BNB Price Prediction: Is Binance Coin a Good Investment?

price prediction is once again a hot topic. The coin behind Binance has just delivered a wild performance in July 2025. It surged to a new all-time high of $859 on July 28, just weeks after hitting a monthly low of $657. That’s a 30% swing in a single month. Right now, BNB trades at $750 — slightly down from the top, but still strong.

So, what’s next? Can BNB go even higher, or has it peaked? Many new investors are asking if it’s still worth buying. Some see it as a long-term winner. Others worry it’s too late to get in.

This article will help you decide. We’ll explore what BNB is, how it works, and what experts say about its future. You’ll also see detailed BNB price predictions for 2025, 2030, 2040 — and even 2050. So, let’s get started.

| Current BNB Price | BNB Price Prediction 2025 | BNB Price Prediction 2030 |

| $980 | $1,400 | $5,700 |

BNB is the native digital currency of the Binance ecosystem. It was launched in July 2017 by Changpeng Zhao, also known as CZ, the founder of Binance. Back then, BNB stood for Binance Coin, and it was introduced through an initial coin offering (ICO). Binance raised $15 million by selling 100 million BNB tokens at a price of $0.15 each.

The original purpose of BNB was simple: to reduce trading fees on the . Users who paid fees with BNB got a discount. This utility made BNB popular among early Binance users.

But since then, BNB has evolved far beyond its original use. Today, it’s a central part of the Binance Smart Chain (BSC), a fast and low-cost blockchain created by Binance. BNB is used to pay for gas fees on BSC — much like ETH is used on ETH. Many projects in the open finance space now use BNB for transfers, smart contracts, and rewards.

BNB also powers several features inside the Binance marketplace. You can use it to pay for trading, withdrawals, and even services like Binance Launchpad. BNB holders can also take part in staking, airdrops, and token launches directly through Binance.

Over time, Binance has introduced a quarterly burn system. This means that Binance uses part of its profits to buy back and destroy BNB tokens. The goal is to reduce the total supply over time, making the token more scarce. Eventually, the supply will be reduced from 200 million to 100 million coins. This deflationary model helps support long-term value.

Today, BNB is no longer just a utility token. It acts more like the fuel of the entire Binance ecosystem. It connects the marketplace, blockchain, wallets, staking, and even the Binance Web3 Wallet. As Binance grows, so does the importance of BNB.

| Current Price | $980 |

| Market Cap | $136,790,345,606 |

| Volume (24h) | $3,398,394,840 |

| Market Rank | #5 |

| Circulating Supply | 139,186,682 BNB |

| Total Supply | 139,186,682 BNB |

| 1 Month High / Low | $1,005.29 / $832.72 |

| All-Time High | $1,005.29 Sep 18, 2025 |

Because of this wide use, many see BNB as more than just a coin. They view it as a long-term asset tied to one of the strongest players in crypto.

BNB has grown into one of the most versatile tokens in the crypto world. It started as a way to save on trading fees, but now powers an entire ecosystem. Let’s break down what makes BNB so useful — both on a technical level and in everyday use.

First, BNB is the native coin of the BNB Chain, which includes two main parts:

- BNB Beacon Chain: handles governance, voting, and .

- BNB Smart Chain (BSC): supports , dApps, , and projects.

Together, these chains allow BNB to be fast, cheap, and scalable. That’s why so many developers choose to build on the or other networks.

BNB is also used to pay gas fees when making transfers on the BSC network. This makes it essential for anyone using open finance protocols or trading altcoins within the Binance ecosystem.

Another major feature is fee discounts. On the Binance marketplace, users who pay trading fees with BNB receive up to 25% off. This gives traders a clear reason to hold and use BNB regularly.

BNB also plays a role in Binance Launchpad, where users can invest early in new token launches. If you hold BNB, you’re eligible to join exclusive sales before tokens are listed publicly.

In addition, BNB is integrated into Binance Earn, where users can stake or lock up their tokens to earn interest. These flexible and fixed savings programs make it easy to grow your BNB holdings passively.

The BNB Vault is another product tied to the token. It combines different earning options into one simple tool, including Launchpool, Flexible Savings, and open finance staking. Again, all powered by BNB.

From a technical view, BNB is a deflationary token. Binance conducts quarterly burns, where it permanently removes coins from circulation. This lowers the supply and is designed to support the token’s price over time.

BNB isn’t just a coin — it’s the engine of Binance. If you use any part of the Binance ecosystem, BNB is almost impossible to avoid. That’s why many investors see it as a core part of their crypto strategy.

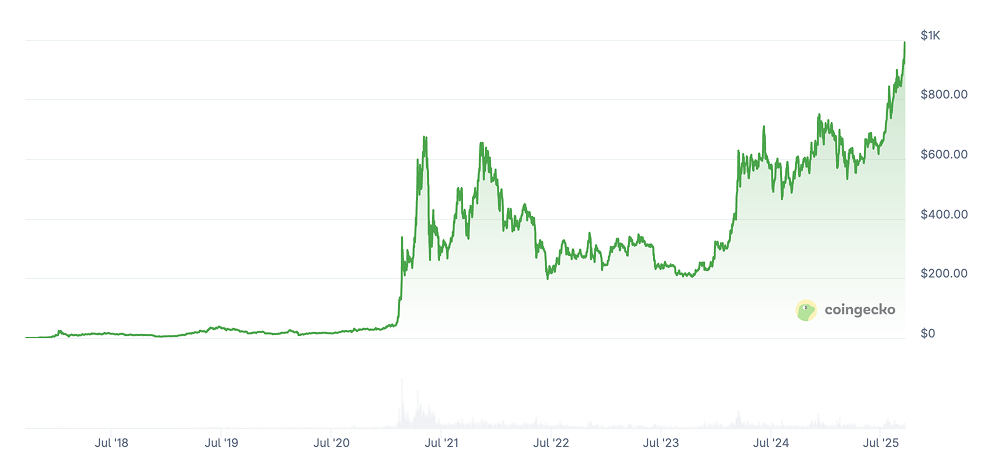

BNB’s price journey tells the story of how it evolved from a simple marketplace token into a top crypto asset.

- 2017–2018: Binance launched BNB during an ICO in July 2017, selling tokens at just $0.15. In total, Binance raised nearly $15 million in ETH and BTC. However, the price soon dropped to an all-time low of $0.09, just a month after launch. BNB remained a niche token at that time.

- 2019: In 2019, BNB reached $38 for the first time. But the rally didn’t last. The price fell steadily, ending the year around $12.11. Despite Binance growing fast, the BNB price stayed quiet.

- 2020: In early 2020, BNB started strong. It doubled in value to $27.19 within a few weeks. Then came the global pandemic. Panic hit the crypto market in March. BNB dropped, but soon recovered. A strong uptrend began in the second half of the year. By December 31, BNB was trading at $37.36.

- 2021: This was BNB’s breakout year. The coin skyrocketed, reaching $690.93 on May 10, 2021. That was a huge leap. But after the rally, the price fell sharply. It bounced back in November 2021, though it failed to reach a new high.

- 2022: In early 2022, BNB jumped again by over 50%. But as the year went on, the price fell across the market. Sentiment was weak, and BNB couldn’t hold its earlier gains.

- 2023: Trouble came in mid-2023. Binance was sued by the SEC, and the price of BNB dropped 23%. In February 2023, BNB was trading around $332, which was nearly 52% below its all-time high.

- 2024: BNB recovered steadily. In 2024, it hit a local high of $793. Confidence in Binance and BNB began to return.

- 2025: This year began at around $700. In April, BNB fell below $600. But since then, the market has reversed course. In July, the price jumped sharply to $859. In August, it continued to rise, reaching $899 by the end of the month. On September 18, 2025, BNB reached a new all-time high of $1,005. It is currently trading slightly lower, around $980, but the momentum remains strong.

CoinGecko, September 19, 2025

| Year | Minimum Price | Maximum Price | Median Price | Price Change |

| 2025 | $642 | $2,153 | $1,400 | +40% |

| 2026 | $826 | $2,546 | $1,700 | +75% |

| 2030 | $2,569 | $8,832 | $5,700 | +480% |

| 2040 | $7,045 | $234,926 | $120,000 | +12,100% |

| 2050 | $14,124 | $387,147 | $200,000 | +20,300% |

Looking ahead to 2025, experts see Binance Coin trading well above its current level of $980. According to , BNB might soar as high as $2,153, which would represent a +120% increase. Even in a bearish scenario, it could drop to $872, which is only -10% from where it stands now.

Over at , analysts expect a similar trend. They forecast a minimum of $1,115 (+15%) and a possible high of $1,216 (+25%), suggesting a slow but steady climb.

Meanwhile, offers a more conservative outlook for 2025. They estimate the lowest price at $642 (-35%) and the Maximum at $821, which is still -15% below today’s price.

In 2026, most analysts agree that BNB will keep gaining value. DigitalCoinPrice predicts a top price of $2,546 (+160%) and a bottom around $2,111 (+115%). This signals continued confidence in BNB’s upward trajectory.

PricePrediction is slightly more cautious but still optimistic. They expect BNB to trade between $1,635 (+65%) and $1,993 (+105%), with a solid Median performance.

Telegaon, however, believes the coin might face a slower year. Their prediction ranges from $826 (-15%) to $1,028 (+5%), which still implies Rise, but not as explosive.

As we approach the next decade, forecasts for BNB become more ambitious. DigitalCoinPrice expects the coin to range between $4,663 (+375%) and $5,392 (+450%), which could reflect BNB’s evolving utility and scarcity.

PricePrediction takes it even further. They suggest a high of $8,832 (+800%), while the coin’s low could still sit around $7,483 (+665%). That kind of Rise would likely come from massive adoption or significant supply reduction.

Telegaon is a bit more moderate but still positive, predicting a maximum price of $3,175 (+225%) and a minimum of $2,569 (+160%) by 2030.

By 2040, BNB might enter an entirely new league. PricePrediction offers a very bullish estimate with a minimum price of $192,147 (+19,500%) and a sky-high maximum of $234,926 (+23,900%). Such a jump would only be possible with extreme global adoption or deflationary tokenomics.

Telegaon isn’t nearly as aggressive but still sees BNB growing steadily. Their 2040 forecast ranges from $7,045 (+620%) to $8,659 (+785%), indicating strong long-term performance even in more conservative scenarios.

Looking deep into the future, the BNB price predictions get even more extreme. PricePrediction believes BNB could hit a minimum of $352,924, a mind-blowing +35,900% increase from today. At the top end, it could reach $387,147, which is +39,400% higher than current levels. These numbers reflect a world where BNB is deeply embedded in global finance.

Telegaon also sees major Rise, but on a smaller scale. They project BNB to range from $14,124 (+1,340%) to $23,766 (+2,300%) by 2050 — still impressive gains for long-term believers.

As BNB gains momentum in 2025, several analysts and institutions have shared bold predictions about where the price might go next. Their opinions vary — from very optimistic to quite cautious — but all agree on one thing: BNB is a coin to watch.

One of the loudest bullish voices comes from BitBull, a respected market analyst. BNB is now in what he calls an “expansion phase.” According to his BNB price prediction, the coin could reach $1,000 by Q4 2025 and $2,000 in early 2026. His forecast is based on technical analysis, specifically a multi-year ascending triangle breakout. BitBull compares this setup to the one seen between 2018 and 2021, when BNB jumped over 920% after breaking past $40.

But this time, he says, it’s not just speculation. It’s Rise. His confidence comes from real data:

- Network activity up 37% over the last month.

- Institutional buying exceeds $600 million.

- Daily transfers surged from 4 million to over 14 million.

— but still positive. Ben Ritchie, Managing Director at Alpha Node Global, expects BNB to hit $1,200 by the end of 2025. He believes demand for BNB will grow in both the Binance marketplace and the BNB Chain. He describes the current price as “fair,” with room to climb as usage increases.

Jeremy Britton, founder of BostonTrading.co, is a bit more conservative. His year-end target is $999, but he sees one big challenge: public perception. According to Britton, parts of the U.S. market still view BNB as a “Chinese coin,” which holds it back. He believes a shift in narrative is needed for BNB to truly unlock its price potential.

From a technical and ecosystem standpoint, Kadan Stadelmann, CTO of Komodo Platform, is optimistic. He points to strong bullish signals and says investor sentiment has improved. He also notes that Binance’s $100 million liquidity program, launched in March 2025, adds serious support for projects on the platform. This could drive more activity — and more demand for BNB.

Not everyone is convinced, though. John Hawkins, a senior lecturer at the University of Canberra, holds a more pessimistic view. He predicts BNB will end the year at just $400. His reasoning? The legal pressure surrounding Binance. In his words, BNB’s price reflects two things: BTC’s price and Binance’s regulatory status. Until both are stable, he believes BNB will struggle.

Finally, bullish sentiment is also fueled by institutional activity:

- Windtree Therapeutics $520 million to buy BNB as a treasury asset.

- Nano Labs its holdings to around 128,000 BNB tokens, worth over $108 million.

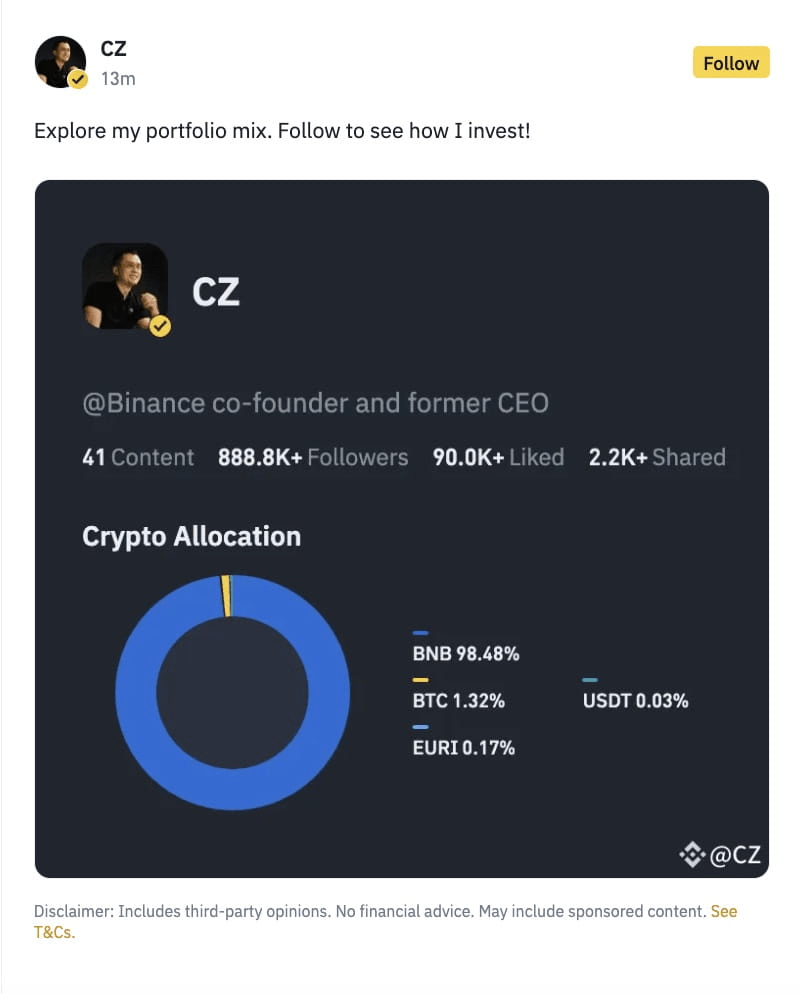

- Changpeng Zhao, Binance’s founder, 98.48% of his public crypto portfolio in BNB.

These moves suggest that some of the biggest players in crypto still believe in BNB’s long-term value.

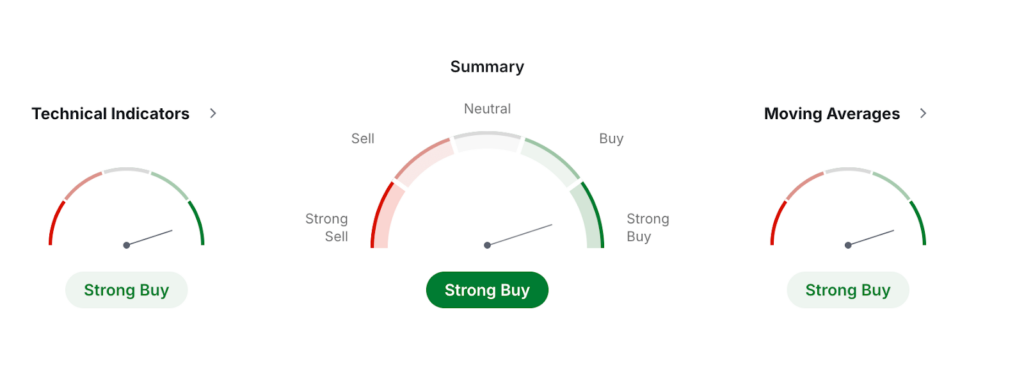

According to monthly data from , BNB continues to show strong bullish momentum in September 2025. The technical outlook is clear and positive. Both moving Medians and technical indicators point toward continued upward movement.

Investing, September 18, 2025

The overall technical summary is rated as “Strong Buy”. This conclusion is based on the combined signals from trend indicators and momentum tools. Out of ten main technical indicators, nine suggest buying, while only one shows neutral sentiment. None point to a sell.

Tools like RSI, MACD, ADX, and CCI all show healthy market strength. RSI is approaching the overbought level but remains in buy territory. MACD confirms a clear bullish signal. The ADX shows that the current trend is strong and well-supported. Momentum indicators such as the Commodity Channel Index and Rate of Change also reflect growing buyer interest.

The market has also become slightly more stable. This is supported by lower volatility data from the Median True Range. It suggests that recent price swings have been more controlled compared to earlier months. That’s often seen during strong trends when buyers dominate and price movement becomes more consistent.

Looking at the moving Medians, the results are even clearer. All 12 major Medians—both simple and exponential—are showing buy signals. This includes short-term, medium-term, and long-term Medians. Even the 200-day moving Median, which helps assess long-term health, is far below the current price. This confirms how much strength BNB has gained in recent months. It also shows that the uptrend is not just a short-term bounce.

Support and resistance levels based on pivot point analysis suggest that the next key price target could be around $760, with higher zones around $999 and possibly $1,113. These levels could act as checkpoints if the current uptrend continues.

The price of BNB depends on several key factors, both inside and outside the Binance ecosystem. Understanding these drivers can help explain why BNB goes up or down.

First, BNB is closely tied to the success of Binance itself. As the world’s largest crypto marketplace, Binance plays a central role in BNB’s utility. The more users trade on Binance or use its services, the more demand there is for BNB. Features like discounted trading fees, Launchpad access, and staking rewards all depend on using BNB. When Binance grows, BNB usually grows too.

Second, network activity on the BNB Chain has a big impact. If developers build more apps on the chain, and if users interact with open finance, NFTs, or games using BNB, it creates real utility. More usage often means more transfers and higher demand for the token, especially since BNB is required for gas fees.

Another important factor is the quarterly token burn. Binance regularly burns a portion of BNB to reduce the supply. This makes the token more scarce over time, which can support its price if demand remains steady or increases.

BNB’s price is also affected by the overall crypto market. If BTC rises, most altcoins — including BNB — tend to follow. On the other hand, bear markets or panic selling can pull BNB down, even if Binance itself stays strong.

Finally, regulation and legal pressure can play a big role. When Binance faces lawsuits or restrictions in key markets, BNB can take a hit. Investors often react quickly to negative news, especially from the U.S. or Europe.

BNB can be a good Funding for people who believe in Binance and its ecosystem. It has strong utility, from fee discounts to staking and Launchoad. However, it is still a digital currency, which means high volatility and risk. Always research and diversify before buying.

BNB started with 200 million tokens, but Binance conducts regular burns. Over 60 million BNB have already been burned, leaving less than 140 million in circulation. These burns reduce supply, which can increase scarcity and price over time if demand continues to grow.

Yes, BNB has a future as long as Binance remains strong. Its usage extends beyond the marketplace, powering the BNB Smart Chain and many open finance apps. The growing ecosystem and regular token burns give it long-term potential, though market conditions still influence its price.

For long-term investors who believe in Binance’s Rise, holding BNB can be rewarding. It provides benefits like trading fee discounts and access to exclusive token sales. However, holding BNB involves risks, such as regulatory challenges and market downturns, so a careful strategy is essential.

As of September 2025, BNB trades around $980, slightly below its recent all-time high of $1,005 on September 18. The price fluctuates daily based on trading dynamics, trading activity, and overall crypto sentiment. Always check updated market data before making any trading decisions.

Many experts believe BNB could reach $1,500 soon if current momentum continues. Analysts like BitBull and Ben Ritchie expect this level by late 2025. However, the final outcome depends on market conditions, regulatory news, and Binance’s overall performance in the coming months.

Some bullish forecasts suggest BNB could hit $2,000 by early 2026. This target is based on technical patterns and strong network Rise. Institutional interest is also growing. Still, reaching $2,000 will require favorable market conditions and no major negative news around Binance.

Reaching $5,000 is possible in the long term but highly speculative. For that to happen, Binance would need massive user Rise, stronger adoption of BNB Chain, and a crypto bull market. Right now, there’s no expert consensus supporting this level as a realistic short-term goal.

A $10,000 BNB is considered extremely unlikely in the near future. It would require BNB to gain more value than most current top assets. While not impossible over many years, such a price would need global adoption, reduced regulation risks, and a major shift in crypto economics.

Predictions for BNB in 2025 range between $1,000 and $1,200. BitBull expects $1,000 by Q4, while Finder panel experts give estimates from $999 to $1,200. Coinpedia sees a near-term target of $900. Most agree BNB is in an uptrend, but risks remain.

Long-term forecasts for 2030 vary widely. Some analysts believe BNB could trade between $2,000 and $3,000, depending on adoption and market Rise. These predictions assume Binance remains dominant and the BNB Chain continues to attract developers and users across open finance, NFTs, and Web3.

By 2040, BNB could be worth $4,000 to $6,000, based on the most optimistic projections. This would require massive global crypto adoption and Binance maintaining its market leadership. However, such long-range forecasts carry high uncertainty and should be viewed with caution.

BNB and ETH serve different roles. ETH is more decentralized and widely used for smart contracts. BNB is faster and cheaper, but more centralized. BNB may be better for users focused on trading and open finance within the Binance ecosystem, while ETH is stronger for Web3 and global apps.

BNB has strong chances to survive long-term as long as Binance stays relevant. Its utility across the Binance marketplace, staking, Launchpad, and BNB Chain gives it lasting value. But it must adapt to changing regulations and keep evolving to stay competitive in a fast-moving market.

Some investors believe BNB is still undervalued, especially when compared to its utility and reach. Its price has not yet matched the full scale of Binance’s ecosystem. However, concerns around regulation and market dominance remain. The answer depends on your view of Binance’s future.

is here to help you if you’re looking for a way to invest in this digital currency. You can buy BNB privately and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 coins and you can do wallet-to-wallet transfers instantly and problem-free.

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to marketplace — for instance, .

- Press the “Start marketplace” button.

- Provide the recipient address to transfer your crypto to.

- Process the transfer.

- Receive your BNB coins.

Follow us on , , , , and to stay updated about the latest news on and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

The post first appeared on .