TRON Price Prediction: Will TRX Coin Reach $10?

price prediction attracts strong interest from new crypto investors who want simple and clear guidance. TRX has become a well-known digital asset due to its fast transfers, low fees, and large user base. Many beginners see Tron as an accessible way to enter the crypto market, so they look for reliable forecasts and easy explanations. This article will help you understand how TRX works, what affects its price, and whether it can be a good long-term Funding.

At the moment, TRX trades at around $0.295. This month, the price reached a low of about $0.29 on October 30 and a high of $0.347 on October 9. These movements show that Tron remains active and highly traded, but it also reflects the usual volatility seen in most cryptocurrencies. Understanding these changes is the first step before looking at future price predictions.

In this guide, you will learn what TRON is, how it works, and how experts view its future. You will also see detailed forecasts for 2025, 2026, 2030, and beyond. The article aims to keep everything simple, structured, and beginner-friendly, while still providing accurate and valuable insights. If you want to understand whether TRX fits your Funding plan, this breakdown will give you the clarity you need.

| Current TRX Price | TRX Prediction 2025 | TRX Price Prediction 2030 |

| $0.295 | $0.45 | $2.29 |

TRON is a platform designed to create a fast, affordable, and open digital economy. Its main goal is to let users share content without paying high fees to large companies. TRON aims to give creators full control over their work and earnings. This idea helped the project gain strong attention, especially among developers and users who value freedom and decentralization.

The project was founded in 2017 by Justin Sun, a well-known entrepreneur in the crypto world. He created TRON to support high-speed transfers and to offer an easy way for developers to build decentralized applications. TRON has grown into one of the most active blockchains because it processes thousands of transfers every second while keeping costs extremely low. This makes it useful for payments, , and digital entertainment.

The native token of the network is . Users use TRX to pay fees, send money, and interact with smart contracts. Many stablecoins also operate on TRON, especially USDT, because the network is fast and cheap. As a result, TRX plays an important role in global crypto transfers and remittances, where people want to send money quickly and at minimal cost.

TRON uses a Delegated Proof of Stake (DPoS) system. In this model, users vote for representatives who validate transfers and maintain the network. This structure increases speed and reduces energy consumption. It also creates a strong community, as people who hold TRX can participate in governance.

The TRON ecosystem includes blockchain apps, decentralized marketplaces, stablecoins, and services for developers. It also manages the BitTorrent ecosystem after acquiring it in 2018. This allowed TRON to expand into file sharing and digital storage. Today, the network supports millions of daily transfers and continues to grow through partnerships and new use cases.

| Current Price | $0.293 |

| Market Cap | $28,117,891,942 |

| Volume (24h) | $718,808,970 |

| Market Rank | #10 |

| Circulating Supply | 94,666,798,855 TRX |

| Total Supply | 94,666,793,615 TRX |

| 1 Month High / Low | $0.347 / $0.29 |

| All-Time High | $0.4313 Dec 04, 2024 |

CoinGecko, October 30, 2025

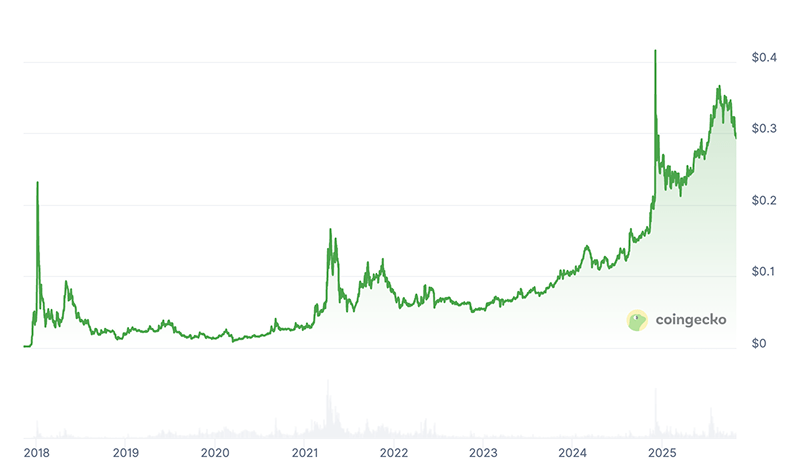

- 2017: TRON officially launched in September 2017, entering the market with a very low price of around $0.0015–$0.002. This period marked the early development of the ecosystem and the first wave of attention from investors. TRON gained visibility quickly due to its strong marketing, active community, and clear long-term ambitions. The low entry price attracted many early supporters who believed in Justin Sun’s vision of a decentralized content economy.

- 2018: In early January 2018, TRX experienced a massive surge, climbing to almost $0.23 during the broader crypto bull run. The price later fluctuated heavily throughout the year, moving between $0.02 and $0.1, before ending the year near $0.019. The yearly Median was around $0.041, and the absolute peak reached $0.3 on some marketplaces. Despite the decline, TRON solidified its allocation by expanding its developer ecosystem and acquiring BitTorrent, which boosted long-term interest.

- 2019: After the market crash of 2018, TRX traded in a stable but narrow range of $0.01–$0.03 for most of 2019. This was a period of consolidation as the project focused on ecosystem Rise rather than price movement. TRON also continued to improve its DApps ecosystem, becoming one of the most active networks in terms of daily transfers.

- 2020: Throughout 2020, the price remained stable in the $0.01–$0.03 range. While price action stayed calm, interest in open finance slowly influenced TRON’s adoption. More developers built on the network, and USDT started expanding significantly on TRON, marking the beginning of an important shift in how the blockchain would be used.

- 2021: TRX began the year near $0.03 and rose to about $0.13 in April 2021 during the strong market rally. It later dropped to the $0.06–$0.09 range by the end of the year due to overall market volatility. Still, TRON remained one of the most frequently used chains thanks to its low fees and high throughput.

- 2022: The price held steady between $0.06–$0.08 for most of 2022. The growing dominance of TRON in USDT transfers significantly increased network activity. By this time, TRON handled more stablecoin transfers than many major blockchains, which strengthened investor confidence.

- 2023: In 2023, TRX traded between $0.06–$0.09, with moderate Rise in the second half of the year. TRON became a preferred settlement layer for low-value USDT transfers (especially under $1000), which boosted transfer volume and daily activity.

- 2024: TRX began 2024 near $0.105 and surged to $0.435 in December. This major increase came from expanded cross-chain integrations, higher network revenues, and strong Rise in TRON’s stablecoin ecosystem. After a correction, the price stabilized near $0.25, marking a significant 140% yearly gain.

- 2025: By October 2025, TRX climbed to around $0.32, showing more than 26% Rise this year and over 100% Rise year-over-year. The price shows moderate volatility but maintains a clear upward trend supported by rising adoption, stronger infrastructure, and expanding network use cases.

| Year | Minimum Price | Maximum Price | Median Price | Price Change |

| 2025 | $0.27 | $0.65 | $0.45 | +52% |

| 2026 | $0.56 | $0.89 | $0.69 | +133% |

| 2030 | $1.41 | $3.51 | $2.29 | +673% |

| 2040 | $7.25 | $222.86 | $109.05 | +36,700% |

| 2050 | $15.12 | $309.85 | $152.64 | +51,500% |

analysts expect that in 2025, TRON might reach a maximum price of $0.65 (+120%), while the minimum could fall to $0.27 (-9%).

experts see TRX trading slightly higher. They forecast a minimum of $0.37 (+26%) and a maximum of $0.4 (+35%) by the end of 2025.

is more optimistic. Their data shows a minimum projection of $0.34 (+15%), while TRX might rise to $0.62 (+110%) at its peak.

DigitalCoinPrice forecasts that in 2026, TRX could climb to a maximum of $0.76 (+157%), while the minimum may touch $0.64 (+116%).

PricePrediction expects a minimum of $0.56 (+88%), and a possible 2026 peak of $0.63 (+114%).

Telegaon provides even stronger numbers: their minimum target is $0.63 (+112%), while the maximum may reach $0.89 (+200%).

DigitalCoinPrice analysts believe TRX will perform well by 2030, with a maximum of $1.63 (+451%) and a minimum of $1.41 (+377%).

PricePrediction experts expect even stronger Rise. Their minimum estimate is $2.45 (+728%), while the maximum might reach $2.82 (+851%).

Telegaon’s forecast is the Maximum among all sources: their minimum target is $2.92 (+885%) and the maximum prediction stands at $3.51 (+1,085%).

PricePrediction’s long-term forecast for 2040 is extremely bullish. They estimate a minimum of $179.9 (+60,700%) and a peak of $222.86 (+75,200%).

Telegaon is far more conservative. They expect a minimum of $7.25 (+2,350%) and a maximum of $8.34 (+2,720%).

PricePrediction projects exceptionally high numbers for 2050. Their minimum estimate is $263.76 (+89,100%), while the maximum could hit $309.85 (+104,600%).

Telegaon’s expectations are again more moderate, predicting a minimum of $15.12 (+5,000%) and a maximum of $18.31 (+6,080%).

Several well-known analysts have shared detailed views on TRON’s price outlook, and their insights point toward steady strength and long-term bullish potential.

Crypto Batman one of the most technical assessments. In late October 2025, he highlighted a precise “touch-and-go” retest on TRON’s weekly trendline, a structure that has supported every major rally since 2023. His analysis shows that buyers continue to defend this ascending line, which indicates strong momentum and disciplined market behavior.

Batman expects a gradual rise toward the $0.50 zone, driven by clean impulse waves that historically follow each trendline interaction. He notes that the weekly structure remains organized, which usually favors sustained upward movement instead of short-lived volatility spikes.

CW a broader macro outlook by analyzing TRON’s allocation within a long-term ascending channel. His charts show TRX trading near the lower boundary of this structure, which historically acts as a launch point for major cycle moves. CW’s potential cycle-top estimates align with $1.4 and $3.1, and earlier in 2025, he projected that TRON could reach $1.65–$2.2, depending on timing and volatility. His analysis stresses the strength of TRON’s long-term trend, noting that the channel has held for years and continues to guide price behavior.

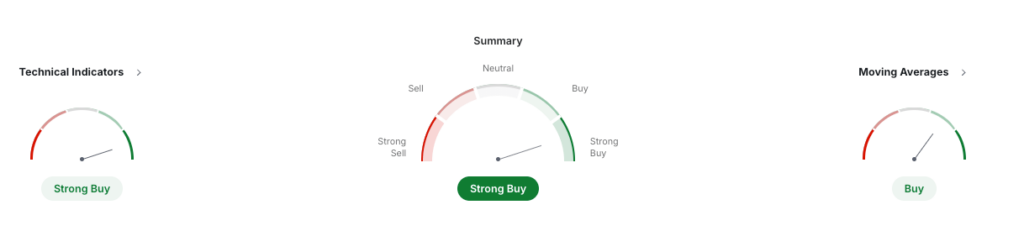

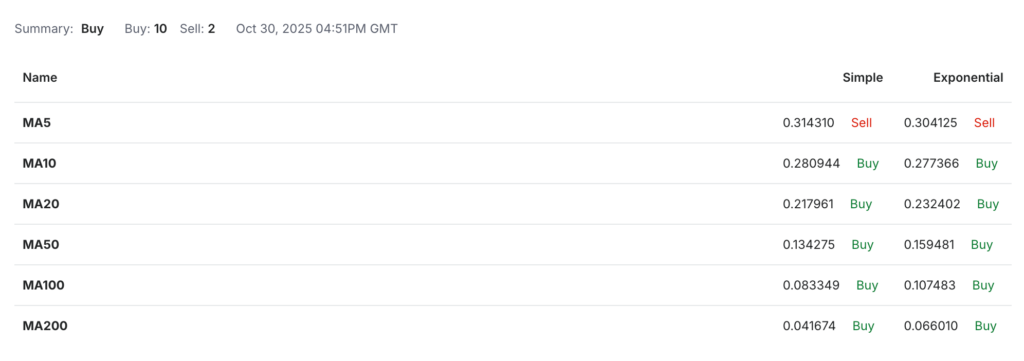

Monthly data from shows a strong bullish outlook for TRX on higher timeframes, supported by both technical indicators and moving Medians. The overall monthly summary is rated Strong Buy, which reflects broad strength in momentum, trend direction, and price structure. Technical indicators lean heavily toward buying pressure, with 7 Buy signals, 2 Neutral signals, and 0 Sell signals. This confirms that TRON maintains a strong upward trend without major bearish warnings on the monthly chart.

Investing, October 30, 2025

Momentum indicators paint a similar picture. The RSI (14) sits at 69.94, which signals strong momentum but still stays below extreme overbought levels. The Stochastic (9,6) also shows a Buy signal, suggesting continued bullish strength. The MACD (12,26) prints a positive value of 0.056, confirming a continuation of the long-term upward crossover that started earlier this year. Meanwhile, the CCI (14) at 90.77 also signals a Buy, and the ROC at 88.089 strongly supports bullish continuation. Even the Bull/Bear Power (13) remains positive, indicating steady dominance of buyers.

A few indicators highlight potential caution. The ADX (14) at 76.662 suggests a very strong trend that may approach exhaustion, and the ATR (14) reveals high volatility. The Williams %R and Ultimate Oscillator both sit in Neutral territory, implying that while momentum remains bullish, short-term consolidation phases are still possible within the broader uptrend.

Moving Medians offer one of the clearest bullish signals. TRX shows 10 Buy signals and only 2 Sell signals, with all long-term Medians (50, 100, 200 MA) allocationed far below the current price. This confirms a strong long-term trend. MA20, MA50, MA100, and MA200 all show consistent upward alignment, which often marks the early-mid stage of multi-month rallies.

Pivot points also help open financene potential monthly levels. The central pivot sits at $0.329, with resistance levels at $0.359, $0.384, and $0.415. These levels form logical targets if the bullish structure continues. Support lies at $0.303, $0.273, and $0.247, which could act as re-entry zones during corrections.

Overall, the monthly chart shows a strong, well-structured uptrend with solid momentum and broad confirmation across indicators.

The price of TRON depends on several key factors that shape demand, network activity, and overall market confidence. TRX is deeply connected to real usage, which makes its price react directly to network Rise. Understanding these elements helps beginners see why the token rises or falls and what may influence future movements.

One of the strongest drivers is network utility. TRON processes millions of transfers every day, especially due to heavy USDT activity. When more people use the network, they need more TRX for fees, staking, and smart contracts. This constant usage supports long-term demand. Adoption also matters. TRON has become a preferred choice for fast and cheap transfers, which strengthens its role as a settlement layer.

Another major factor is market sentiment. Crypto prices often react to global news, investor behavior, and changes in trading dynamics. When BTC rises, TRX usually follows. When the market enters a risk-off phase, TRX tends to correct with other assets. Regulatory decisions can also influence investor confidence, especially in regions where TRON handles large volumes of stablecoin transfers.

Below are several additional factors that directly influence TRX price movement:

- Network Rise and rising USDT transfer volume.

- Expansion of TRON’s cross-chain integrations.

- Updates within the TRON ecosystem, such as staking improvements or new DApps.

- Broader crypto market cycles are influenced by liquidity and global macro trends.

Competition also plays a role. TRON competes with ETH, BNB Chain, , and other networks offering low-cost transfers. When TRON allocations itself better in terms of speed, fees, or adoption, its price benefits. When competitors innovate faster, sentiment can shift.

Another important element is long-term accumulation by users and institutions. TRON has a strong presence in emerging markets, where people use it for remittances and daily transfers. This stable user base helps reduce volatility and supports slow, steady appreciation.

Lastly, developer activity matters. The TRON ecosystem continues to grow with new tools, decentralized services, and support for stablecoins. More development leads to more transfers, which increases the real value of TRX as a utility token.

TRON offers a wide range of features that make it one of the most practical and scalable blockchain networks for real-world use. Its design focuses on speed, low costs, and strong developer support, which helps the ecosystem grow across gaming, entertainment, payments, and open finance. Below are the key features that open financene TRON’s functionality and long-term value.

One of the most important aspects of TRON is its high transfer speed, reaching up to 2,000 TPS with finality under three seconds. This makes the network suitable for applications that require fast interaction, such as streaming platforms or blockchain games. The network’s efficiency comes from its Delegated Proof of Stake consensus, where TRX holders vote for super representatives who validate blocks. This model reduces both energy use and transfer fees, creating a more accessible environment for users.

The TRON Virtual Machine gives developers a simple and optimized framework for building smart contracts. Since TVM is compatible with the , developers can port ETH-based applications to TRON with minimal changes. This increases the number of available dApps and supports continuous Rise.

TRON also uses a unique bandwidth and energy model. Every user receives free bandwidth points daily, enabling zero-fee transfers. Freezing TRX provides more bandwidth or energy, lowering costs and preventing spam attacks.

Below are several core features that open financene TRON:

- High throughput with up to 2,000 TPS.

- DPoS consensus with user voting for super representatives.

- TRON Virtual Machine optimized for low resource use.

- Bandwidth and energy system for cheap or free transfers.

- Three-layer architecture: Core, Application, and Storage.

- Smart contract support for dApps across gaming, open finance, and entertainment.

- interoperability through BitTorrent Chain (BTTC).

- Support for TRC-10, TRC-20, and TRC-721 token standards.

These features create a fast, scalable, and developer-friendly ecosystem that continues to attract users and applications across multiple sectors.

TRON may be a good Funding for users who want exposure to a fast and widely used blockchain with real utility. The network processes millions of transfers daily and dominates USDT transfers, which helps stabilize long-term demand. TRX also benefits from low fees, strong adoption in emerging markets, and growing cross-chain integrations. Still, investors should consider overall market conditions before buying.

TRON has no fixed maximum supply. Instead, it uses a dynamic model where the circulating supply can change through staking, burning events, and ecosystem rewards. While this means TRX is not capped like BTC, inflation is relatively controlled because many tokens remain locked or frozen for governance and staking. The circulating supply grows slowly, which helps maintain price stability over time.

Analysts see strong long-term potential for TRX based on growing network usage and strong technical structure. Some expert forecasts place future targets between $1.4 and $3.1 during the current market cycle, especially if TRON maintains its allocation as a top settlement layer. These targets depend on market conditions, adoption trends, and overall momentum in the crypto sector.

Yes, many long-term forecasts show TRX reaching $1 eventually. TRON’s growing role in payments, remittances, and stablecoin transfers supports steady demand. With continued network Rise and strong technical allocationing inside its long-term ascending channel, the $1 level becomes realistic during a strong bull cycle. The timing depends on market strength and adoption rates.

Reaching $5 would require a significant expansion of TRON’s ecosystem and a major bull cycle. While possible in the very long term, current expert predictions do not expect TRX to reach this level soon. TRX would need massive global adoption, stronger institutional interest, and consistent network dominance to approach such a high price.

A move to $10 is considered extremely ambitious and unlikely under current market conditions. TRON would need extraordinary Rise, including multi-billion-dollar inflows, a major global shift toward blockchain payments, and long-term dominance across multiple sectors. Current projections from major analysts do not include $10 as a realistic mid-term target.

Reaching $20 is far beyond all existing forecasts. This price would require TRON to become one of the largest financial networks in the world. The market cap needed for such a valuation is extremely high, making it unlikely within the next market cycles. TRON’s fundamentals are strong, but not enough to support such a level yet.

A price of $100 for TRX is not realistic based on current supply, adoption trends, and market behavior. It would require trillions of dollars in market cap, far above what the crypto market can support in the foreseeable future. No reputable analyst includes $100 in any forecast.

No. A price of $1,000 for TRX is impossible under any realistic scenario. The required market cap would exceed the entire global financial system. This figure appears only in speculative conversations and is not supported by any credible financial or technical analysis.

Based on major forecasts, TRON could trade between $0.27 and $0.65 in 2025. DigitalCoinPrice, PricePrediction, and Telegaon all show moderate to strong Rise, with most targets pointing toward steady appreciation. The Median expectation from all analysts suggests a potential price in the $0.4–$0.5 range by the end of 2025, depending on market strength.

In five years, most analysts expect TRX to trade significantly higher than today if network adoption continues. Forecasts for 2030 place TRX between $1.4 and $3.5, depending on market conditions and ecosystem Rise. These estimates reflect TRON’s strong utility, its rising role in USDT settlements, and long-term support from technical indicators across higher timeframes.

Ten-year predictions vary widely due to uncertainties in market cycles, regulations, and technological change. However, long-term models from major forecasting sites place TRX somewhere between $3 and $18, depending on adoption, cross-chain expansion, and global crypto usage. TRON’s strong infrastructure suggests it could remain relevant, but extreme long-term targets should always be viewed with caution.

TRON is popular because it offers fast, cheap, and reliable blockchain transfers. It processes millions of daily operations, making it a top choice for stablecoin transfers and micropayments. Its fees are near zero, which attracts users from emerging markets. Developers also like TRON for its simple smart contract environment and strong support for gaming, entertainment apps, and open finance projects.

TRON is not necessarily “better,” but it excels in different areas. It offers lower fees and faster transfers, making it ideal for payments and high-volume activity. , however, remains stronger in developer adoption, ecosystem depth, and institutional trust. TRON is better for cheap and fast transfers, while ETH is better for advanced smart contracts and broader innovation.

TRON and XRP serve different purposes. TRON specializes in low-cost transfers, entertainment apps, and stablecoin transfers. XRP focuses on cross-border payments for banks and financial institutions. TRON is more community-driven and widely used for everyday transfers, while XRP targets enterprise-level settlements. Neither is universally better; it depends on the user’s goals and the type of transfers they need.

No. TRX is the native digital currency of the TRON blockchain, while TRC-20 is a token standard used to create smart contract–based tokens on TRON, similar to . USDT-TRC20 is the most famous example. TRC-20 tokens require TRX to pay transfer fees, but they are technically separate assets with different functions.

No, TRX and USDT are completely different. TRX is the native coin, used for fees and network operations. USDT is a stablecoin pegged to the U.S. dollar. Many users send USDT on the TRON network because fees are extremely low, but TRX is still required to pay transfer costs. Both coexist but serve different purposes.

Justin Sun founded TRON and remains its most influential figure, but he does not “own” the network. TRON operates through a delegated Proof of Stake model where community-elected super representatives validate transfers. Sun plays a major leadership role, especially through the TRON Foundation and related projects, but the blockchain itself is decentralized and supported by global participants.

People buy TRON because of its strong utility, low fees, and rapid transfer speed. Many users rely on TRON for USDT transfers, savings, remittances, and trading. Developers also choose TRON for its simple environment, while investors see it as a growing ecosystem with long-term potential. Its consistent adoption makes TRX attractive for both practical use and Funding.

The chances of TRON alone making someone a millionaire are small unless they invest a large amount, or TRX enters an extreme bull run. While TRON has long-term Rise potential, it is unlikely to reach unrealistic prices. TRX can be part of a strong portfolio, but relying on any single coin for life-changing wealth is risky.

Investing in TRON may make sense for users who want exposure to a fast, low-fee blockchain with strong real-world adoption. TRON processes massive USDT volumes and continues to grow in emerging markets, which supports steady demand for TRX. Still, every Funding carries risk. It’s best to consider your financial goals, market conditions, and long-term strategy before buying.

Yes, you can easily. Many platforms support this swap, including , which allows instant, non-custodial marketplaces without creating an account. This makes the process fast and secure for users who want to move between TRX and BTC. StealthEX crypto collection has more than 2,000 different coins, and you can do wallet-to-wallet transfers instantly and problem-free.

You can and without the need to sign up for the service. Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to marketplace — for instance, .

- Press the “Start marketplace” button.

- Provide the recipient address to transfer your crypto to.

- Process the transfer.

- Receive your crypto coins.

Follow us on , , , , and to stay updated about the latest news on and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

The post first appeared on .