BTC Cash Price Prediction: Will BCH Reach $1000?

When people search for a BTC Cash price prediction, they want clear answers about its future. is one of the most well-known cryptocurrencies, and many beginners wonder if it can grow in the coming years. Before we look ahead, let’s start with the present numbers.

As of mid-September 2025, the BTC Cash price is around $590. In the last month, the coin has shown both ups and downs. The lowest point came on 30 August at $525, while the Maximum level reached $618 on 6 September. This means BCH moved within a range of about 17% during the month. The overall change shows moderate strength, but also signals how volatile crypto markets can be.

This article will guide you step by step through what BTC Cash is, how it works, and why people invest in it. You will also find a detailed BCH price prediction for 2025, 2026, and even long-term outlooks until 2050. We will also check expert opinions, technical analysis, and the key factors that affect the price. By the end, you will know if BCH is a coin worth considering for your portfolio.

| Current BCH Price | BCH Price Prediction 2025 | BCH Price Prediction 2030 |

| $592 | $900 | $3,800 |

BTC Cash (BCH) is a digital currency created on August 1, 2017, after a hard fork of BTC. The split happened because the community could not agree on how to scale the network. Developers and producers who supported larger blocks launched BTC Cash with the goal of improving transfer speed and reducing costs. From the beginning, the project focused on being peer-to-peer electronic cash, usable in daily payments.

BCH runs as an open-source blockchain that uses the same proof-of-work consensus algorithm as BTC, SHA-256. Its main difference lies in block size. While BTC kept its block size at 1 MB, BTC Cash increased it first to 8 MB and later to 32 MB. This change allows more transfers per block, reducing congestion and lowering fees. As a result, users experience faster and cheaper transfers compared to BTC during times of high activity.

The network works through a distributed ledger where every transfer is permanently recorded. producers process and secure the chain by solving mathematical problems, and they receive BCH rewards plus transfer fees for each block. transfer costs are usually below $0.01, which makes BTC Cash practical for microtransfers and online payments. Its design aims to keep fees low and confirmation times fast, especially during peak usage.

The mission of BTC Cash is to follow Satoshi Nakamoto’s original vision of a global electronic cash system. It seeks to improve scalability, lower transfer costs, and expand accessibility so that anyone can use digital money for everyday needs. The project emphasizes decentralization, with decisions driven by the community instead of a central authority.

BTC Cash has also faced challenges. In November 2018, disagreements about its future direction caused another fork, creating BTC SV (Satoshi Vision). Despite this, BCH has remained among the most recognized cryptocurrencies by market cap. It is listed on most major marketplaces, accepted by various merchants, and continues to attract users looking for a payment-focused digital currency. Today, BTC Cash allocations itself as one of the main alternatives to BTC, offering faster and cheaper transfers while staying true to the idea of being electronic cash for the world.

| Current Price | $592 |

| Market Cap | $11,774,419,616 |

| Volume (24h) | $396,870,495 |

| Market Rank | #17 |

| Circulating Supply | 19,926,213 BCH |

| Total Supply | 19,926,213 BCH |

| 1 Month High / Low | $618.5 / $525.5 |

| All-Time High | $3785.82 Dec 20, 2017 |

BTC Cash (BCH) is built on a blockchain architecture that closely resembles BTC, but it introduces several enhancements designed to improve scalability and usability.

At its core, BCH uses the Unspent transfer Output model, or UTXO, which ensures efficiency and flexibility in processing transfers. This model allows for transfer-level sharding, which contributes to higher scalability and better performance across the network.

Like BTC, BCH employs the SHA-256 Proof-of-Work consensus mechanism, which enables producers to validate blocks by solving cryptographic puzzles. Because the hashing function is identical, producers can easily switch between BCH and BTC depending on profitability, providing greater flexibility within the mining ecosystem.

The network maintains a target block time of ten minutes, and its total supply is fixed at 21 million coins, mirroring BTC’s monetary policy and ensuring scarcity.

A key advantage of BTC Cash is its approach to scalability. While BTC remains limited to a 1 MB block size, BCH supports blocks up to 32 MB. This increase allows the blockchain to handle hundreds of transfers per second, reducing congestion and lowering fees even during peak demand.

In practice, transfer fees on BCH Median under $0.01, making the network highly practical for microtransfers, online purchases, and small peer-to-peer payments. The larger block size also ensures high throughput, which supports a wider range of real-world applications without compromising confirmation speed.

BTC Cash has expanded beyond simple payments through improvements in scripting and smart contract capabilities. The protocol enhances the traditional BTC Script language, enabling more complex transfer logic through regular annual upgrades. Native introspection opcodes give developers the ability to examine transfer data, unlocking covenant-style functionalities that add flexibility and control to contract design.

BCH also implements Schnorr signatures, an advanced signature scheme that improves efficiency by reducing transfer size and computational demands by as much as 30%.

Smart contract development on BTC Cash has grown significantly, with tools such as CashScript providing a high-level programming language similar in style to Solidity. This makes it easier for developers familiar with ETH to build on BCH.

The introduction of CashTokens in May 2023 integrated native fungible and non-fungible tokens directly into the blockchain. This upgrade opened the door to open finance applications, enabling automated market makers, decentralized marketplaces, and other complex financial products to operate natively on BTC Cash without relying on external layers.

Maintaining network stability is another critical aspect of BCH’s design. The blockchain uses the ASERT difficulty adjustment algorithm, which recalibrates mining difficulty on a per-block basis. This provides smoother and more predictable block times compared to earlier adjustment systems. The algorithm helps prevent sharp oscillations in difficulty and block times, resulting in a more stable environment for both users and producers. At the same time, the shared hashing algorithm with BTC ensures that hash rate can move between the two chains efficiently, keeping both networks secure while balancing producer incentives.

Together, these features create a blockchain that is not only faster and cheaper than BTC but also more versatile. BTC Cash combines the reliability of a proof-of-work network with advanced scalability, contract functionality, and token standards, making it a strong candidate for real-world payments and decentralized applications.

CoinGecko, September 16, 2025

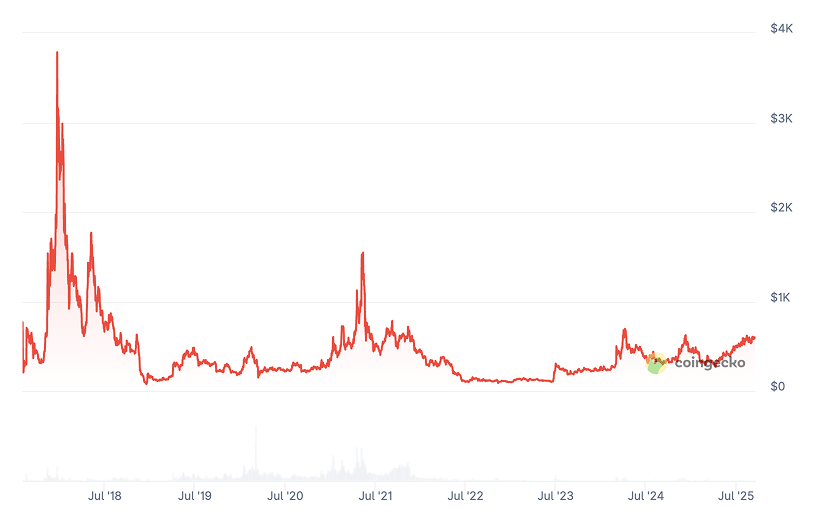

BTC Cash has a price history marked by extreme volatility, dramatic peaks, and equally deep corrections.

It began trading on July 23, 2017, with a closing price of $551.11. Within weeks, momentum grew as investors sought alternatives to BTC. By October 2017, BCH hovered near $650, showing early signs of demand. The rally intensified in November as capital poured into crypto markets, lifting the coin above $1,000. The climax came in December when BTC Cash hit ATH of $3,785.82 on December 20, 2017.

The following year, 2018, delivered a harsh reality check. From January to March, BCH plunged from above $2,000 to around $800–$1,000. A short recovery to $1,500 during spring quickly faded, and prices drifted lower through summer, reaching $400–$600. The final blow arrived in December when BTC Cash collapsed to $76.93, its historical bottom, highlighting the burst of the 2017 bubble.

In 2019, the market showed signs of recovery. For the first quarter, BCH traded steadily between $100 and $150. Renewed optimism helped it break $200 in April and climb to $500 by mid-year. The rally did not last, and the year closed at $203.65. Still, this was a 24.4% gain compared to January, reflecting a slow rebound.

The year 2020 brought new momentum as cryptocurrencies gained global attention. Early in the year, BTC Cash climbed toward $250, only to face a pandemic-driven crash in March, dropping near $130. A strong recovery followed, lifting BCH to $400 by June. For the rest of the year, prices consolidated between $300 and $450 before ending at $342.22, up 68.1% year-over-year.

In 2021, BCH experienced one of its most volatile years. Between January and March, it surged to $600–$700 as institutions began to pay attention. Corrections followed in spring, yet the coin held above $300. By late summer, swings between $300 and $800 kept traders busy. The final quarter brought another run, with BCH peaking near $1,600 before retreating. The year ended at $430.15, securing a 25.5% annual gain despite intense turbulence.

The cycle turned negative again in 2022. Prices fell to $400–$500 in early months and slid further to $200–$300 by mid-year. By December, BTC Cash closed at just $97, a crushing 78.2% decline for the year.

Recovery returned in 2023. From January to March, the coin rebounded from $90 to $200. It pushed higher to $300 by mid-year, supported by renewed interest in open finance and institutional activity. Despite later consolidation, BCH ended the year at $259.67, marking a 168.3% surge.

In 2024, the trend stabilized. The coin traded between $250 and $350 early in the year, climbed to $400–$500 in summer, and closed December at $433.35, a 61.7% annual increase.

By 2025, BTC Cash continued its positive path. Prices ranged from $400 to $550 in the first quarter, corrected briefly to $250–$350 in spring, but quickly recovered. By mid-year, BCH held firm above $500 and reached a high of $632.64. As of September 15, it trades at $599.57, representing a 33.4% rise since January.

| Year | Minimum Price | Maximum Price | Median Price | Price Change |

| 2025 | $538 | $1,326 | $900 | +50% |

| 2026 | $847 | $1,567 | $1,200 | +100% |

| 2030 | $2,545 | $5,248 | $3,800 | +540% |

| 2040 | $7,961 | $89,798 | $50,000 | +8,350% |

| 2050 | $15,735 | $180,000 | $100,000 | +16,800% |

experts anticipate BTC Cash may trade between $538 (-10%) at its 2025 low and $1,326 (+120%) at its peak valuation.

crypto analysts project stronger performance, with BCH coin expected to range from $651 (+10%) to $738. (+25%) during 2025.

analysts present a broader outlook, estimating a 2025 price range of $545 (-10%) to $842 (+40%), suggesting institutional interest and merchant payment integration.

DigitalCoinPrice experts project that in 2026, BCH crypto may reach $1,567 (+160%) at peak valuation, while potentially declining to $1,291 (+115%) at its lowest point.

According to expert analysis from PricePrediction, BTC Cash is projected to reach a peak of $1,118 (+90%) in 2026, with a conservative floor estimate of $901 (+50%).

Telegaon’s bullish outlook suggests BCH may trade between $847 (+40%) at minimum and $1,201 (+100%) at maximum during 2026.

DigitalCoinPrice’s analysis suggests significant appreciation potential for BTC Cash by 2030, with price projections indicating a maximum target of $3,317 (+455%) and a minimum expected valuation of $2,864 (+375%).

According to PricePrediction’s 2030 projections, BCH is anticipated to appreciate significantly, with a potential low of $4,557 (+660%) and a possible peak of $5,248 (+775%).

According to Telegaon’s 2030 forecast, BCH could achieve a maximum valuation of $3,337 (+460%), while maintaining a floor of $2,545 (+325%).

According to PricePrediction’s analysis, BTC Cash (BCH) could reach a valuation range of $65,456 (+10,850%) on the conservative end, up to $89,798 (+14,900%) in an optimistic scenario by 2040.

Telegaon analysts forecast more conservative 2040 price targets, anticipating a range of $7,961 (+1,250%) to $9,521 (+1,500%).

According to PricePrediction, BTC Cash could reach extraordinary valuations by 2050, projecting a conservative floor of $157,095 (+26,100%) and a potential peak of $180,000 (+30,000%), with an Median around $169,368 (+28,150%).

Telegaon offers a more moderate but still highly optimistic forecast, with BCH expected to range between $15,735 (+2,550%) and $25,945 (+4,250%).

Expert opinions on BTC Cash vary, but many analysts agree that its payment-focused design and low transfer fees give it long-term potential.

Michael van de Poppe, a well-known strategist at CryptoQuant, has been among the most optimistic. In June 2025, that BCH could reach between $700 and $900 by the end of the year. He argued that adoption for everyday payments remains the strongest driver for BTC Cash and highlighted that its low-cost transfers make it more practical than many competitors. If his projection proves correct, BCH could deliver gains of more than 50% compared to recent levels. His forecast reflects confidence that utility and scalability will open financene the next stage of Rise.

provided a technical outlook. He identified $634.30 as the key resistance level to watch. Breaking this threshold could push BCH toward his one-week target range of $634 to $669, suggesting short-term gains of up to 11.3%. He also mapped a medium-term range of $580 to $720, showing bias toward the higher end as momentum builds. Anderson cautioned that $524 represents immediate support in case of selling pressure, but overall his analysis leaned toward bullish continuation through the final quarter of the year.

added more granularity with a month-by-month forecast. Their September analysis placed BCH between $543.73 and $625.97, with an Median near $584.85. Looking ahead to December, they see the possibility of BCH hitting $702.57 if market conditions remain favorable. They noted that recent profit-taking after BCH crossed $600 led to short-term corrections, but they remain confident in the underlying momentum.

Changelly’s expert group . Their projections set the 2025 range between $513.53 and $624.12, with an Median around $568.83. While this appears more conservative than other forecasts, Changelly emphasizes steady, sustainable Rise. They anticipate BCH reaching an Median of $833.42 in 2026 and potentially climbing to $2,675.04 by 2029. This shows belief in its long-term fundamentals, even if near-term price action remains modest.

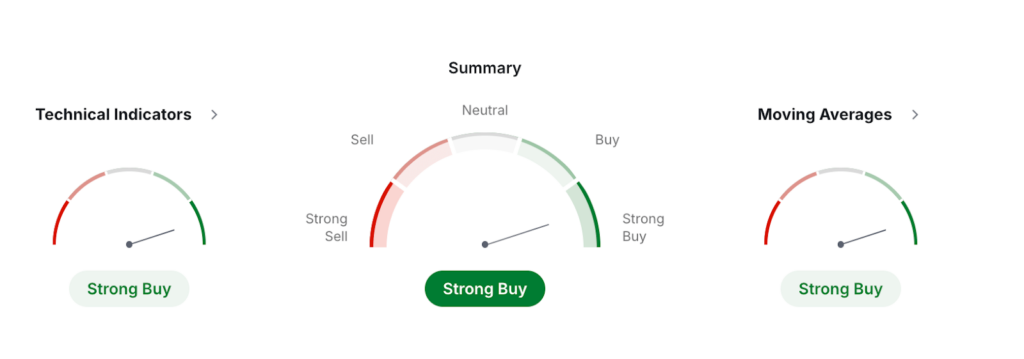

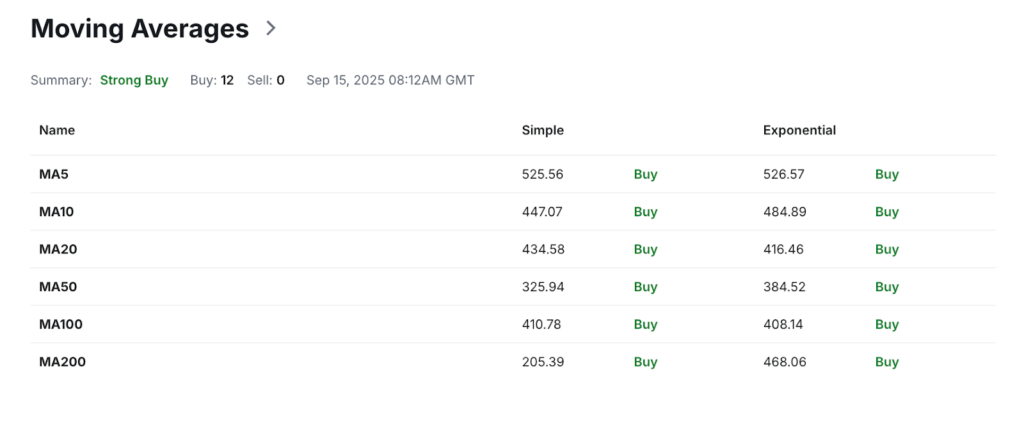

Based on , the technical outlook for BTC Cash against USDT appears strongly bullish. The summary indicates a Strong Buy signal overall, with both moving Medians and technical indicators aligned in favor of further upward momentum. Moving Medians show unanimous strength, with twelve buy signals and no sell signals recorded. Similarly, technical indicators highlight nine buy signals without any bearish warnings, underscoring the positive setup for BCH in the current cycle.

Investing, September 16, 2025

The relative strength index (RSI) at 61.81 points toward continued buying interest without yet breaching extreme overbought levels, though it leans closer to bullish territory. The stochastic oscillator at 64.18 also shows a buy signal, while the stochastic RSI registers at 100, indicating that the coin may be overbought in the shorter term. The MACD reading of 58.73 supports a buy stance, confirming bullish momentum. Supporting these trends, the Median directional index (ADX) stands at 28.63, reflecting a strengthening trend. Other momentum indicators, such as the Williams %R at -9.82 and the Commodity Channel Index (CCI) at 140.72, also point toward sustained buying pressure despite some overbought conditions.

Volatility appears controlled, with the ATR showing a reading of 137.05, which suggests relatively low turbulence compared to previous months. Momentum indicators such as the Ultimate Oscillator at 56.80, the Rate of Change (ROC) at 45.25, and Bull/Bear Power at 231.27 all contribute additional confirmation of bullish strength. Each aligns with the trend that BTC Cash has been building since early 2025, when it rebounded from lower levels to consolidate above the $500 threshold.

Examining moving Medians further reinforces the bullish picture. All short-term and long-term signals are positive. The 5-day moving Median sits at 525.56 (simple) and 526.57 (exponential), both well below the current trading range, suggesting strong upward momentum. The 10-day Medians are equally supportive at 447.07 and 484.89, while the 20-day and 50-day Medians also confirm rising price action. Even the 200-day Medians, at 205.39 (simple) and 468.06 (exponential), show clear alignment with the bullish scenario, marking a significant reversal from bearish trends seen in previous years.

Pivot point analysis highlights critical levels to watch. The central pivot for September stands at 563.55, with support levels ranging from 377.72 to 495.13 and resistance levels stretching from 612.53 up to 729.93. These figures suggest the possibility of BTC Cash testing higher ranges if momentum holds. Fibonacci levels also confirm 563.55 as a key pivot, projecting potential upside toward 680.95.

Altogether, monthly technicals strongly favor continued bullish momentum for BTC Cash. Despite short-term overbought signals, the alignment of trend indicators, moving Medians, and pivot analysis suggests BCH remains allocationed for further gains in the months ahead.

The price of BTC Cash depends on a combination of market forces, adoption trends, and broader macroeconomic conditions. At its core, BCH operates as a decentralized digital currency, so its value is influenced by supply and demand in global markets. With a maximum supply capped at 21 million coins, scarcity plays a long-term role in supporting price levels, especially as more investors look for alternatives to BTC.

One of the strongest drivers is adoption for payments. BTC Cash was designed to function as electronic cash, and its low fees make it attractive for everyday transfers. When merchants, online platforms, or payment processors integrate BCH, it creates direct demand that can push the price higher. The same effect is seen when new wallets or apps make the coin easier to use.

Investor sentiment is another key factor. Positive news, such as institutional interest or large-scale integrations, can fuel rallies. On the other hand, negative press, regulatory crackdowns, or security issues can trigger sell-offs. Like other cryptocurrencies, BCH often moves in correlation with BTC, meaning that a rally or crash in BTC can influence BCH prices regardless of its own fundamentals.

Technical developments also matter. Upgrades to scalability, smart contracts, or token standards can boost confidence in the network and expand its use cases. For example:

- Larger block size ensures lower fees and faster processing, supporting more transfers.

- CashTokens integration has enabled open finance and NFTs on the BCH network, creating new sources of demand.

- Efficiency upgrades like Schnorr signatures reduce transfer size and costs, improving usability.

Market liquidity is another element. When BCH is listed on more marketplaces or paired with stablecoins, it attracts broader participation. Conversely, low liquidity can increase volatility.

Finally, macroeconomic conditions influence price. Rising interest rates, inflation concerns, or shifts in global risk appetite often impact digital currency markets as a whole. In bullish environments, BCH benefits from capital inflows into digital assets. In bearish conditions, speculative capital often exits, driving prices lower.

Altogether, the price of BTC Cash depends on a mix of adoption, innovation, investor sentiment, and global economic context. These factors interact constantly, creating the volatility that open financenes BCH’s market behavior.

BTC Cash can be a good Funding for those who believe in crypto payments. It offers low fees, fast transfers, and long-term Rise potential. However, its price is volatile, and returns are never guaranteed. Investors should research carefully and avoid investing more than they can afford to lose.

Yes, BTC Cash has a future as long as people use it for payments and transfers. Developers continue improving the network with features like CashTokens and smart contracts. While competition is strong, BCH’s focus on peer-to-peer payments gives it a clear purpose in the broader crypto market.

BTC Cash is one of the most recognized cryptocurrencies after BTC. It has been in the top rankings by market cap since 2017. Many marketplaces list it, and it is accepted by a growing number of merchants worldwide. Popularity has ups and downs but remains strong overall.

The main disadvantages are price volatility and competition. BCH often follows BTC’s trends, which can cause unpredictable price swings. It also competes with other blockchains that offer faster smart contracts. Some critics say merchant adoption has been slower than expected. These challenges may limit its short-term Rise.

BTC Cash is mainly used for fast and cheap payments. It supports peer-to-peer transfers, online purchases, and even remittances across borders. With upgrades like CashTokens, it can also support decentralized apps, token creation, and open finance. Its main strength is staying true to the vision of electronic cash.

As of mid-September 2025, BTC Cash trades around $599.5. That means $1 equals about 0.00167 BCH. The value changes daily as crypto markets are volatile. To check the latest rate, investors usually use marketplaces, wallets, or crypto price trackers for real-time conversion updates.

The Maximum price of BTC Cash was recorded in December 2017, when it reached $3,7845.82. This happened during the massive crypto bull run of that year. Since then, the coin has experienced several ups and downs, but that all-time high remains a reference point for many traders.

Experts have different opinions on how high BTC Cash can go. Some predictions suggest $900 in 2025, while long-term forecasts extend into thousands of dollars. In theory, if adoption rises and demand grows, BCH could move much higher, but no prediction is certain. It remains speculative.

Yes, it is possible for BTC Cash to reach $1,000 again. It has done so in the past, most recently during the 2021 bull market. Analysts believe adoption, market cycles, and investor sentiment could push the price above this milestone in the next few years.

Reaching $10,000 would require massive adoption and Funding inflows. Some very optimistic forecasts point to this level by 2040 or 2050. However, this target is speculative and far from guaranteed. BCH would need global-scale usage as everyday money to reach such a high valuation.

A $100,000 price for BTC Cash is extremely unlikely in the near term. Such a level would require global adoption, massive liquidity, and institutional support on a scale not yet seen. While some forecasts for 2050 are highly optimistic, most analysts view this as speculative and unrealistic.

Analysts expect BTC Cash to perform positively in 2025. Forecasts suggest prices between $538 and $1,326 depending on market conditions. Adoption for payments and continued network improvements are key drivers. However, investors should also consider overall crypto trading dynamics, which strongly influence BCH’s performance year by year.

Predictions for 2026 vary across experts. Some see BCH reaching around $1,118, while others expect up to $1,567. More conservative forecasts place it closer to $850. The exact level will depend on adoption Rise, BTC’s influence, and global economic factors that shape investor appetite for digital assets.

By 2030, forecasts show BTC Cash could trade in the $2,800–$5,200 range. DigitalCoinPrice projects a maximum of $3,317, while PricePrediction estimates up to $5,248. Analysts suggest long-term adoption of crypto payments and merchant use cases may help BCH sustain much higher valuations compared to current levels.

Long-term projections for 2040 show wide differences. PricePrediction estimates BCH could reach between $65,456 and $89,798, while Telegaon expects a more modest $7,961 to $9,521. These ranges highlight the uncertainty of long-term crypto predictions, but they also show strong potential if BCH gains global adoption.

BTC (BTC) is more established and widely accepted, making it the safer choice for many investors. BTC Cash (BCH) offers faster and cheaper payments with larger block sizes. BTC is seen as a store of value, while BCH focuses on being practical digital cash. The “better” coin depends on use.

BTC Cash is cheaper mainly because it has lower demand and weaker brand recognition compared to BTC. BTC is considered the original digital currency and attracts institutional investors as “digital gold.” BCH focuses on payments, but adoption has been slower, keeping its valuation much lower than BTC’s.

It is very unlikely that BTC Cash will overtake BTC. BTC has stronger network effects, larger liquidity, and global brand dominance. While BCH provides advantages in payments, BTC’s role as the leading store of value remains unmatched. BCH is more likely to complement BTC than replace it.

If you send BTC Cash (BCH) to a BTC (BTC) wallet, it will not appear as BTC because the two blockchains are separate. The coins remain on the BCH blockchain linked to that address. Recovery is only possible if the wallet owner controls the private keys.

ETH (ETH) and BTC Cash (BCH) serve different purposes. ETH is built for smart contracts and decentralized apps, while BCH focuses on fast, cheap payments. ETH dominates open finance and NFTs, while BCH aims to be digital money. The better choice depends on whether you want payments or dApp access.

Yes, BTC Cash is accepted by many online merchants, payment processors, and even some physical stores. Its low fees make it ideal for small purchases and cross-border transfers. The number of businesses supporting BCH continues to grow as crypto adoption expands in the global retail and service sectors.

BTC Cash can be a good coin to buy if you believe in its use as digital money. It offers speed and low fees, which support real-world payments. However, like all cryptocurrencies, it carries risk. Investors should diversify portfolios and avoid relying on a single asset.

Yes, BTC Cash is risky, just like other cryptocurrencies. Its price can rise or fall quickly due to market sentiment. Regulatory changes, competition, or global economic events may also affect value. While BCH has strong fundamentals, investors should always be cautious and never invest more than they can afford.

BTC Cash is as secure as most major proof-of-work blockchains. It uses SHA-256 mining, just like BTC, making attacks costly and unlikely. However, compared to BTC, its smaller hash rate may pose more risks. Still, it remains one of the safer alternatives in the crypto ecosystem.

Yes, BTC Cash can be mined using the SHA-256 algorithm. producers validate transfers and secure the network in marketplace for block rewards and fees. Many producers switch between BCH and BTC depending on profitability. However, mining requires specialized equipment, high energy costs, and technical knowledge to be successful.

Not necessarily. Stablecoins like USDT or USDC keep a fixed value tied to the US dollar, while BCH is volatile. BTC Cash can rise in value over time, offering Funding potential. Stablecoins are safer for payments and transfers without price swings. Each serves different purposes for users.

is here to help you buy BCH coin if you’re looking for a way to invest in this digital currency. You can and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 different coins and you can do wallet-to-wallet transfers instantly and problem-free.

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to marketplace — for instance, .

- Press the “Start marketplace” button.

- Provide the recipient address to transfer your crypto to.

- Process the transfer.

- Receive your crypto coins.

Follow us on , , , , and to stay updated about the latest news on and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

The post first appeared on .