DeXe Price Prediction: Is DEXE Coin a Good Investment?

If you’ve been looking for a DEXE price prediction, you’re in the right place. has caught the attention of many new crypto investors because of its recent price swings and growing presence in the market. The big question is whether DEXE can keep climbing or if the hype will fade.

At the moment, the current price of DEXE is $10.5. September was a busy month for the token. On September 6, it dropped to a monthly low of $6.85. Just two weeks later, on September 21, it spiked to a monthly high of $12.76. That’s an 85% move between the low and the high. Compared to today’s price, DEXE is up around 37% from its bottom, but still about 27% below its September peak.

This kind of fast rise and pullback shows how volatile crypto can be. Yet, for many investors, it’s also what makes DeXe exciting. In this guide, we’ll explain what DeXe is, why people are paying attention, and what analysts expect for its price in the coming years. We’ll look at predictions for 2025, 2026, 2030, and even 2050.

Don’t worry if you’re just starting out in crypto. We’ll keep things simple, clear, and beginner-friendly. By the end, you’ll have a better idea of whether DeXe is a project worth watching or investing in.

| Current DEXE Price | DEXE Price Prediction 2025 | DEXE Price Prediction 2030 |

| $10.5 | $15 | $60 |

is a decentralized protocol designed to help communities and organizations govern themselves in a fair and transparent way. It started as a social trading platform but has grown into a full DAO constructor. Today, it offers a backend with over 60 modular smart contracts and a frontend DApp that allows anyone to manage a DAO with no coding skills. This combination makes DeXe both powerful and beginner-friendly.

The project began on September 18, 2019. At first, the idea was simple: let users copy trades from successful investors in a decentralized way. In the first quarter of 2020, the platform launched with basic features. A few months later, on September 28, 2020, the team released the official DEXE token, which became the core of the ecosystem.

DeXe was created by a group of Ukrainian developers. The founding team includes Yuriy Hotoviy, co-founder of DeXe Network and CEO of Billtrade, Dmytro Kotliarov, a key contributor, and Vitalii Maistrenko, the technical director. To support Rise, DeXe held an ICO in late 2020 and raised $1.8 million. The sale attracted several well-known crypto funds such as ZBS Capital, Quest Capital Group, BN Capital, Consensus Lab, and Nova Club.

The mission of DeXe, as stated in its whitepaper, is to create a system where every vote matters, collaboration is encouraged, and true decentralization is achieved. The vision is based on four main principles. First, real decentralization with automated and transparent execution of DAO proposals. Second, a meritocracy model, where influence is not determined only by token holdings but also by proven expertise. Third, strong incentive models that reward active participation. And finally, seamless infrastructure, built from years of research and an understanding of market needs.

| Current Price | $10.5 |

| Market Cap | $902,621,822 |

| Volume (24h) | $30,478,038 |

| Market Rank | #85 |

| Circulating Supply | 83,733,647 DEXE |

| Total Supply | 96,504,599 DEXE |

| 1 Month High / Low | $12.76 / $6.85 |

| All-Time High | $32.38 Mar 8, 2021 |

CoinGecko, October 1, 2025

DeXe launched on September 28, 2020, as a governance token for its decentralized social trading and asset management platform. Since then, the token has shown the kind of sharp ups and downs typical of open finance assets. Its price history is full of dramatic moves, from record highs to long bear phases.

DEXE entered the market on October 7, 2020, at $1.49. The early trading phase was tough. Within the first month, the token fell by 50%, reaching $0.77 in early November. The all-time low of $0.73 was recorded during this period. This drop reflected typical post-launch selling pressure and low awareness of the project at that time.

The year 2021 was a turning point. On March 8, DEXE hit its all-time high of $32.38, a staggering 4200% increase from its lowest level. This was part of the broader open finance boom, often called “open finance Summer 2.0.” By year’s end, DEXE was down 50% from its January price, despite reaching record highs mid-year.

Like the wider crypto sector, DEXE faced a harsh bear market in 2022. The token started at $5.87 and ended at $3.02, a 50% yearly drop. The lowest point was $2.47. This period was open financened by fading interest in open finance after the explosive Rise of 2021.

In 2023, the market calmed down. DEXE traded between $1.92 and $3.25, closing the year at $2.43. That marked only a 17% decline, the most stable yearly performance since 2021. It signaled the project’s slow but steady consolidation.

The year started strong at $10.33, with a rally up to $16.47. However, optimism didn’t last. By December, the price slid back to $7.36, a 30% loss for the year and 55% down from its yearly high.

This year opened at $17.42 and briefly touched $19.2. Since then, however, DEXE has faced consistent selling pressure. At the beginning of October 2025, the price is $10.5. That means a 40% decline from the start of the year and a 45% drop from its 2025 peak.

| Year | Minimum Price | Maximum Price | Median Price | Price Change |

| 2025 | $7.31 | $20.62 | $15 | +40% |

| 2026 | $14.4 | $23.48 | $20 | +90% |

| 2030 | $40.25 | $80.36 | $60 | +470% |

| 2040 | $117.24 | $6,652 | $3,000 | +28,500% |

| 2050 | $7,321 | $8,611 | $8,000 | +76,000% |

According to data, DeXe (DEXE) could trade between $8.43 (-20%) at the lowest and $20.62 (+95%) at the Maximum in 2025.

suggests a narrower range, with DeXe moving between $10 (-5%) and $10.94 (+5%).

analysts expect stronger Rise, forecasting a potential rise to $16.52 (+55%), though the token might also dip to $7.31 (-2302%).

In 2026, DigitalCoinPrice forecasts DEXE to reach a high of $23.48 (+125%) and a low of $20.16 (+90%).

PricePrediction.net projects a more moderate scenario, with a minimum of $14.4 (+35%) and a maximum of $17.61 (+70%).

Telegaon offers similar optimism, expecting a peak at $23.09 (+120%), with the lowest value near $16.67 (+60%).

Looking at 2030, DigitalCoinPrice predicts a possible maximum of $51.43 (+390%), while the minimum might stay at $44.56 (+325%).

PricePrediction.net is even more bullish, estimating a high of $80.36 (+665%) and a minimum of $70.62 (+575%).

Telegaon foresees a more balanced scenario, forecasting a maximum of $46.08 (+340%) and a low of $40.25 (+285%).

For 2040, PricePrediction.net expects massive long-term Rise, projecting a minimum of $5,244 (+50,000%) and a maximum of $6,652 (+63,000%).

Telegaon provides a more conservative outlook, with DEXE trading between $117.24 (+1,000%) at the lowest and $141.36 (+1,250%) at the peak.

By 2050, PricePrediction.net analysts forecast exponential gains, suggesting a possible low of $7,321 (+69,500%) and a maximum of $8,611 (+82,000%).

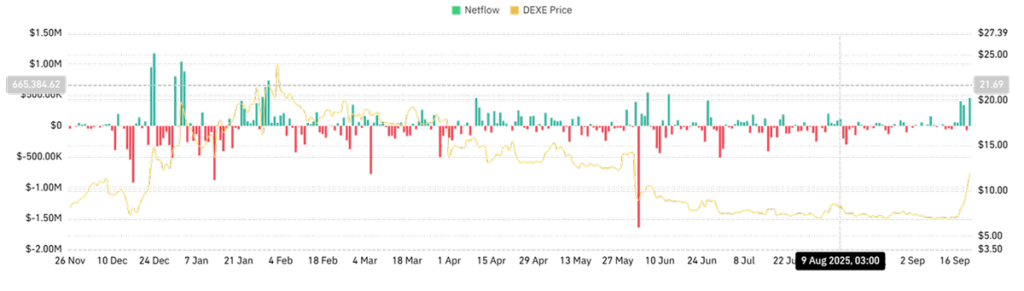

Experts have recently turned their focus to DeXe (DEXE) following a sharp rally in September 2025, which highlighted how powerful whale activity can be in shaping the token’s short-term performance.

According to from September 20, DEXE climbed 45% in just a few days, reaching a 3-month high of $12.68 before easing back. Analysts linked this move directly to heavy whale accumulation in both spot and futures markets, which dominated trading flows for an entire week.

Data from CryptoQuant confirmed this view, showing a strong positive buy-sell delta of 27,000.. This signaled that whales were accumulating, not selling. Analysts noted that this kind of focused whale activity usually builds a strong support base, which can fuel further upward momentum if it continues.

From a technical perspective, the rally came with clear signals. The Relative Strength Index (RSI) hit 91, well into overbought territory, while the Chaikin Money Flow (CMF) rose to 0.12, showing clear buyer dominance. Experts explained that these readings often indicate powerful momentum, but also raise caution since such levels can precede high volatility.

In terms of price targets, analysts see a mixed outlook. If whale demand remains strong, DEXE could break above the $15 resistance level in the near term. On the other hand, if momentum cools, retracement levels around $9.5 and $8.6 are viewed as key supports. Medium-term projections remain more optimistic, with some experts suggesting the token could retest older highs if institutional demand continues to grow.

Beyond technicals, fundamental catalysts also shaped expert sentiment. The September rally coincided with the launch of AgentBound Tokens and integration with TheONETradeAI, both seen as meaningful upgrades that expanded utility and attracted fresh retail and institutional interest. These developments gave analysts confidence that the rally was not just speculative but supported by real ecosystem Rise.

Still, risks remain. Data from CoinGlass showed that DEXE’s spot netflow surged to a 3-month high of $450,000, reflecting significant retail profit-taking. Analysts warned that if this selling pressure grows, it could weigh on prices and offset the impact of continued whale accumulation.

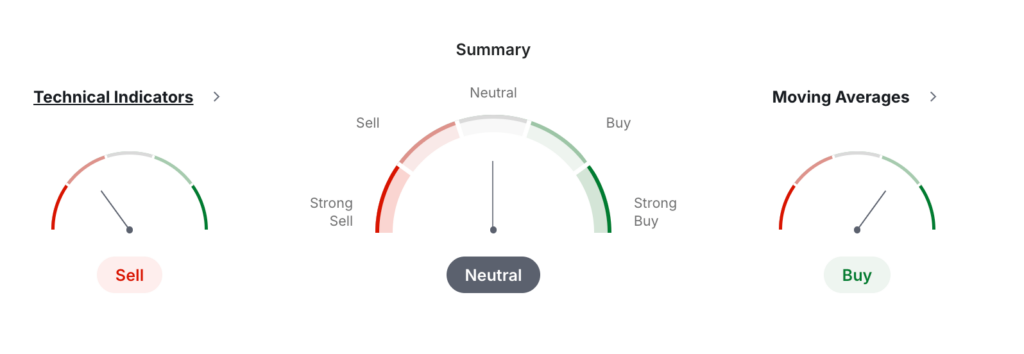

According to the latest monthly data from Investing.com, DeXe shows a mixed technical picture. The overall summary leans Neutral, with moving Medians flashing Buy signals, while technical indicators point more toward Sell pressure. This split reflects the current uncertainty surrounding the token after sharp swings in recent months.

Investing, October 1, 2025

On the side of technical indicators, the breakdown shows 3 Buy signals, 2 Neutral, and 5 Sell signals. The Relative Strength Index (RSI 14) is at 49.89, which is neutral, indicating that the token is neither overbought nor oversold. The Stochastic (9,6) at 21.48 signals a sell, suggesting weak momentum. Interestingly, the Stochastic RSI (14) is at just 12.91, placing DEXE in an oversold zone, which may hint at possible upside if buyers step in. Meanwhile, the MACD (12,26) shows a buy signal, pointing to potential bullish momentum. The ADX (14) stands at 22.68, also signaling buy, reflecting a modest upward trend strength. However, other indicators like Williams %R at -77.53 and Bull/Bear Power at -2.29 suggest bearish pressure is still present.

Looking at moving Medians, the summary is more optimistic with 7 Buy signals against 5 Sell signals. For example, the MA50, MA100, and MA200 all show strong buy signals, reflecting long-term bullish momentum. Shorter-term Medians are less supportive, with the MA5 and MA10 (exponential) signaling sell pressure. This divergence indicates that while the long-term outlook for DEXE remains positive, short-term traders still face downward resistance.

Pivot points add another layer to the analysis. The classic pivot point is at $9.71, placing immediate resistance at $12.64 and support at $6.55. Under the Fibonacci model, the first support is at $7.39, while resistance levels line up at $12.05 and $13.48. The Camarilla levels suggest tighter trading ranges, with strong support at $8.91 and resistance at $10.59.

Overall, the monthly technical outlook suggests that DeXe is currently in a neutral consolidation phase. Long-term indicators remain bullish, but near-term selling signals mean traders should watch for either a break above $12.6 or a slide toward $8.6. The next move will likely depend on whether buyer momentum can outweigh profit-taking pressure.

The price of DeXe (DEXE) is shaped by several key factors that combine market sentiment, technical dynamics, and real-world adoption. Like most cryptocurrencies, it reacts strongly to short-term speculation but also has long-term drivers connected to its ecosystem.

One of the biggest influences is market demand and supply. When more traders buy and hold DEXE, the price tends to rise. On the other hand, profit-taking or lack of interest can lead to steep declines. Because DeXe is a governance token, the level of community participation also matters.

Another factor is whale activity. Large holders can push the price up quickly through accumulation, as seen in September 2024, or create strong corrections when selling. Retail traders often follow these moves, adding to volatility.

Fundamental developments play a major role as well. Whenever DeXe introduces new features, integrations, or partnerships, the token attracts more attention. For example, the release of AgentBound Tokens and AI-driven tools like TheONETradeAI boosted both visibility and utility. This shows that actual product Rise can support price appreciation beyond speculation.

Regulatory conditions are also critical. Since DeXe operates in the open finance sector, any new laws affecting DAOs or open finance protocols could influence demand. Favorable regulation may boost confidence, while restrictive policies could limit adoption.

Global crypto market cycles affect DEXE too. In bullish markets, investors look for tokens with strong fundamentals, and DeXe often benefits from this trend. In bearish conditions, however, even good projects struggle as liquidity leaves the market.

To summarize, the price of DeXe is influenced by:

- Demand and supply dynamics

- Whale accumulation or selling

- New features and partnerships

- Regulatory news and compliance

- Overall crypto trading dynamics

DeXe stands out in the open finance space thanks to its advanced smart contract architecture, flexible governance models, and strong focus on security.

At its core, the protocol is built on over 60 modular smart contracts, forming a scalable framework for decentralized governance. This three-tier design includes core contracts, factory contracts, and governance contracts. The system is supported by a ContractsRegistry, which serves as a central hub for managing upgrades, while CoreProperties ensure universal settings remain consistent across every DAO. Because the library is open source, independent teams can freely adopt and implement parts of the protocol, making DeXe highly adaptable.

Governance lies at the heart of DeXe. Each DAO created within the ecosystem uses four main contracts:

- GovPool

- GovUserKeeper

- GovValidator

- GovSettings

This setup enables flexible decision-making with different voting models, including ERC20 tokens, ERC721 NFTs, ERC721Enumerable, and ERC721Power standards. To enhance fairness, DeXe uses a two-stage validation process where members first approve a proposal, followed by a validator review. It also employs a non-linear voting system that limits the dominance of large stakeholders, ensuring power is not concentrated in just a few wallets.

A unique feature of DeXe is its delegation system, which empowers experts to play a larger role. Through the use of ERC721Expert NFTs, subject-matter specialists can gain magnified voting power and directly manage treasury delegations. Vote Power contracts dynamically adjust influence based on expert status and delegated assets. To maintain engagement, the system provides activity-based rewards for active delegates, encouraging consistent participation.

Security has been a top priority since DeXe’s creation. The protocol has been audited by firms such as Cyfrin, CertiK, Ambisafe, and Hacken, and has undergone more than 1,000 unit, integration, and simulation tests with full coverage. Specific measures like the GovUserKeeper contract protect user funds during voting, while the validator review layer blocks malicious proposals before they can cause harm.

DeXe can be a good Funding for those who believe in decentralized governance. It offers strong technical design and a growing DAO ecosystem. However, like most cryptocurrencies, it is very volatile. Investors have seen large gains and equally sharp drops. It may suit long-term believers but should be approached with caution.

The main purpose of DeXe is to provide infrastructure for decentralized organizations. Its system of modular smart contracts helps communities build and manage DAOs. This ensures governance is fair and transparent. The project’s mission is to give every participant a real voice, instead of concentrating power in a few wallets.

The DEXE token serves as the governance tool of the ecosystem. Holders can vote on proposals, delegate power to experts, and participate in decision-making. Beyond governance, the token also trades on major marketplaces, giving it both utility and liquidity. This makes it valuable inside and outside the DAO framework.

DEXE was launched on the ETH blockchain and also exists as a BEP20 token on Binance Smart Chain. This multi-chain presence gives users the choice of security on ETH or lower fees on BSC. It also helps DEXE integrate with a wide range of open finance platforms.

The future of DEXE depends on adoption of DAOs and Rise in decentralized governance. Analysts expect increasing demand if more projects use DeXe’s modular system. Long-term predictions range from modest Rise to massive upside, but results will depend on both development and overall crypto market cycles.

The roadmap focuses on expanding governance features, strengthening security, and increasing cross-chain compatibility. Recent milestones include AgentBound Tokens and AI integrations. Future plans involve broader adoption by external projects and more advanced DAO management tools, aiming to allocation DeXe as a leading governance protocol.

The all-time high of DeXe was $32.38, reached on March 8, 2021. This marked a 4,200% increase from its all-time low of $0.73 in November 2020. Despite the correction afterward, this record high remains a key reference point for investors.

Analysts believe DEXE could revisit and possibly surpass its all-time high if adoption increases. Short-term projections suggest resistance around $15. Long-term models show potential Rise to $40, $80, or even higher if DAOs become mainstream. The upside depends on both fundamentals and broader market conditions.

It is possible, but not guaranteed. A move to $100 would require strong adoption, institutional demand, and a bullish crypto cycle. While some experts see this as achievable in the long run, others caution that DEXE would need widespread DAO integration before such levels are realistic.

A $1,000 price target is highly speculative. Reaching this level would require exponential Rise in DeXe adoption and a massive shift in the crypto market. While long-term forecasts by some platforms predict huge gains, most analysts consider $1,000 an extremely ambitious goal under current conditions.

Analysts expect DeXe to trade in a wide range in 2025. DigitalCoinPrice predicts prices between $8.4 and $20.6. PricePrediction.net offers a more modest forecast between $10 and $10.9. Telegaon suggests $7.3 on the low end and $16.5 on the high end. These numbers show Rise potential of 15% to 120% from the current $10.5, but also risks of decline.

By 2030, experts see stronger gains. DigitalCoinPrice estimates between $45 and $50. PricePrediction.net is even more bullish, forecasting $70 to $80. Telegaon expects $40 to $46. If these predictions hold, DeXe could grow by 330% to over 750% compared to today’s price.

Long-term forecasts vary greatly. PricePrediction.net projects extraordinary Rise, from $5,250 to $6,650. That would represent gains of over 55,000%. Telegaon provides a more conservative outlook, with predictions between $115 and $140. Even the cautious scenario would still mean more than 1,100% Rise from today’s value.

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to marketplace — for instance, .

- Press the “Start marketplace” button.

- Provide the recipient to transfer your crypto to.

- Process the transfer.

- Receive your coins.

Follow us on , , , , and to stay updated about the latest news on and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

The post first appeared on .