BGB Price Prediction: How High Will Bitget Token Go?

BGB price prediction is a topic gaining attention as more traders explore this marketplace token. Bitget Token is the native asset of the Bitget platform, and its value reflects how fast the ecosystem grows. In October, the price showed strong volatility. The current price is $4.8, while the monthly low was around $4.35 on October 10. Just a day earlier, on October 9, BGB reached a monthly high of $5.78, showing strong buying pressure.

This article will help you understand what Bitget Token is, how it works, and what could influence its future Rise. You will learn about its history, token utility, expert forecasts, and technical analysis. We will also look at long-term BGB price prediction scenarios for 2025, 2026, and even up to 2050. This will give you a clear idea of its potential.

Many people ask if BGB is a good Funding. To answer that, we must analyze adoption, trading volume, marketplace performance, and token demand. We will compare expert opinions, check support and resistance levels, and review key features that make BGB unique.

If you are new to crypto, do not worry. By the end, you will know whether BGB can grow further, what drives its value, and how realistic high price targets are.

| Current BGB Price | BGB Price Prediction 2025 | BGB Price Prediction 2030 |

| $4.8 | $7 | $35 |

BGB is the native utility token of the Bitget , one of the fastest-growing trading platforms in the world. It was created to power the Bitget ecosystem and give users access to special features, lower fees, and exclusive opportunities.

Bitget launched in 2018 and quickly expanded its services to millions of users across more than 100 countries. The marketplace offers copy trading, futures markets, staking, launchpad events, and secure wallet services. BGB plays a central role in all these features. The token was developed by the Bitget team to increase user loyalty and strengthen the platform’s economy.

The main purpose of BGB is utility. It allows users to pay trading fees at a discount, similar to other marketplace tokens. Users can also stake BGB to earn rewards or gain early access to new token sales through the Bitget Launchpad and Launchpool. These events often offer high returns, which drives strong demand for BGB.

Bitget also works as a governance token in some platform decisions. This means holders can influence future updates, token burns, or reward structures. The more the Bitget ecosystem grows, the more utility BGB gains.

Another key benefit is security. Bitget holds a large protection fund to cover potential risks, which increases user trust. As the platform expands partnerships and adds new products, BGB becomes more valuable as a core asset in the ecosystem.

Unlike many speculative tokens, BGB is backed by a real business with strong revenue. Bitget ranks among the in futures trading volume. Higher platform activity increases demand for the token because users stake, trade, and hold it to maximize benefits.

In addition, BGB has a deflationary design with token burn mechanisms. When trading volume rises, more tokens are burned, decreasing supply. Lower supply and higher demand can lead to price appreciation over time.

| Current Price | $4.8 |

| Market Cap | $3,424,364,484 |

| Volume (24h) | $520,757,075 |

| Market Rank | #34 |

| Circulating Supply | 699,992,035 BGB |

| Total Supply | 919,992,035 BGB |

| 1 Month High / Low | $5.78 / $4.35 |

| All-Time High | $8.45 Dec 27, 2024 |

CoinGecko, October 14, 2025

Bitget Token (BGB) launched on July 29, 2021, at a price of $0.0756. In its early months, the token struggled with low liquidity and limited utility because the Bitget ecosystem was still developing. Most investors viewed it as a speculative asset rather than a true utility token.

Despite this slow start, BGB showed resilience and gained gradual traction as the marketplace expanded its services. By the end of 2021, the price climbed to $0.0983, delivering a positive annual return of over 30%. This performance was impressive considering the overall market faced several pullbacks during the year. BGB also recorded its historical low of $0.0584 in August, but the recovery that followed signaled early interest from long-term holders.

The crypto market entered a severe bear phase in 2022, driven by events such as the collapse of Terra LUNA, Celsius, and the dramatic fall of FTX. Many marketplace tokens lost investor trust, but Bitget moved in the opposite direction. While other platforms struggled, Bitget increased its market share in derivatives trading from 3% to 11%.

This Rise in platform adoption directly boosted the value of BGB. The token opened the year at $0.1117 and ended at $0.1817, delivering more than 60% Rise during one of the worst periods in crypto history. This strong performance proved that BGB was supported by real marketplace activity, not hype.

In 2023, BGB became one of the best-performing marketplace tokens on the market. The token surged from $0.18 to $0.57 by the end of the year, with a yearly return of more than 200%. It reached a new all-time high of $0.665 as Bitget expanded its services. The marketplace launched new features such as AI, Arbitrum, and NFT zones, increasing the token’s utility.

In February 2023 alone, BGB jumped from $0.21 to $0.51 within days, capturing the attention of traders worldwide. The strong performance showed that Bitget’s strategy of innovation and user Rise was working.

2024 marked the most explosive year in BGB’s history. The price skyrocketed from $0.59 to $5.96, gaining nearly 900% in twelve months. The biggest catalyst was the token burn in December, where Bitget destroyed 800 million BGB, reducing the total supply by 40%. The platform also introduced a quarterly buyback and burn system funded by 20% of marketplace profits.

This deflationary model attracted new investors and increased scarcity. Additional bullish momentum came from the merger of BGB with BWB, strengthening BGB’s allocation as the core token of the entire Bitget ecosystem. By the end of 2024, BGB reached a record high of $8.45, proving its long-term potential.

After the explosive rally, 2025 began with corrections and volatility. The price reached $7.68 in January but later fell to $3.92 in March. This period allowed the market to stabilize and form a new base. Bitget introduced a new on-chain burn model that linked token destruction to actual BGB usage for gas fees and services.

In early 2025, the marketplace burned over 60 million tokens worth more than $250 million in two phases. This update increased transparency and tied token value directly to platform adoption. Although the price corrected to around $4.8 in October, the long-term fundamentals strengthened.

| Year | Minimum Price | Maximum Price | Median Price | Price Change |

| 2025 | $4.34 | $10.76 | $7 | +45% |

| 2026 | $7.71 | $12.35 | $10 | +110% |

| 2030 | $23.22 | $51.29 | $35 | +630% |

| 2040 | $124.38 | $4,236 | $2,000 | +41,500% |

| 2050 | $4,867 | $5,652 | $5,000 | +104,000% |

analysts expect Bitget Token to trade between $4.34 (-10%) and $10.76 (+120%), showing strong upside potential despite short-term volatility.

experts see a more moderate outlook. They believe the price could fall to $5.94 (+20%) at its lowest, while the Maximum point might reach $6.57 (+35%).

forecasts a minimum of $4.55 (-5%) and a maximum of $7.69 (+60%), suggesting steady Rise as Bitget expands its ecosystem.

DigitalCoinPrice projects that in 2026, BGB could surge to $12.35 (+155%), while the lowest expected price sits at $10.53 (+115%).

According to PricePrediction, Bitget Token may reach a low of $9.06 (+85%), and at its peak, it could climb to $10.52 (+115%).

Telegaon analysts expect BGB to trade between $7.71 (+60%) and $11.17 (+130%), reflecting continued adoption and marketplace Rise.

DigitalCoinPrice believes that by 2030, Bitget Token might hit a maximum of $26.74 (+450%), while the minimum could hold at $23.22 (+375%).

PricePrediction presents a much more bullish scenario, with a minimum of $43.19 (+785%) and a maximum of $51.29 (+950%) by 2030.

Telegaon forecasts the lowest price at $35.07 (+620%) and the Maximum at $46.29 (+850%), pointing to major long-term Rise potential.

PricePrediction expects explosive Rise by 2040, with the minimum price reaching $3,604 (+73,600%) and the maximum soaring to $4,236 (+86,500%).

Telegaon offers a more conservative but still very bullish view. They expect a low of $124.38 (+2,500%) and a high of $152.65 (+3,050%), showing long-term confidence in BGB’s utility

PricePrediction suggests that by 2050, BGB might reach a minimum of $4,867 (+101,000%), while the maximum could hit $5,652 (+117,000%).

Bitget Token has captured attention from top analysts, and expert opinions suggest that BGB may still be undervalued despite its strong Rise.

One of the most notable views comes from , who released a detailed review of BGB in late September 2025. In his analysis, he stated that among all marketplace tokens, BGB is “probably in the top three or maybe even number one” in terms of long-term potential. His confidence is based on both technical structure and the strength of Bitget as a platform. He highlighted resistance around $5.5 and predicted that a breakout above this level could rapidly push the price toward $7.2 in the short term. To show his conviction, he even opened a 3x leveraged long allocation live during the video, setting his liquidation price around $3.5. This move signals that he does not expect a deep decline and instead anticipates continued upside momentum.

A more institutional perspective comes from Bitget’s own , released in October. While it is not an external analysis, market experts pay close attention to these reports because they offer insights into platform Rise and token utility. The report confirmed the successful rollout of the Universal marketplace (UEX) model, which unifies CEX and DEX liquidity. It also revealed that on-chain trading volume exceeded $113 million per day, proving growing adoption.

Analysts have also noted the importance of BGB’s migration to the Morph blockchain and the launch of AI-powered trading tools, which could make Bitget more competitive. CEO Gracy Chen stated that each milestone, including tokenized stocks and the GetAgent AI system, is designed to create a seamless, intelligent, and borderless digital asset experience. This level of innovation increases investor confidence in long-term demand for BGB.

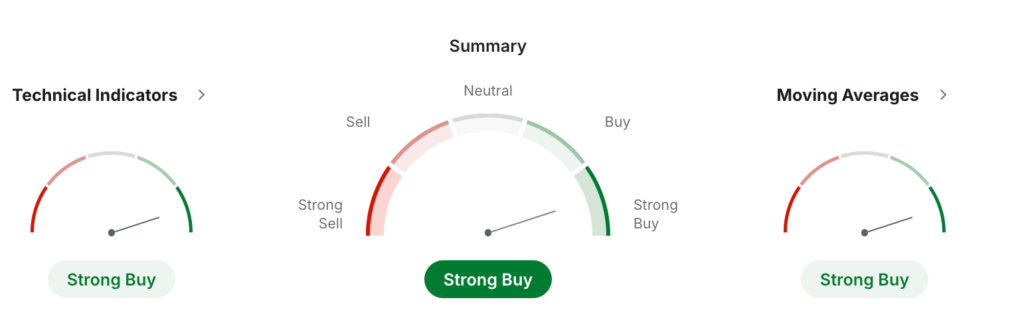

The monthly technical outlook for BGB/USDT shows strong bullish momentum, supported by data from . Both the Technical Indicators and Moving Medians are signaling a Strong Buy, which suggests that buyers continue to dominate the market even after recent corrections. The overall summary indicates Strong Buy, with 12 buy signals and 0 sell signals from moving Medians. This is rare and shows a clear long-term uptrend.

Investing, October 14, 2025

Short-term indicators also support bullish sentiment. The RSI (14) sits at 64.78, which is not overbought yet, leaving room for further Rise. The MACD (12,26) confirms upward momentum with a strong buy signal, and the ADX (14) at 30.13 shows a healthy trend strength. Several other indicators like CCI (14), ROC, and Bull/Bear Power also point toward upward movement. Only a few momentum oscillators, such as the Stochastic and Ultimate Oscillator, show short-term sell signals, suggesting minor pullbacks are possible but not trend reversals. The ATR (14) reflects high volatility, meaning traders should expect strong price swings in both directions.

Price action remains above every major moving Median. BGB trades far above the MA20, MA50, MA100, and even MA200, confirming a long-term bullish structure. This indicates that even deep corrections have not invalidated the broader uptrend. The MA5 and MA10 also align to the upside, showing strong near-term momentum. When all major moving Medians point in the same direction, it often signals that institutional money is supporting the move.

Pivot point data shows the primary support at around $5.07 and resistance levels at $5.64 and $6.06. A break above $6.06 could open the way toward $6.64 in the monthly range. The Fibonacci and Woodie levels also align near these zones, reinforcing them as key decision points. If BGB stays above $5.00, the bullish structure remains intact. Overall, the monthly analysis suggests continuation of the uptrend, with possible consolidation before the next major breakout.

The price of Bitget Token (BGB) is driven by a mix of platform performance, market demand, token utility, and broader economic factors. Because BGB is the native token of the Bitget ecosystem, its value is closely linked to the marketplace’s success and innovation. When Bitget attracts new users, adds features, or increases trading volume, demand for BGB rises. As more people use the token for discounts, , or launchpad access, buying pressure increases and supports price Rise.

One of the most important price drivers is marketplace activity. Higher futures and spot trading volumes lead to greater BGB utility. Bitget is one of the top derivatives marketplaces in the world, and institutional participation has been rising. More volume means more fees collected, and a portion of those fees is used for buybacks and burns, directly reducing token supply. This deflationary mechanism makes BGB more scarce over time.

Another major factor is token utility expansion. The more use cases BGB has, the stronger its value. Bitget continues to introduce new features such as AI trading tools, tokenized stocks, governance functions, and on-chain products via the Morph blockchain. Every new product that integrates BGB increases real usage and long-term adoption.

Key price drivers include:

- Platform trading volume

- Token burns and supply reduction

- Launchpad and staking rewards

- marketplace innovation and updates

- User Rise and community adoption

Market sentiment also affects price. If overall crypto markets are bullish, investors seek high-performing marketplace tokens like BGB. In bearish periods, BGB has historically shown strong resilience, which builds trust and attracts long-term holders.

Regulatory clarity is another factor. Bitget operates in multiple regions and maintains transparency reports, which help allocation BGB as a reliable asset compared to tokens from less compliant marketplaces. Institutional partners prefer regulated platforms, increasing demand over time.

Competition also influences BGB. If Bitget outperforms marketplaces like Binance, OKX, or Bybit in features or rewards, investors may shift capital into BGB. This trend has already happened in the past during market crises, when Bitget gained market share while others struggled.

Finally, strategic announcements can trigger price moves. Partnerships, listings, network upgrades, and supply burns often create strong price spikes. When Bitget aligns these events with growing demand, BGB benefits directly and can enter new bullish cycles.

Bitget Token (BGB) is designed with strong technical foundations to support performance, security, and . It operates as an on the ETH blockchain, which means it benefits from ETH’s mature infrastructure and security model.

Because it is fully compatible with the , developers can easily integrate BGB into smart contracts, wallets, and open finance platforms without building custom solutions. This compatibility also allows BGB to interact with thousands of existing tools and services within the ETH ecosystem.

Security is one of the most important features of BGB. Since it inherits ETH’s validator-based finality, it benefits from a decentralized and battle-tested network. The token follows the standard ERC-20 implementation, which uses proven security practices. BGB can be stored in hardware wallets, non-custodial wallets, or major centralized marketplaces, allowing users full flexibility and protection.

Its compatibility with leading open finance protocols also enables lending, borrowing, staking, and liquidity provision with minimal risk. Bitget maintains high compliance standards and has integrated BGB across its products in a secure and scalable way.

Where BGB truly stands out is in cross-chain functionality. It is natively supported on multiple networks, including , , BNB Chain, Base, TON, and TRON. This multi-chain presence allows BGB to reach more users and avoid being limited to a single ecosystem.

Through Bitget’s Onchain service, users can trade across four major blockchains from one interface. The GetGas feature enables paying gas fees using BGB on several networks, solving one of the biggest problems in multi-chain usage. Seamless asset transfers between networks allow users to move liquidity quickly and efficiently without relying on complicated external bridges.

BGB has shown strong performance compared to other marketplace tokens, delivering massive gains in 2023 and 2024. Its value is backed by real utility inside the Bitget ecosystem. Bitget is one of the fastest-growing marketplaces in the world, and as the platform expands, demand for BGB increases. The token also has a deflationary model with regular buyback and burn events, reducing supply over time. While all crypto Fundings carry risk, BGB combines utility, adoption, and strong tokenomics, making it an attractive long-term option for many investors.

BGB is the native utility token of the Bitget . It was created to support trading, rewards, governance, and on-chain services. BGB allows users to access lower trading fees, participate in launchpads, stake for rewards, and unlock exclusive features on the platform. It also serves as a multi-chain asset, working across several blockchains thanks to bridges and the Morph network. Unlike many speculative tokens, BGB is backed by a real business with millions of users and high trading volume.

BGB offers several practical benefits that increase its value. Holders receive discounted trading fees, which is essential for active traders. They can stake BGB to earn rewards or access exclusive launchpad and launchpool events with high-profit potential. The token is also used for governance, allowing holders to influence platform development. BGB can be used for gas fee payments on supported chains through the GetGas feature.

BGB officially launched on July 29, 2021. In its early phase, the token had limited utility as the Bitget platform was still developing. Over time, Bitget introduced new products such as copy trading, futures, launchpad events, tokenized stocks, and AI tools. Each major upgrade increased the real-world value of BGB.

As of the latest data, 1 BGB is worth $4.8.

The all-time high (ATH) for BGB is $8.45, reached on December 27, 2024. This price spike was driven by a massive token burn event where Bitget destroyed 800 million BGB, reducing total supply by 40%.

BGB has been rising due to a combination of real utility, strong marketplace Rise, and limited supply. Bitget continues to attract new users and increase trading volume, which raises demand for BGB.

Reaching $10 is possible but depends on market conditions and breakouts above key resistance levels. The current price is $4.8, so BGB would need to more than double. In 2024, the token already delivered a 900% gain, proving it can move quickly during bullish cycles. Analysts like Dan from Coin Bureau Trading expect a rally toward $7.2 if BGB breaks above $5.5. If momentum continues, $10 is achievable during a strong crypto market or after a major burn event.

Reaching $100 would require long-term adoption and major ecosystem expansion. This target is unlikely in the short term, but it is not impossible over many years. PricePrediction and Telegaon forecast triple-digit prices in extremely bullish long-term scenarios, especially after 2040. For BGB to reach $100, Bitget would need to become one of the leading global financial platforms, with BGB powering most of its services.

The future of BGB looks promising due to Bitget’s aggressive expansion strategy. The platform is evolving into a hybrid marketplace with both CEX and open finance features under the Universal marketplace model. BGB will play a central role in this transformation.

Analysts expect BGB to maintain strong performance in 2025, even after recent corrections. DigitalCoinPrice believes the price could range between $4.3 and $10.7, suggesting both short-term volatility and long-term upside. PricePrediction offers a more moderate outlook, placing the price between $6 and $6.5. Telegaon forecasts between $4.5 and $7.7, showing confidence in BGB’s Rise as Bitget expands.

Long-term forecasts for 2030 are extremely optimistic. DigitalCoinPrice expects BGB to reach up to $26.7, while PricePrediction offers a much higher target of $51.3. Telegaon places the high near $46.3, indicating strong confidence in Bitget’s Rise over the next decade.

Bitget and are both leading marketplaces, but they excel in different areas. Binance is larger in general, but Bitget has become the top platform for copy trading and derivatives Rise. While Binance remains number one in size, Bitget is catching up quickly and is considered more innovative in key areas.

is here to help you buy Bitget crypto if you’re looking for a way to invest in this digital currency. You can and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 different coins, and you can do wallet-to-wallet transfers instantly and problem-free.

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to marketplace — for instance, .

- Press the “Start marketplace” button.

- Provide the recipient address to transfer your crypto to.

- Process the transfer.

- Receive your crypto coins.

Follow us on , , , , and to stay updated about the latest news on and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

The post first appeared on .