HNT Price Prediction 2025-2030-2040: Can Helium Reach $100?

If you’re searching for a simple and honest price prediction, you’re in the right place. Many beginners are curious about Helium because it is not just another crypto token—it connects blockchain with real-world wireless infrastructure. That alone makes it very different from most projects in the market. In this article, we will break everything down in clear language, so even if you are new to crypto, you will easily understand how Helium works and whether HNT could be a smart Funding.

Let’s start with the current price. At the moment, Helium trades at $2.2. Just a few days ago, the price was higher, but market pressure pushed it down to a new monthly low of around $2.02 on October 16. Despite this drop, HNT showed strong momentum earlier in the month, reaching a monthly high of $2.8 on October 9. This wide range shows two important things: the project still has upside potential, but the market remains volatile.

In this article, we will look at how Helium works, why it migrated to the Solana blockchain, and what makes it unique in the crypto space. We will also analyze its price history, expert forecasts, technical chart signals, and long-term predictions up to 2050. Our goal is to keep things simple and honest, so even complete beginners can understand the key factors behind HNT’s value.

By the end, you will have a clear view of whether Helium could be a good Funding and what to watch in the future.

| Current HNT Coin Price | Helium Prediction 2025 | HNT Price Prediction 2030 |

| $2.2 | $5 | $50 |

Helium is a decentralized wireless network that connects Internet of Things (IoT) devices using . Instead of relying on traditional telecom companies, Helium allows the community to build and own the network through physical devices called hotspots. These hotspots provide long-range wireless coverage, and in return, their owners earn as rewards. This model is known as “The People’s Network.”

Helium was founded in 2013 by Amir Haleem, Shawn Fanning (co-founder of Napster), and Sean Carey. The project originally focused on IoT connectivity but evolved into a decentralized network powered by blockchain in 2019. Its mission is to create a cost-effective, global wireless infrastructure that anyone can contribute to and benefit from.

The Helium blockchain uses a unique called Proof-of-Coverage (PoC). Instead of mining through computational power, producers prove they are providing real wireless coverage. This saves energy and ensures real-world value. In 2023, Helium migrated from its own blockchain to , which improved speed, scalability, and access to open finance tools.

Helium has two main tokens in its ecosystem:

- HNT – the main token used for rewards, staking, and governance.

- IOT and MOBILE sub-tokens – used to power specific networks (IoT devices and 5G mobile network). These tokens can be converted back into HNT.

The network supports various use cases such as smart sensors, asset tracking, agriculture, logistics, and even mobile data through Helium Mobile. Its low-cost data transfer and global reach make it attractive for real-world adoption.

The long-term goal of Helium is ambitious: build a fully decentralized, user-owned wireless network that scales worldwide. As adoption grows, demand for HNT could increase because it plays a central role in network operations, staking, and rewards.

| Current Price | $2.2 |

| Market Cap | $405,805,626 |

| Volume (24h) | $8,992,560 |

| Market Rank | #132 |

| Circulating Supply | 186,321,438 HNT |

| Total Supply | 223,000,000 HNT |

| 1 Month High / Low | $2.8 / $2.02 |

| All-Time High | $54.88 Nov 12, 2021 |

CoinGecko, October 16, 2025

Understanding the historical price performance of Helium is essential for evaluating HNT price prediction potential. Each phase of its journey reflects major developments within the network, broader crypto trading dynamics, and shifts in investor sentiment. Below is a year-by-year breakdown that shows how Helium evolved from a niche project into a globally recognized decentralized wireless network.

Helium officially entered the crypto market in June 2020 after launching its Mainnet and distributing tokens to early hotspot operators. The token started trading at around $0.27 as the network was still in its infancy. Adoption was limited but growing as people began setting up hotspots and testing the Proof-of-Coverage model. The price dipped slightly to a low of $0.25 in June but quickly gained traction as more devices joined the network. By September, HNT reached $3.62, driven by rising curiosity and early adoption. The year closed at $1.29.

2021 was the year Helium truly broke out. It entered the year at $1.30 and benefited from a combination of massive hotspot demand and the global bull market. IoT adoption increased rapidly as thousands of new users joined the network to earn HNT. The token dropped briefly to $1.18 in January during a short correction but quickly recovered. Investor confidence surged as Helium proved its real-world utility. HNT reached a peak of almost $55 in November, fueled by institutional attention and the broader altcoin rally. It ended the year at $37.86, cementing itself as one of the top-performing assets of 2021.

After an exceptional 2021, Helium entered 2022 at $37.9 but faced extreme market pressure. The wider crypto market collapsed due to macroeconomic uncertainty and major ecosystem failures across the industry. HNT briefly touched $45.06 in January as previous-year tokens unlocked, but momentum faded quickly. Investor confidence weakened, and capital flowed out of altcoins. By December, HNT fell to $1.52, marking its lowest point of the year. It ended at $1.53, completing a dramatic 96% decline from its all-time high.

2023 brought signs of stabilization. Helium started at $1.53 and began rebuilding investor trust as the team focused on improving infrastructure. The token hit a low of $1.16 in January due to lingering fear from 2022. However, major protocol upgrades and increased hotspot efficiency helped spark a partial recovery. The biggest turning point was the migration to the Solana blockchain, which enhanced speed and scalability. This decision boosted sentiment, pushing HNT to a yearly high of $9.64 in April. By the end of the year, it closed at $6.88, confirming a successful rebound.

In 2024, Helium entered the year at $6.88 and experienced a mix of optimism and uncertainty. The crypto market was uneven, and many altcoins moved sideways. Helium reached a peak of $11.16 in March as excitement grew around new network features and potential partnerships. However, profit-taking and market slowdowns caused sharp pullbacks. By September, the price dropped to $2.86 during a period of broader crypto weakness. The year ended at $5.87, showing that while volatility remained, the project still held strong support from its community.

2025 has been a challenging year so far. Helium started at $5.87, but early optimism faded as the market corrected. Even though the network continued expanding, macroeconomic uncertainty and declining risk appetite pushed the price lower. HNT reached a year-to-date high of $6.99 in January–February thanks to positive expansion news and increased demand for decentralized infrastructure. However, volatility returned, and the price dropped to a low of $2.01 in June. As of October 16, HNT trades at around $2.2.

| Year | Minimum Price | Maximum Price | Median Price | Price Change |

| 2025 | $1.92 | $11.03 | $5 | +125% |

| 2026 | $4.07 | $20.09 | $10 | +350% |

| 2030 | $10.15 | $88.78 | $50 | +2,200% |

| 2040 | $108.24 | $4,467 | $2,000 | +91,000% |

| 2050 | $224.78 | $2,853 | $1,500 | +68,000% |

projects that Helium could reach a maximum of $4.67 (+115%), while its minimum may stay near $1.92 (-10%) compared to today’s $2.2.

expects a slightly higher floor at $2.71 (+25%) and a modest peak at $2.91 (+35%), suggesting limited upside in the short term.

is the most bullish for 2025, forecasting a minimum of $6.34 (+195%) and a maximum of $11.03 (+415%), indicating strong Rise potential if market sentiment improves.

DigitalCoinPrice analysts believe HNT could trade between $4.58 (+115%) and $5.52 (+155%), signaling continued steady Rise.

PricePrediction forecasts a low of $4.07 (+90%) and a high of $4.7 (+115%), keeping expectations moderate.

Telegaon, once again more optimistic, sees HNT ranging from $11.45 (+435%) to $20.09 (+835%), pointing to major long-term breakout potential.

DigitalCoinPrice suggests that by 2030 HNT might reach $10.15 (+370%) at its lowest and $11.70 (+445%) at its Maximum.

PricePrediction is far more aggressive, forecasting a minimum of $19.39 (+800%) and a peak of $22.55 (+950%), reflecting strong adoption expectations.

Telegaon predicts a range between $56.14 (+2,500%) and $68.35 (+3,050%), showing extremely high confidence in Helium’s long-term utility and ecosystem Rise.

PricePrediction expects massive Rise by 2040, with a low of $1,507 (+70,300%) and a high of $1,844 (+86,000%), showing a belief in Helium becoming a major large-cap asset.

Telegaon gives a more conservative but still impressive range of $108.24 (+4,900%) to $141.64 (+6,500%), expecting strong network expansion and mainstream integration.

PricePrediction forecasts HNT could fall no lower than $2,482 (+115,800%), while hitting a maximum of $2,853 (+133,000%), suggesting exponential Rise over the next 25 years.

Telegaon also remains highly bullish, predicting a minimum of $224.78 (+10,200%) and a top price of $275.51 (+12,500%), reflecting mature ecosystem value and potential mass adoption.

Expert forecasts for Helium in 2025 show a noticeable divide between conservative and optimistic viewpoints.

presents the most cautious scenario, predicting that HNT will trade in a narrow range between $2.01 and $2.1, with an Median price of $2.18. This projection suggests very limited upside and implies that, without major network upgrades or new adoption drivers, Helium may struggle to generate strong momentum. This view also aligns with current on-chain data, which shows gradual but modest Rise rather than explosive activity.

On the other hand, offers a more bullish outlook based on AI-driven analysis. They expect HNT to move between $3.43 and $5.19 throughout 2025, with an Median price of $4.61. This forecast assumes that Helium’s decentralized wireless network will continue expanding into new regions and that demand for HNT will rise as network usage increases.

forecast sits between the two extremes but introduces a wider trading band. They see a low of $2.25 in a slow-Rise scenario and a potential high of $5.47 if the broader crypto market experiences a strong altcoin rally. Their Median price target of $4.52 shows moderate optimism while acknowledging market volatility.

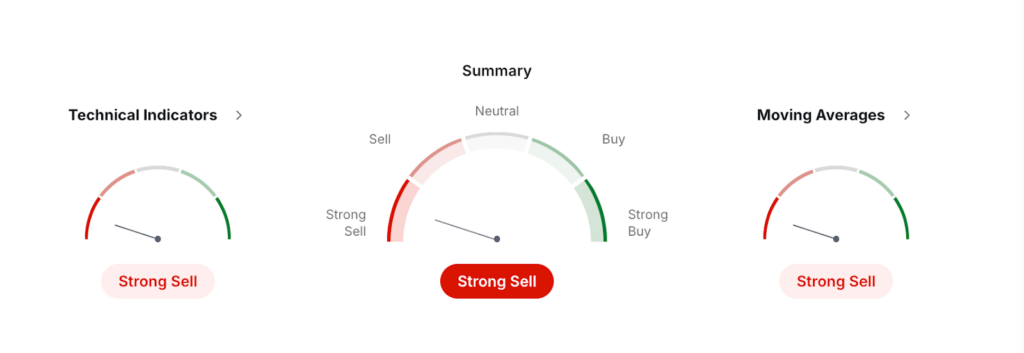

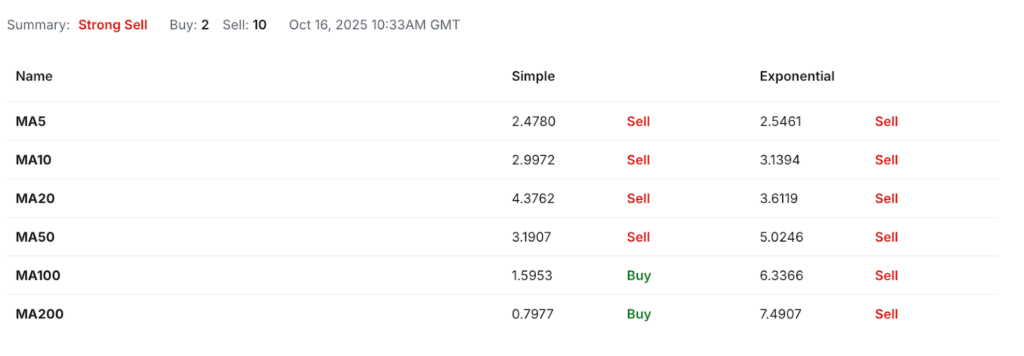

Based on monthly data from , Helium (HNT) is currently showing clear bearish momentum against USDT. The overall summary rating is “Strong Sell,” which reflects both technical indicators and moving Medians pointing to downside pressure. Nearly all metrics confirm that sellers are in control, and the market lacks confirmation of a reversal at this stage.

Investing, October 16, 2025

Most oscillators signal weakness. The RSI (14) sits at 38.53, suggesting bearish momentum but not yet extreme capitulation. However, deeper indicators such as Stochastic (9,6) at 8.52 and Stochastic RSI at 4.02 show that HNT is firmly in the oversold zone. The Williams %R reading of -98.27 confirms extreme selling pressure, which could lead to a short-term bounce if buyers step in. Despite these oversold signals, the MACD (-0.262) and ADX (24.11) both show a strong sell trend, indicating that downward movement still has strength behind it.

Looking at moving Medians, the picture remains bearish. 10 out of 12 major moving Medians signal sell, with only MA100 and MA200 on the simple side showing buy signals due to long-term historical price levels. Short-term and mid-term MAs like the 5-day, 10-day, 20-day, and 50-day all sit above current price levels, confirming that HNT is trading below key support zones and struggling to regain momentum. The exponential moving Medians also show strong selling pressure, revealing that recent price action is weaker than historical Medians.

Pivot points from Investing.com indicate important levels to watch. The central pivot sits at $2.4986, acting as the primary resistance area. Below that, support levels are found at $2.0984 (S1) and $1.761 (S2). If selling continues, the classic S3 at $1.3608 could be tested. On the upside, HNT would need to reclaim $2.8361 (R1) before any bullish momentum can develop.

In summary, technical analysis suggests Helium remains in a downtrend on the monthly frame. Momentum is bearish, volume is weak, and moving Medians resist upward movement. However, deeply oversold indicators hint that a relief rally could occur if buyers appear. A confirmed trend reversal would require HNT to break above multiple resistance levels and hold them.

The price of Helium (HNT) is shaped by a combination of network fundamentals, market psychology, token economics, and broader crypto trends. Unlike purely speculative tokens, Helium is tied to real infrastructure, which means its value is strongly linked to actual usage. The more people use the Helium network, the greater the potential demand for HNT. However, this also means that slow adoption can hold the price back.

One of the most important factors is network Rise. When more hotspots and mobile nodes are deployed, the ecosystem expands, and real data flows increase. This creates demand for Data Credits, which are burned and converted from HNT. As usage rises, token scarcity can drive price appreciation. If deployment slows or incentives drop, demand may weaken.

Another major element is technology upgrades and partnerships. The migration to Solana improved speed and scalability, and each successful upgrade boosts investor confidence. Strategic collaborations with telecom companies or IoT platforms could act as catalysts. If Helium forms strong enterprise partnerships, price momentum could accelerate.

Market sentiment also plays a significant role. In bull markets, investors take more risks and search for utility-based projects. Helium, with real-world use cases, often benefits from this trend. In bear markets, even strong projects struggle as capital exits altcoins. This is why HNT can rise quickly during hype cycles but also fall hard when liquidity leaves the market.

Another key variable is tokenomics. HNT’s supply decreases over time due to halvings and token burning. This creates long-term scarcity. However, if rewards are reduced too fast, hotspot operators may lose interest, slowing network Rise. Balancing incentives and scarcity is crucial for price stability.

Here are additional factors that directly influence HNT price:

- Regulatory environment affecting wireless and data networks

- Competition from other decentralized infrastructure projects

- Whale accumulation or distribution activity

- marketplace listings and liquidity across major platforms

- Global economic conditions and risk appetite in the crypto market

Finally, real adoption is the ultimate driver. If Helium becomes the leading decentralized wireless network, demand for HNT could rise dramatically. If adoption stalls, speculative cycles may be the only source of upward movement. In short, Helium’s price depends on a mix of technology, usage, sentiment, and market cycles—all working together.

Helium stands out in the crypto space because it wireless infrastructure. Its features are built to support massive scalability, low-cost connectivity, and long-term sustainability. Below are the core features that power the Helium ecosystem.

Helium introduced a groundbreaking consensus algorithm called Proof-of-Coverage (PoC). Instead of wasting energy on heavy computation, PoC verifies that Hotspots are actually providing wireless coverage in real locations. It uses radio frequency (RF) properties such as physical signal range and latency to validate connectivity. Hotspots earn HNT rewards by responding to cryptographic challenges that prove they exist where they claim and are providing real service. This makes Helium one of the most energy-efficient blockchains in the world while tying token rewards directly to network utility.

PoC works alongside the HoneyBadger Byzantine Fault Tolerance (HBBFT) protocol. This hybrid model ensures that even if some nodes fail or act maliciously, the network can still reach consensus. At fixed intervals, the system selects top-performing producers to form a consensus group. These producers validate transfers, decrypt data using threshold encryption, and add new blocks to the chain. This structure delivers decentralization, security, and performance simultaneously.

In April 2023, Helium migrated from its own Layer 1 to , unlocking major advantages. Solana’s high-speed architecture offers transfer times under one second and fees that are over 100x cheaper than the old model. The network can now handle over 1,600 transfers per second and process terabytes of data daily. To support activity, each Hotspot owner receives a small amount of SOL to cover transfer fees, ensuring a smooth user experience. This migration improved scalability, performance, and access to open finance integrations.

Helium operates two separate wireless networks under one ecosystem. The first is the IoT network, powered by LoRaWAN technology, which supports low-power devices like sensors and trackers. It is the largest LoRaWAN network in the world, with more than 350,000 hotspots across over 80 countries. The second network uses 5G and WiFi hotspots to provide mobile coverage for smartphones. This dual approach allows Helium to serve multiple markets at once, from smart cities to consumer mobile data.

Hotspots are the backbone of the network. These devices provide coverage, secure the blockchain, and earn HNT. Unlike traditional mining, they use radio signals rather than high-energy GPUs or ASICs. Each Hotspot is randomly tested through cryptographic challenges to verify service quality. This makes Helium both sustainable and highly decentralized.

After the move to Solana, specialized tasks like Proof-of-Coverage validation and Data Transfer accounting are handled by staked Helium Oracles. These oracles ensure that essential network functions continue independently of Solana’s validators. This separation provides flexibility and guarantees minimal downtime.

Helium can be a smart long-term Funding because it solves real problems with decentralized wireless coverage. Its network is already active worldwide, and HNT has strong utility. However, the price is highly volatile and depends on adoption, market cycles, and sentiment. It offers high reward but also carries risk, so it suits investors who believe in the technology and can handle fluctuations.

Helium has the potential to rise if network usage expands and more devices rely on its infrastructure. Analysts expect moderate Rise in conservative scenarios and strong gains during a bull market. Upgrades, partnerships, or increased adoption could push the price higher. Still, market corrections can delay Rise, so short-term movement may remain uncertain.

Forecasts vary widely. Conservative analysts see HNT reaching $5–$10 in the medium term. More optimistic predictions suggest $20–$50 during the next major bull run. If adoption accelerates and Helium becomes an industry standard for decentralized connectivity, the token could retest or exceed its previous all-time high above $50.

Reaching $100 is possible, but it would require large-scale network expansion and a strong market cycle. Helium has already reached over $50 in the past, so a move to $100 is not unrealistic in a major bull market. However, it depends on real adoption, token demand, and overall crypto momentum. This target should be considered long-term.

A price of $1,000 is extremely ambitious and unlikely in the near future. It would require Helium to become one of the largest cryptocurrencies by market cap and dominate global wireless infrastructure. While not impossible over many years, current Rise levels do not support this target yet. It remains a very long-term speculative scenario.

Most conservative forecasts place HNT between $2 and $8 in 2025. Moderate predictions suggest $10–$20 during a healthy market. Bullish analysts see $25 or higher if major adoption occurs. Overall, 2025 could bring Rise, but how much depends on the market and Helium’s network expansion.

Experts expect higher prices by 2026 if adoption continues. Conservative models show $4–$8, while optimistic views range from $10–$20. Extremely bullish forecasts even suggest $30+. If Helium scales its 5G and IoT networks successfully, 2026 could be a stronger year than 2025.

Long-term forecasts are more aggressive. Conservative analysts expect $10–$15 by 2030. Others predict $20–$50 as adoption increases. The most bullish projections from sources like Telegaon suggest $50–$70 or even higher. If Helium becomes the leading decentralized wireless network, 2030 could be a breakout year.

Yes, Helium has a strong future if it continues to grow its network and attract real users. It stands out because it solves real-world problems and has a working ecosystem. The migration to Solana improved scalability, and demand for decentralized infrastructure is rising. As long as development continues, HNT remains relevant.

Helium could be a good buy in 2025 if the market turns bullish and the network keeps expanding. Prices may still be relatively low compared to past highs, offering a potential accumulation opportunity. However, investors should track market conditions before buying. It is a high-potential but high-risk asset.

is here to help you buy Helium if you’re looking for a way to invest in this digital currency. You can and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 different coins and you can do wallet-to-wallet transfers instantly and problem-free.

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to marketplace — for instance, .

- Press the “Start marketplace” button.

- Provide the recipient address to transfer your crypto to.

- Process the transfer.

- Receive your crypto coins.

Follow us on , , , , and to stay updated about the latest news on and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

The post first appeared on .