Starknet Price Prediction: Is STRK Coin a Good Investment?

The price prediction is a hot topic right now. Many new investors are curious if this token has the potential to grow or if it is just another short-term trend. To answer that, we need to look at Starknet from the ground up – what it is, how it works, and what experts expect in the years ahead.

At present, STRK trades around $0.155. In the past month, the price has been moving sharply. It dropped to a low of $0.113 on September 25 and later climbed to a high of $0.196 on October 6. These swings show how quickly the token can react to market changes. For newcomers, this volatility may seem scary, but it also creates chances for profit.

In this article, we’ll take a closer look at Starknet. You’ll learn who created it, why it exists, and what role the token plays in the project’s future. We’ll also explore STRK’s price history, expert forecasts, and the main factors that could influence its value.

The goal is simple: give you clear, beginner-friendly insights without complicated jargon. By the end, you should feel more confident about whether Starknet deserves a place in your portfolio.

| Current STRK Price | STRK Price Prediction 2025 | STRK Price Prediction 2030 |

| $0.155 | $3 | $4 |

is an advanced Layer 2 scaling solution for . It works as a permissionless validity rollup, often called a zk-rollup. The project was created by StarkWare Industries, an Israeli company founded in 2018 by a team of leading cryptography experts. Their mission is to make ETH more scalable and affordable without losing its decentralization or security.

At the heart of Starknet lies the STARK technology, which stands for Scalable, Transparent Argument of Knowledge. This system processes transfers off-chain, then sends cryptographic proofs back to ETH for verification. The benefit is simple: Starknet can handle thousands of transfers at a fraction of the cost, while ETH ensures their integrity. In practice, this means lower gas fees and faster confirmation times for users, but with the same level of trust and security provided by ETH.

The project was founded by a team with impressive credentials. Eli Ben-Sasson, co-founder of Zcash and a professor at Technion, is the CEO and President. Uri Kolodny, a former McKinsey analyst and entrepreneur, served as StarkWare’s first CEO. Michael Riabzev, also from Technion, contributed as an early researcher, and Alessandro Chiesa, a professor at UC Berkeley and co-creator of Zcash, is the Chief Scientist. Together, they bring decades of combined experience in zero-knowledge proofs and blockchain cryptography.

Starknet relies on a two-part system to function. Sequencers process and order transfers, similar to ETH producers, while Provers generate STARK proofs for groups of transfers. These proofs are then sent to ETH’s mainnet, where a special verifier smart contract checks them. If valid, the state of Starknet is updated on ETH. This method allows one proof to confirm thousands of transfers, saving massive amounts of block space and fees.

A key element of Starknet is its native programming language, Cairo. Unlike Solidity, which is common on ETH, Cairo was built specifically for Starknet. It is inspired by Rust, making it secure and efficient for developers. Every Cairo program can be proven cryptographically with STARK technology, ensuring correctness. Cairo is universal, meaning it can be used to build any type of decentralized app, not just financial ones. Developers familiar with Rust will find Cairo relatively easy to learn.

Cairo also uses a special data type called “felt” (field element), which represents integers in a open financened range. This design makes the language tightly connected with cryptographic proof systems, ensuring smooth performance and verifiability. Thanks to this approach, Starknet opens the door for scalable, secure, and versatile applications on ETH, pushing forward the next generation of blockchain development.

| Current Price | $0.155 |

| Market Cap | $714,062,329 |

| Volume (24h) | $76,235,743 |

| Market Rank | #152 |

| Circulating Supply | 4,318,575,355 STRK |

| Total Supply | 10,000,000,000 STRK |

| 1 Month High / Low | $0.193 / $0.113 |

| All-Time High | $4.41 Feb 20, 2024 |

CoinGecko, October 9, 2025

Starknet officially launched its token, STRK, on February 20, 2024, with one of the largest airdrops in crypto history. Over 728 million tokens were distributed to more than 1.3 million addresses. The token opened at around $3 and quickly touched its all-time high of $3.15 on major marketplaces like Binance, Bybit, and OKX.

However, the excitement faded almost immediately. By the end of February, STRK had fallen to $1.75, marking a 40% drop in just one month. Heavy selling pressure from airdrop recipients created a wave of supply that the market could not absorb.

In March 2024, STRK staged a short recovery, climbing 25% to $2.18, with a peak of $2.98. Unfortunately, this proved to be the last major rally before a long downturn. From April through August, the token collapsed month after month. April dropped 45% to $1.23, and June marked a brutal 40% slide to $0.69. By August, STRK traded at just $0.36, losing almost 90% from its launch price.

September gave a brief relief rally of 25% to $0.44, but October erased gains with a 15% decline to $0.37. In November, STRK surprised the market with a sharp 90% surge to $0.71, likely driven by a broader crypto market rally. Still, December ended the year with a 35% correction to $0.47.

If 2024 was difficult, 2025 proved even more brutal. In January, STRK dropped 25% to $0.355. February saw another crash of 40% to $0.216, and March extended the pain with a 30% fall to $0.149. By April, the token stabilized at $0.145, but May resumed the slide to $0.133.

June 2025 became the darkest point in Starknet’s history. The price collapsed another 15% to $0.116, touching an all-time low of $0.097 on June 22, 2025.

After that, the token finally showed signs of stabilization. July stayed flat at $0.116, while August posted a modest 10% gain to $0.125. In September, the price fell 10% to $0.113. By early October 2025, STRK had climbed 95% to $0.196, giving investors some hope of recovery after a devastating year.

| Year | Minimum Price | Maximum Price | Median Price | Price Change |

| 2025 | $0.15 | $6.16 | $3 | +1,850% |

| 2026 | $0.275 | $8.64 | $4 | +2,480% |

| 2030 | $0.78 | $24.35 | $10 | +6,350% |

| 2040 | $58.25 | $122.72 | $100 | +64,500% |

| 2050 | $144.39 | $165.94 | $150 | +97,000% |

expects Starknet to trade between $0.15 (-5%) at the low end and $0.36 (+120%) at the peak in 2025.

gives a narrower outlook, with STRK projected to range from $0.191 (+20%) to $0.209 (+30%).

, however, predicts a far more bullish year ahead, estimating that STRK could surge to $6.16 (+3,650%) at its maximum, with a minimum around $4.71 (+2,800%).

For 2026, DigitalCoinPrice forecasts that STRK could reach as high as $0.42 (+160%), while its minimum could be around $0.35 (+115%).

PricePrediction.net anticipates a price range between $0.275 (+70%) and $0.335 (+105%).

Telegaon is again far more optimistic, expecting STRK to climb to $8.64 (+5,150%), with a possible low of $6.23 (+3,700%).

Looking further ahead, DigitalCoinPrice projects STRK to trade between $0.78 (+380%) and $0.89 (+450%) by 2030.

PricePrediction.net has a more bullish forecast, with STRK ranging from $1.26 (+680%) to $1.43 (+780%).

Telegaon presents the most ambitious outlook, predicting STRK could skyrocket to $24.35 (+15,000%), while the minimum could still be a strong $18.32 (+11,500%).

PricePrediction.net foresees massive long-term Rise, with STRK potentially trading between $99.87 (+61,000%) and $122.72 (+75,000%) in 2040.

Telegaon is also extremely bullish, forecasting a range between $58.25 (+36,000%) and $70.15 (+43,000%).

By 2050, PricePrediction.net suggests STRK could explode in value, with a minimum target of $144.39 (+90,000%) and a maximum of $165.94 (+105,000%).

Analyst Viktoras Karapetjanc from Traders Union on Starknet’s recent recovery and short-term outlook. He described the latest 20% surge in STRK as a constructive move supported by strong sentiment and capital inflows. According to him, the launch of non-custodial BTC staking, combined with a major 100 million STRK incentive program introduced in late September, has drawn significant liquidity into the ecosystem. This is reflected in trading volume, which has jumped fourfold to over $220 million, signaling growing market interest and bullish momentum.

Karapetjanc explained that current price action remains supported above key moving Medians, which is a positive sign for structural momentum. Still, he cautioned that the token shows signs of being overbought, making a short-term pause or consolidation more likely before another major breakout. He pointed to $0.1962 as a key resistance level and emphasized that as long as STRK holds above dynamic supports, temporary pullbacks should be seen as opportunities for accumulation. His conclusion was optimistic: the broader setup remains bullish in the medium term.

Other market analysts present a range of technical outlooks. predicts STRK will rise to a range of $2–$2.8 in 2025, and potentially reach an ambitious $75–$110 by 2030. These numbers highlight long-term Rise potential, though they represent a very bullish stance compared to the current price of $0.155.

CoinEdition . Their forecast suggests STRK could climb as high as $5 in 2025, and reach $15 by 2030. Their optimism is based on Starknet’s allocation as a leading ETH Layer-2 solution, a sector expected to grow as ETH maintains its role as the dominant smart contract platform.

Adding another perspective, analyst Benjamin Cowen has not issued direct STRK price predictions but . In his broader outlook, Cowen argued that altcoins often underperform during certain phases of the market cycle, especially before BTC halving events. He expects BTC dominance to rise into late October, a trend that could weigh on altcoins, including STRK. His analysis suggests that while Starknet benefits from strong fundamentals, macro conditions could temporarily limit upside momentum.

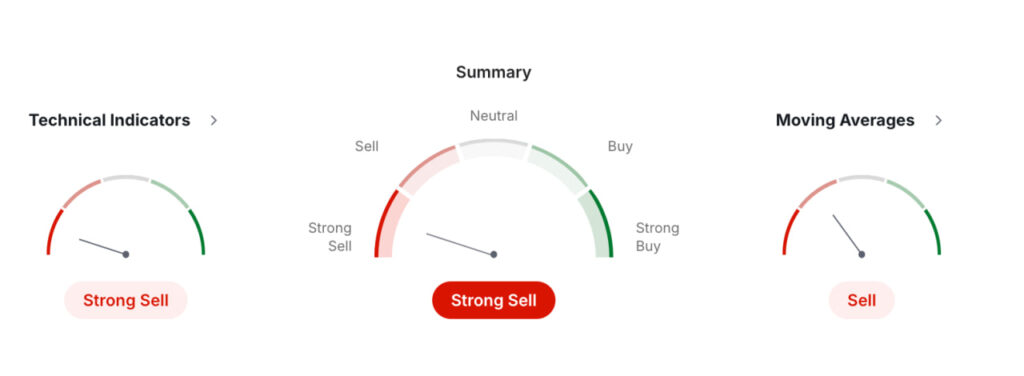

According to data from , the technical outlook for Starknet (STRK/USDT) is heavily bearish on the monthly frame. The platform’s automated summary assigns a “Strong Sell” rating, reflecting weakness across both technical indicators and moving Medians.

Investing, October 9, 2025

The technical indicator section shows a very negative picture. Out of eight tracked signals, seven are bearish, one is bullish, and none are neutral. The Relative Strength Index (RSI 14) sits at 27.24, which indicates oversold conditions but still registers as a sell signal. Similarly, the MACD (12,26) reads -0.033, another clear sell. Additional indicators like the CCI (14) at -51.98, the ROC at -53.58, and the Bull/Bear Power at -0.1816 all point toward continued downside momentum. Meanwhile, the Stochastic RSI (14) flashes an overbought condition at 100, which may seem contradictory but usually reflects short-term volatility. Despite these mixed signals, the consensus remains negative.

Moving Medians reinforce the bearish view. Out of twelve key Medians tracked, eight signal sell and only four suggest buy. The short-term MA5 is supportive, showing 0.133 (simple) and 0.146 (exponential), both in buy territory. However, the MA10 through MA200 trend much weaker. For instance, MA20 and MA50 indicate heavy sell pressure with exponential values well above current market levels, such as 0.524 for MA20 and 1.006 for MA50. The long-term MA200 at 1.514 also shows strong resistance, far from the current price of 0.155 suggesting the market is struggling to reclaim higher historical ranges.

Pivot point levels provide some guidance for potential support and resistance. Classic calculations set immediate support around 0.119 and resistance near 0.154–0.167, levels that align closely with recent trading behavior. The Fibonacci model places similar support at 0.119 and resistance at 0.154. These zones indicate that buyers may defend the 0.119–0.132 range, while sellers dominate once prices push above 0.154.

Overall, the monthly technical analysis suggests that STRK remains in a fragile allocation. While oversold signals like RSI hint at the chance for a short-term bounce, the broader framework leans bearish, with moving Medians and momentum indicators pointing lower. Traders should be cautious, as the path of least resistance still appears to the downside unless STRK can consistently hold above key pivot levels around 0.154–0.167.

The price of Starknet (STRK) is influenced by a mix of internal project factors and broader crypto market conditions. Understanding these drivers helps investors see why the token can rise sharply at times and fall just as quickly.

One of the main factors is market sentiment. When traders believe in Starknet’s Rise, demand increases and the price climbs. Positive news such as marketplace listings, partnerships, or ecosystem incentives often trigger strong rallies. On the other hand, negative headlines or uncertainty in the crypto market usually push the price down.

Another key element is network adoption. Starknet is a Layer-2 scaling solution for ETH, and its value depends on how many developers and users actually build on it. If more decentralized applications (dApps) launch on Starknet, demand for STRK tokens increases, which can support higher valuations.

The tokenomics of STRK also plays a big role. The large airdrop in 2024 created heavy selling pressure, which caused steep declines in price. Future token unlocks or reward programs may have similar effects. Supply and distribution directly impact the balance between buyers and sellers.

External market conditions are equally important. Like most altcoins, STRK tends to follow BTC’s overall trend. When BTC dominance rises, altcoins like Starknet often struggle. In contrast, during strong altcoin seasons, capital flows into Layer-2 projects can boost STRK significantly.

Several specific factors stand out:

- Ecosystem incentives such as staking rewards or liquidity programs can increase demand.

- ETH’s scalability needs: if network fees rise, demand for Starknet as a scaling solution grows.

- Regulatory clarity: favorable rules may encourage more institutional use, while negative ones could hold adoption back.

- Technology progress: upgrades to Cairo or improved prover performance can increase Starknet’s competitiveness.

In short, STRK’s price is shaped by a balance of adoption, token distribution, technical innovation, and overall crypto sentiment. The stronger these elements align, the higher the chance for long-term Rise.

Starknet combines advanced cryptography, efficient scaling, and user-friendly design. Its features are built to make ETH faster and cheaper while keeping it secure and decentralized.

- No trusted setup: Unlike zk-SNARKs, STARKs do not require any initial ceremony, reducing centralization risks.

- Quantum resistance: Built on hash functions, STARKs are resistant to potential quantum computer threats.

- Transparency: Proofs can be verified without relying on external parameters, making them more auditable.

- Validity rollup (zk-rollup): Starknet processes transfers off-chain and submits proofs to ETH, lowering costs while maintaining security.

- Sequencers and provers: Sequencers order and validate transfers, while provers generate cryptographic proofs for entire blocks.

- Execution trace and state diff: Detailed tracking of transfer execution ensures stronger security guarantees.

- Parallel processing: Provers handle multiple transfer groups at once, boosting speed and scalability.

- Rust-inspired: Designed for developers, Cairo makes writing secure and scalable programs easier.

- Provable computing: Every Cairo program can be cryptographically proven without requiring advanced knowledge of ZK proofs.

- Field element (felt) data type: Cairo uses “felt” as its primitive data type, operating on integers in a large prime number field.

- Two program types: Supports both stateless programs and stateful contracts, enabling a wide variety of applications.

- Smart accounts by default: Every account on Starknet is a smart contract account, unlike ETH’s externally owned accounts.

- Programmable wallets: Accounts can include advanced features like multi-factor authentication, social recovery, or automated payments.

- Hardware signers: Supports secure enclaves in smartphones, allowing biometric authentication through Face ID or fingerprint scans.

- Paymaster functionality: Users can pay gas fees in any token, or third parties can sponsor transfer costs.

- Session keys: Enables users to approve multiple transfers in advance, removing the need to sign each one individually.

Together, these features make Starknet a highly flexible and secure Layer-2 solution. It gives developers powerful tools for building decentralized applications and provides users with smoother, cheaper, and safer interactions compared to using ETH mainnet directly.

Starknet (STRK) can be considered a speculative Funding. It offers cutting-edge scaling technology for ETH, which gives it strong potential. However, like most altcoins, it is highly volatile and influenced by broader market conditions. For long-term believers in Layer-2 solutions, STRK may present an opportunity, but it carries significant risks.

Starknet is used as a Layer-2 scaling network for ETH. It helps process transfers faster and at lower costs by moving them off-chain, then submitting cryptographic proofs back to ETH. Developers can build decentralized apps (dApps) on Starknet, ranging from finance to gaming, without facing ETH’s high gas fees.

As of early October 2025, Starknet (STRK) is priced around $0.155. This is a steep drop from its launch price of $3 in February 2024. Despite the decline, recent months have shown signs of stabilization after hitting a historical low of $0.096 in June 2025.

The token has the potential to rise if adoption of Starknet increases and ETH’s demand for scaling solutions grows. Expert forecasts show mixed results, with some predicting gradual Rise and others projecting explosive long-term gains. The key driver will be whether developers and users continue to build on Starknet.

Future predictions for STRK vary widely. Some analysts expect it to trade below $1 in the near term, while others forecast double- or even triple-digit values by 2030 and beyond. The difference depends on how fast Starknet gains adoption as a top ETH Layer-2 solution.

Forecasts for 2025 are highly mixed. DigitalCoinPrice expects a range between $0.15 and $0.36. PricePrediction.net gives a narrower view between $0.19 and $0.21. Telegaon is extremely bullish, projecting a maximum of $6.16, which would represent thousands of percent in Rise from current levels.

Starknet is built as a Layer-2 rollup on ETH. It processes transfers off-chain using STARK proofs and then submits them to ETH’s mainnet for verification. This design combines ETH’s security with faster, cheaper execution.

ETH processes all transfers on-chain, which makes it slower and more expensive during high demand. Starknet processes transfers off-chain and bundles them into proofs verified on ETH. This makes Starknet faster, cheaper, and more scalable, while still relying on ETH for security.

Several wallets support Starknet, including Argent X and Braavos, which are designed specifically for the network. In addition, multi-chain wallets like Metamask can be connected through browser extensions or bridges. As the ecosystem grows, more wallets are expected to add direct Starknet integration.

You can buy Starknet (STRK) on major marketplaces such as Binance, Bybit, and OKX, where it was first listed in February 2024. These platforms offer high liquidity and allow trading pairs like . For users who prefer a quick and private option without creating an marketplace account, services like also support STRK swaps. This makes it possible to purchase the token directly with other cryptocurrencies in a fast and non-custodial way.

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to marketplace — for instance, .

- Press the “Start marketplace” button.

- Provide the to transfer your crypto to.

- Process the transfer.

- Receive your Starknet coins.

Follow us on , , , , and to stay updated about the latest news on and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

The post first appeared on .