to buy more. When they panic, they sell. This emotional side of the market often causes big swings — both up and down.

Institutional adoption is another powerful influence. When big companies, hedge funds, or governments buy BTC or offer crypto services, it boosts confidence in the asset. These large players often invest millions or even billions, helping to push the price higher. Recent interest from firms like BlackRock, Fidelity, and MicroStrategy shows that institutions are becoming major players in the crypto space.

BTC is also affected by macroeconomic trends. If inflation rises or central banks print more money, many investors turn to BTC as a hedge, like digital gold. On the flip side, when interest rates go up, traditional Fundings like bonds become more attractive, and some people pull money out of crypto.

Regulation plays a huge role too. Friendly laws can help BTC grow by making it safer and easier to access. Harsh rules or bans can scare people away. For example, ETF approvals, tax changes, or new crypto laws in the U.S. or EU can cause major price shifts.

Finally, there’s the BTC halving — an event that happens every four years. It cuts the reward producers get in half, reducing the number of new coins entering circulation. In the past, halvings have been followed by major bull runs. The next halving could again change the supply dynamics and push prices higher.

BTC can be a good long-term Funding, especially for those who believe in its future value and limited supply. It’s highly volatile, so it’s not for everyone. Many treat it like digital gold — a hedge against inflation and currency risk. Always invest only what you can afford to lose.

At the current price of $125,000, $100 will get you about 0.0008 BTC. You don’t need to buy a full coin to get started. BTC is divisible into tiny units called satoshis, making it easy for anyone to invest any amount — even just a few dollars.

If BTC stays around $125,000, your $100 Funding would equal roughly 0.0008 BTC. If the price goes up, your BTC will be worth more. If the price drops, you’ll lose value. Like any asset, returns depend on market movement. BTC has shown big swings in the past.

If you had bought $1,000 worth of BTC in 2009, you’d likely be a millionaire today. At that time, BTC was nearly worthless — often traded for fractions of a cent. Your $1,000 could have bought millions of BTC, now worth billions at today’s prices. But that window has passed.

BTC itself is secure, but your safety depends on how and where you store it. Use trusted marketplaces, set up two-factor authentication, and consider moving your coins to a private wallet. Like all Fundings, BTC carries risk — so always do your own research before buying.

Many experts believe BTC will continue to rise over time, especially as adoption grows and supply remains limited. Price dips are normal in crypto, but long-term trends have been upward. Still, no one can predict the future with certainty — always be prepared for volatility.

After crossing $125,000, BTC is in a strong uptrend. Some analysts see room for further gains, possibly toward $150K or even $250K. Others warn of a short-term correction. It depends on macro factors, investor demand, and whether major players keep buying. Watch for strong resistance levels ahead.

Yes, many analysts say it’s possible. Experts like Tom Lee and Anthony Scaramucci believe BTC could hit $200K to $250K by the end of 2025. This depends on factors like institutional demand, regulatory clarity, and interest rate policy. It’s ambitious — but not out of reach.

Some long-term forecasts suggest BTC could reach $1 million per coin, especially if it replaces gold as a global store of value. It would require massive adoption and global trust. Experts like PlanB and Cathie Wood see this as possible within 5–10 years, though risks remain.

This is extremely unlikely in the near term, but not impossible in theory. For BTC to reach $10 million, it would need to become the dominant global financial system, replacing fiat currencies. Michael Saylor has speculated on this, but most analysts see it as a very long-term possibility — if at all.

No, that’s not possible. BTC’s price can’t realistically reach $1 billion per coin without the complete collapse of global fiat currencies. Such a price would mean the total value of BTC exceeds the world’s economy by far. It’s more a thought experiment than a real forecast.

In theory, yes — but it’s highly unlikely. BTC is now held by millions of people, major companies, and financial institutions. Its network is secure, decentralized, and widely trusted. For BTC to reach zero, global confidence would have to vanish overnight, which seems very far-fetched at this point.

Realistically, BTC could reach between $250,000 and $1 million in the coming years, according to many analysts. These targets depend on adoption, regulations, and global economic conditions. While higher predictions exist, they are more speculative. Most experts agree that BTC still has room to grow.

Predictions for 2025 vary, but many experts see BTC trading between $150,000 and $250,000 by year-end. Some bullish forecasts go higher, especially if inflation rises and interest rates fall. However, short-term volatility can change the picture quickly. Always think long-term when investing in BTC.

By 2030, a realistic price range for BTC could be $500,000 to $1 million, assuming continued adoption and limited supply. This would depend on how widely it’s used as a store of value or payment method. Regulatory clarity and institutional involvement will also shape this path.

By 2035, some long-term forecasts suggest BTC could trade between $1 million and $2.5 million per coin. These predictions assume that BTC continues to grow as a global store of value and financial hedge. However, long-term price targets always carry high uncertainty and depend on global economic trends.

Estimates for 2040 vary widely. Some experts believe BTC could be worth $2–5 million, while more conservative analysts suggest $1 million is a more realistic ceiling. Factors like mainstream adoption, regulation, and technology upgrades will all play a role in determining BTC’s future value.

By 2050, the most bullish forecasts see BTC reaching $10 million or more, but most analysts consider $1–3 million more grounded. Over the next 25 years, BTC’s role in the financial system will either grow massively — or face challenges from future technologies and competing assets.

The largest known holder is Satoshi Nakamoto, the mysterious creator of BTC. Satoshi is believed to own over 1 million BTC, untouched since early mining days. Among institutions, MicroStrategy, led by Michael Saylor, holds the most BTC, followed by companies like Tesla and Funding funds like Grayscale.

Mining one BTC today can take around 10 minutes, but this is a bit misleading. BTC is mined in blocks, and each block currently produces 3.125 BTC (as of the last halving). To earn a full BTC, producers need powerful machines and often join mining pools to share rewards.

is here to help you buy BTC crypto if you’re looking for a way to invest in this digital currency. You can and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 different coins and you can do wallet-to-wallet transfers instantly and problem-free.

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to marketplace — for instance, .

- Press the “Start marketplace” button.

- Provide the recipient address to transfer your crypto to.

- Process the transfer.

- Receive your BTC coins.

Follow us on , , , , and to stay updated about the latest news on and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

The post first appeared on .