Quant Price Prediction: How High Can QNT Crypto Go?

When people search for price prediction, they usually want a simple answer: is it a good Funding or not? The truth is, there’s no single answer. But by looking at the numbers and understanding what Quant really does, we can get a clearer picture.

Right now, the Quant price sits at $101. Over the last month, it has moved up and down in a way that many beginners find confusing. The lowest point was $97.28 on September 10, while the Maximum was $111.27 on August 23. That’s a difference of about 14%. For someone new to crypto, these swings may seem dramatic, but they’re actually quite normal.

This article is here to guide you step by step. First, we’ll explain what Quant is and why it was created. Then, we’ll look at its key features, how the token works, and what makes it stand out. Finally, we’ll go through expert QNT price predictions for 2025, 2030, and even 2050, so you can see the bigger picture.

If you’ve ever wondered whether Quant has real long-term potential, keep reading.

| Current QNT Price | QNT Price Prediction 2025 | QNT Price Prediction 2030 |

| $101 | $150 | $700 |

Quant Network is a project launched in 2018 with a clear mission: remove the barriers that exist between isolated blockchains and traditional business software. Instead of forcing companies to build new infrastructure from scratch, Quant offers a ready-to-use platform called Overledger Enterprise. This system is designed as a plug-and-play solution that allows firms to connect to multiple blockchains quickly and securely. For businesses, this means faster adoption, lower costs, and less dependence on large technical teams.

The vision behind Quant is ambitious. The team wants to create what many call a universal operating system for blockchains. In this model, all networks—public and private—can communicate with each other without friction. Quant has worked with major institutions, including the Bank of England, on projects that explore central bank digital currencies (CBDCs) and other enterprise-level blockchain applications. It also enables developers to create multi-chain applications, known as MApps, which can use several distributed ledger technologies (DLTs) at the same time. The focus is always on delivering enterprise-grade security, scalability, and flexibility.

At the core of this ecosystem is Overledger. It is built as a layered architecture with three main parts.

- The first is the blockchain layer, which supports multiple chains such as BTC, ETH, and Hyperledger.

- The second is the gateway layer, which manages communication between different blockchains and ensures smooth handling of queries and transfers.

- The final layer is the application layer, where developers build and run MApps using Quant’s APIs.

This design ensures interoperability across diverse technologies, low latency, and the ability to add new blockchains in a modular way as the industry evolves.

The QNT token plays a central role in keeping this system running. It is not just a digital asset but also the fuel of the ecosystem. Businesses and developers need QNT to pay licensing fees, access the Overledger API, and marketplace value across different blockchains. With a maximum supply capped at around 14.88 million tokens, scarcity adds an element of long-term value protection. As demand for Overledger services grows, the need for QNT increases too, which supports the token’s price and network Rise.

Real-world use cases for Quant are wide-ranging. In finance and open finance, it enables seamless transfer of assets between protocols and improves efficiency in yield farming. In supply chain management, it helps track products across different networks while automating payments. In the public sector, it plays a role in testing CBDC frameworks and integrating government solutions. Even in healthcare, Quant offers a secure way to marketplace patient data between disconnected systems, improving safety and transparency.

| Current Price | $101 |

| Market Cap | $1,475,655,069 |

| Volume (24h) | $15,615,861 |

| Market Rank | #97 |

| Circulating Supply | 14,544,176 QNT |

| Total Supply | 14,881,364 QNT |

| 1 Month High / Low | $111.27 / $97.28 |

| All-Time High | $427.42 Sep 11, 2021 |

Quant is more than just another digital currency. Its strength lies in the Overledger operating system, a platform built to solve one of the biggest problems in blockchain today: interoperability.

By design, Overledger allows different networks—both public and private—to connect and communicate without friction. This approach makes Quant highly valuable for enterprises, governments, and developers who need secure and scalable blockchain solutions.

To understand how Quant achieves this, it helps to look at its core features:

- Overledger Operating System: A blockchain-agnostic OS that provides a universal API gateway. It allows developers to create multi-chain applications (MApps) capable of running across several blockchains at once.

- Multi-Layer Architecture: The system separates blockchain, gateway, and application layers. This modular design makes it easier to integrate new networks and services, ensuring flexibility and long-term scalability.

- API-Driven Development: Quant offers a full set of APIs and SDKs that simplify integration. Developers can build interoperable applications across multiple chains with minimal effort, lowering costs and technical barriers.

- High Throughput & Low Latency: Overledger is optimized for enterprise-level use, handling large volumes of transfers efficiently while keeping delays to a minimum. It balances performance without compromising decentralization or security.

- Robust Security: Advanced cryptographic algorithms and a distributed node network protect data integrity. This setup prevents single points of failure and ensures reliability even in complex environments.

- Permissioned & Public Chain Support: Quant connects both private enterprise blockchains and public networks like BTC and ETH. This hybrid capability enables real-world applications where organizations need to combine privacy with openness.

- CBDC & Enterprise Integration: Quant is already collaborating with central banks and financial institutions to support digital currency issuance and cross-network interoperability. This makes it one of the few blockchain projects allocationed to benefit directly from the rise of CBDCs.

Together, these functions show why Quant is seen as a leader in blockchain interoperability. It does not compete with existing chains but instead connects them, opening the door to new use cases. From finance and healthcare to supply chains and government systems, QNT is building the infrastructure that could make blockchain adoption mainstream.

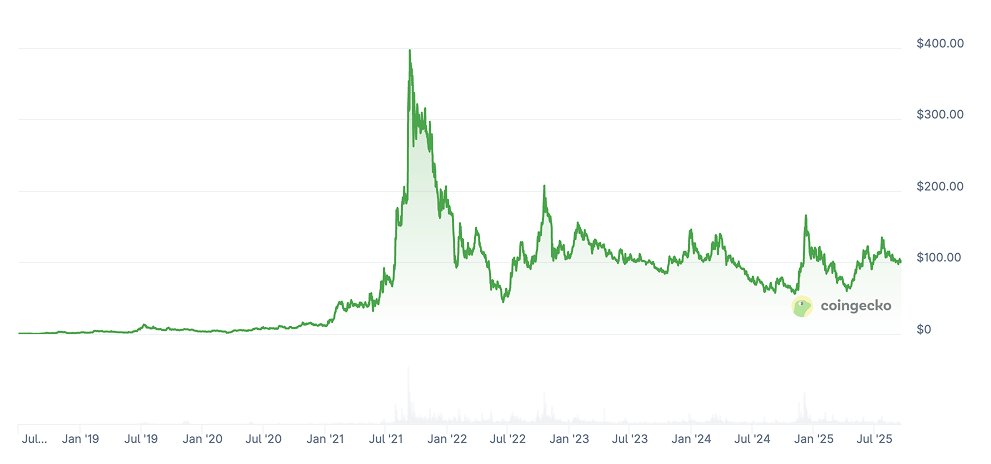

CoinGecko, September 18, 2025

Quant’s price history tells a story of sharp rises, deep corrections, and steady recoveries. Each year reflects changing market conditions.

Quant made its debut in June 2018 at around $0.29. Within just a few months, excitement around the project drove the price to a peak of $5.3 in October. By the end of the year, it settled near $2.17, still an impressive 650% increase compared to its launch. This strong start highlighted the market’s early confidence in Quant’s vision.

In 2019, QNT opened at about $2.12. The first months saw steady gains, but the summer brought a strong surge in demand. The token hit a yearly high of nearly $15.77, before closing the year at $3.66. Despite the pullback, it still recorded an annual gain of roughly 72%, showing solid resilience in a mixed crypto market.

The year 2020 marked another turning point. Starting at $3.66, QNT rose as high as $17.35 before finishing at $11.23. This represented a 207% yearly increase, proving that Quant was steadily building momentum even during a year dominated by global economic uncertainty.

For Quant, 2021 was a breakout year. The token opened at $11.23 and skyrocketed to an all-time high of $427.42 during the broader crypto bull run. By December, the price settled at $179.05, which still reflected an astonishing 1,495% annual gain. This surge cemented Quant’s allocation as one of the most notable blockchain projects of the cycle.

After the record highs of 2021, the market corrected sharply in 2022. QNT began the year at $179.05, fell to a low of $40.41, and eventually closed at $105.24. That marked a 41% yearly drop, consistent with the overall downturn across the crypto sector.

In 2023, Quant showed renewed strength. It opened the year at $105.25 and climbed to $163.14 at its peak. The year ended at $137.79, giving QNT a 30% increase, a clear sign of recovery after the tough bear market.

The following year proved challenging again. Starting at $137.77, QNT dropped as low as $50.05 during mid-year corrections. By December, the token closed at $106.29, representing a 22% decline over the year.

Quant began 2025 at $106.23. So far, it has reached a high of $135.84 and a low of $58.59. As of mid-September, QNT trades near $101, reflecting a modest 4.5% drop since January.

| Year | Minimum Price | Maximum Price | Median Price | Price Change |

| 2025 | $91.01 | $222.8 | $150 | +50% |

| 2026 | $166.09 | $360.23 | $250 | +150% |

| 2030 | $481.29 | $893.68 | $700 | +590% |

| 2040 | $1,439. | $35,744 | $18,000 | +17,700% |

| 2050 | $3,123 | $55,529 | $25,000 | +24,650% |

anticipate Quant (QNT) may trade between $91.01 (-10%) at its 2025 low and $222.80 (+120%) at peak valuation.

project stronger performance, with QNT expected to range from $110.79 (+9%) to $124.46 (+22%) during 2025.

analysts suggest a 2025 price range of $112.59 (+10%) to $218.35 (+115%).

DigitalCoinPrice experts project that in 2026, QNT may reach $262.24 (+160%) at peak valuation, while potentially declining to $217.77 (+115%) at its lowest point.

Based on PricePrediction’s forecast, in 2026 QNT could trade between $166.09 (+63%) and $196.42 (+93%).

Telegaon’s bullish outlook suggests QNT may trade between $224.51 (+120%) at minimum and $360.23 (+255%) at maximum during 2026.

DigitalCoinPrice analysts think that by 2030, QNT could reach a maximum of $557.84 (+450%), while maintaining a minimum of $481.29 (+375%).

PricePrediction’s 2030 projections anticipate stronger Rise, with a potential low of $739 (+627%) and a possible peak of $893 (+780%).

According to Telegaon, QNT could achieve a maximum valuation of $645.09 (+535%), while holding a floor at $584.48 (+475%).

PricePrediction projects that by 2040, QNT may trade between $21,991 (+21,565%) and $35,744 (+35,100%), marking extreme long-term bullishness.

Telegaon analysts expect a more moderate outlook, with QNT forecasted to move between $1,439 (+1,315%) and $1,573 (+1,450%).

DigitalCoinPrice has not published 2040 targets, making these two sources the main long-term outlooks.

PricePrediction gives the most aggressive 2050 QNT price prediction, projecting a range from $41,190 (+40,470%) to $55,529 (+54,600%), assuming massive adoption of Quant’s interoperability solutions.

Telegaon’s 2050 targets are far more conservative, ranging between $3,123 (+2,980%) and $3,518 (+3,360%).

When looking at Quant price prediction, it helps to compare expert commentary with automated forecasts. Together, they provide a balanced view of what might come next for the token.

One of the most respected analysts, Benjamin Cowen, a recurring risk factor that could affect QNT. In his September 2025 outlook, he warned that the crypto market tends to perform poorly during this month. His research pointed out that from 2017 through 2020, both BTC and altcoins repeatedly posted negative September returns.

Cowen called this pattern “red September after red September,” and stressed that altcoin-to-BTC trading pairs, such as QNT/BTC, are particularly vulnerable. He also noted that in past cycles, the first monthly close below support often happened about a month before the Federal Reserve’s first rate cut. If this historical pattern repeats, QNT could face short-term downside pressure against BTC.

On the other side, algorithm-based platforms provide structured forecasts that help investors set expectations. uses a machine-learning model built on historical data and blockchain metrics. Its model places QNT’s near-term trading range between $98.83 and $122.14, with an Median price of $117.29. This forecast suggests moderate upside from the current price but no explosive rally.

provides a much wider band using a hybrid of technical and AI-driven models. Its range stretches from $62.5 at the low end to $393.91 at the high end. While such a wide span makes it harder to use in trading strategies, it shows just how volatile QNT could be if market conditions shift suddenly.

Meanwhile, shorter-term trading forecasts from and both point to a much tighter daily range of around $96.5 to $100.5. These projections are based on standard technical tools like RSI and moving Median convergence. Since both platforms rely on similar datasets, their predictions overlap, offering traders a realistic short-term window for QNT’s daily movements.

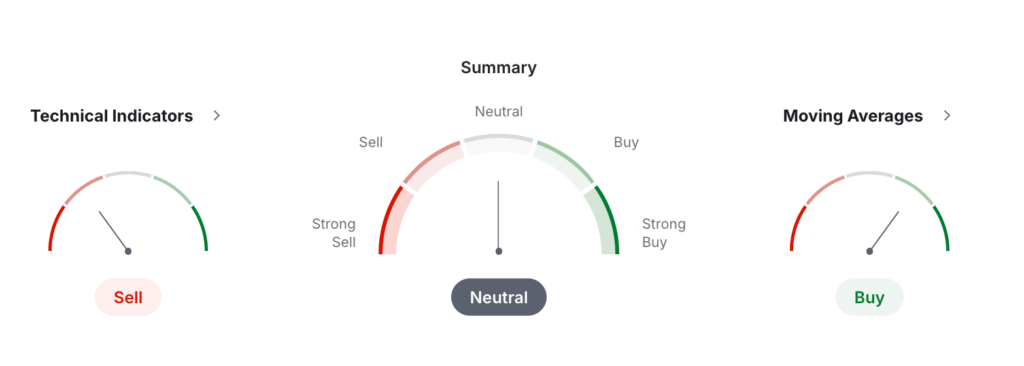

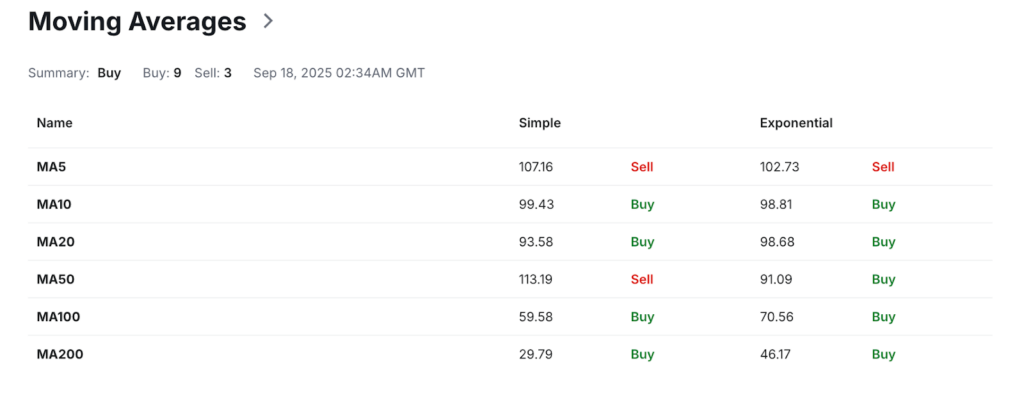

The latest monthly technical analysis for the QNT/USDT pair from gives a mixed picture, reflecting both buying interest and signs of weakness. Overall, the platform’s summary shows a neutral rating, with moving Medians leaning positive while technical indicators signal mild selling pressure.

Investing, September 18, 2025

Looking closer, the moving Medians provide the strongest bullish signal. Out of twelve tracked Medians, nine suggest buying and only three recommend selling. Short-term data shows some divergence: the 5-day simple and exponential Medians lean bearish, but the 10-day and 20-day Medians both point to a buy. Longer-term signals are more convincing, with the 50-day exponential moving Median and all 100- and 200-day Medians firmly in buy territory. This indicates that while QNT has faced recent corrections, its long-term trend remains supported.

Technical indicators, however, are less optimistic. The Relative Strength Index (RSI) stands at 51, which is neutral and suggests neither overbought nor oversold conditions. Momentum tools are more divided. The Stochastic oscillator at 43.14 points to a sell, while the Stochastic RSI at 72.24 indicates a buy. Similarly, the MACD shows a bearish reading of -0.98, hinting at downward momentum, while the Rate of Change (ROC) and Bull/Bear Power both lean bullish. This split highlights a market in balance, where bulls and bears are competing for control.

Pivot point data adds more context. The classic model shows support at $96.71 and resistance around $114.28, suggesting a relatively narrow trading corridor. Fibonacci levels reinforce this outlook, with the pivot set at $107.39 and resistance close to $114.10. Together, these numbers confirm that QNT is trading in a consolidation phase, with no clear breakout yet.

The price of Quant (QNT) does not move in isolation. Like most cryptocurrencies, it reacts to a mix of technical, fundamental, and market-wide factors. Understanding these drivers can help investors see why the token rises or falls in value.

One of the most important influences is market sentiment. When BTC and ETH rally, altcoins like QNT usually benefit as well. On the other hand, during bear markets, even strong projects often lose value as investors move to safer assets.

Another factor is adoption of Overledger, the core technology behind Quant. As more businesses and governments integrate this system, demand for QNT tokens increases. Since the supply of QNT is fixed, greater usage often supports higher prices over time.

Regulation also plays a key role. Positive signals, such as support for central bank digital currencies (CBDCs), can lift QNT, while stricter rules on crypto markets may weigh on its price.

From a technical side, trading indicators such as RSI, MACD, and moving Medians often shape short-term price action. These tools influence how traders react, creating momentum swings that push QNT higher or lower.

Other important drivers include:

- Partnerships and enterprise adoption – collaborations with banks or tech firms can spark rallies.

- Macro events – interest rate changes, inflation data, or global crises affect investor appetite for risk.

- Competition – rival interoperability projects can limit Rise if they gain faster traction.

In short, QNT’s price depends on both internal progress and the broader crypto environment. Long-term Rise will likely come from the adoption of its interoperability solutions, while short-term moves remain tied to overall market cycles and trader sentiment.

Quant can be a good Funding for those who believe in blockchain interoperability. Its Overledger technology is unique and already tested with enterprises and central banks. However, like all cryptocurrencies, QNT is volatile. Investors should consider it as a long-term play and avoid expecting fast, guaranteed profits.

The biggest risks are price volatility and regulatory uncertainty. QNT can lose value quickly during market downturns. Competition from other interoperability projects may also impact Rise. Investors should only allocate money they can afford to lose and keep in mind that crypto Fundings carry higher risks than traditional assets.

Quant is a blockchain project focused on connecting different networks. Its main product, Overledger, acts like an operating system that links public and private blockchains. This allows developers and enterprises to build applications that use multiple blockchains at once. The QNT token is the fuel that powers this ecosystem.

Quant is used to enable communication between separate blockchain systems. Businesses use it to integrate multiple ledgers without building new infrastructure. Developers use it to create multi-chain applications. QNT tokens are required for licenses, transfer fees, and as a medium of marketplace within the Overledger network.

The maximum supply of QNT is capped at around 14.88 million tokens. This makes it a relatively scarce digital currency compared to others with billions of tokens. Limited supply can help protect against inflation, meaning if demand grows, the price of QNT could rise faster over time.

The all-time high for QNT was reached in September 2021, when the price hit about $427.42. This spike came during a broad crypto bull run and reflected strong investor interest in interoperability solutions. Since then, the price has corrected, but the all-time high remains a reference point for future Rise potential.

In the near term, most analysts see QNT trading between $200 and $400 depending on market conditions. Long-term predictions are more ambitious, with some sources suggesting prices in the thousands if adoption accelerates. Realistically, Rise will depend on enterprise adoption, regulation, and broader crypto market cycles.

Yes, QNT could reach $500 if adoption expands and the crypto market enters a new bull cycle. Its limited supply supports higher valuations when demand increases. However, breaking $500 would require not just speculation but also stronger real-world use cases and broader institutional support for Quant’s Overledger system.

Quant reaching $1,000 is possible in the long term but not guaranteed. It would likely require mass adoption of Overledger by enterprises and central banks. Some expert forecasts suggest this level could be achieved by the early 2030s, but investors should treat such targets as optimistic scenarios, not certainties.

Reaching $2,000 would demand exponential Rise in both adoption and market sentiment. This scenario could play out if central bank digital currencies and large enterprises rely heavily on Quant’s interoperability technology. While ambitious, such a price is not impossible in the next two decades if Quant maintains its leadership allocation.

A $10,000 price for QNT is an extremely ambitious target. It would likely require global adoption of Overledger as the leading interoperability standard across finance, healthcare, supply chains, and government. While not impossible over decades, most analysts see it as a stretch goal rather than a realistic near-term forecast.

Reaching $50,000 would put Quant among the most valuable assets in the crypto world. For this to happen, Quant would need to power a massive share of global blockchain activity. Such a price assumes near-universal adoption, which is unlikely soon but could be considered in long-term, highly optimistic scenarios.

The idea of QNT reaching $100,000 is more speculative than realistic. It would require adoption on a scale that transforms global finance and beyond, essentially making Quant the backbone of digital infrastructure. While supporters dream of such levels, no credible forecasts suggest QNT will reach this price in the foreseeable future.

A realistic price prediction considers both Rise and risk. Many analysts expect QNT to trade in the $500–$1,000 range by 2030 if adoption grows. Longer-term forecasts, such as by 2040, suggest values in the low thousands. While predictions vary, most agree QNT has potential without assuming extreme price targets.

Forecasts for 2025 vary widely. Some platforms like DigitalCoinPrice expect highs around $220, while Telegaon’s analysis suggests QNT could climb above $200. More cautious predictions place it closer to $120. Overall, 2025 could bring moderate Rise, but it will depend on broader crypto market cycles and enterprise adoption.

In 2026, analysts see Quant trading between $166 and $360. Optimistic sources believe strong enterprise adoption could push prices higher, while conservative outlooks suggest moderate Rise. A mid-range forecast puts QNT between $200 and $250. The actual outcome will likely depend on macroeconomic conditions and central bank digital currency projects.

By 2030, estimates vary between $550 and $900, depending on the forecasting source. This would represent significant Rise from today’s levels. If Overledger gains mainstream traction in enterprise and government systems, QNT could move closer to the higher end of these predictions. However, competition may limit extreme upside.

Analysts do not all agree on 2035 targets, but long-term models often point to prices above $1,000. Some highly bullish forecasts even suggest several thousand dollars if adoption accelerates.

QNT price predictions for 2040 show huge differences. PricePrediction.net expects extreme Rise into the tens of thousands, while Telegaon offers a more moderate outlook in the $1,400–$1,500 range.

By 2050, forecasts stretch from just over $3,000 to more than $50,000 depending on the source. The higher projections assume near-universal adoption of Overledger across global industries, while the lower ones assume steady but limited Rise.

Yes, QNT has a future if blockchain interoperability continues to gain importance. Its Overledger system is one of the few enterprise-ready solutions connecting different blockchains. As long as businesses, governments, and developers look for seamless multi-chain integration, Quant is likely to stay relevant in the evolving digital economy.

Some analysts consider QNT undervalued because of its limited supply and strong use case in enterprise adoption. Compared to tokens with no clear utility, QNT stands out. However, the market often values tokens based on hype rather than fundamentals, so undervaluation is subjective and depends on investor perspective.

QNT may be worth buying for investors who believe in long-term blockchain adoption, especially in finance and government. Its unique technology and partnerships provide strong fundamentals. Still, because prices are volatile, it’s best to view QNT as a long-term Funding and diversify rather than rely on it alone.

is here to help you buy QNT coin if you’re looking for a way to invest in this digital currency. You can and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 different coins and you can do wallet-to-wallet transfers instantly and problem-free.

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to marketplace — for instance, .

- Press the “Start marketplace” button.

- Provide the recipient address to transfer your crypto to.

- Process the transfer.

- Receive your crypto coins.

Follow us on , , , , and to stay updated about the latest news on and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

The post first appeared on .