Pyth Network Price Prediction: Is PYTH a Good Investment?

When people look at new crypto projects, one of the first questions is price. That is why many investors search for a clear price prediction before making any move. Right now, PYTH trades at around $0.164. The token had an interesting month. Through most of August, it stayed between $0.11 and $0.12, showing little strength. On August 26, it reached a monthly low of $0.1085.

Everything changed in the last days of the month. On August 29, the price jumped sharply. First, it moved to $0.18, and then pushed up to a monthly high of $0.2489. That means the token gained over 130% from its monthly bottom in just a few days. Such sudden Rise caught the attention of traders. Now, many beginners wonder if this is the start of a bigger trend or just a short rally.

| Current PYTH Price | PYTH Price Prediction 2025 | PYTH Price Prediction 2030 |

| $0.164 | $1.5 | $8.5 |

is a blockchain project built to solve one of the most important problems in crypto: reliable data. Most decentralized applications (dApps) need access to outside information such as stock prices, crypto values, or commodities. Without this data, they cannot function properly. Pyth provides these numbers directly on-chain through what is called an oracle network.

An oracle works like a bridge between the . In the case of Pyth, it collects prices from trusted sources like trading firms, marketplaces, and financial institutions. These providers send their data to the Pyth Network, where it is combined and updated in real time. Developers can then use this feed in their apps without worrying about manipulation or delays.

The project was launched in 2021 and has quickly become one of the largest oracle systems. It is connected to , including Solana, , and BNB Chain. That wide coverage makes Pyth different from many competitors who often focus on just one chain. The ability to broadcast data across ecosystems is key for adoption.

The PYTH token is the native currency of the network. It is used for several purposes. First, it secures the system by aligning the incentives of data providers and users. Second, it allows holders to take part in governance decisions. That means token owners can vote on updates, upgrades, and future directions of the protocol. Finally, PYTH can be staked in the network to support its operation.

The main goal of Pyth is clear: deliver fast, accurate, and fair data for the decentralized economy. By doing this, it helps developers create safer open finance applications, trading platforms, and prediction markets. Reliable data is the foundation for all of these services.

Pyth was created by a group of industry leaders with strong backgrounds in finance and blockchain. Many well-known market makers and marketplaces are involved, which gives the project credibility. Their involvement also increases trust, since these firms already manage large amounts of financial data in traditional markets.

| Current Price | $0.164 |

| Market Cap | $940,593,921 |

| Volume (24h) | $169,156,485 |

| Market Rank | #79 |

| Circulating Supply | 5,749,984,586 PYTH |

| Total Supply | 10,000,000,000 PYTH |

| 1 Month High / Low | $0.2489 / $0.1085 |

| All-Time High | $1.15 Mar 16, 2024 |

Pyth Network stands out as a decentralized oracle network built to deliver financial data directly on-chain. Unlike other oracles that depend on third-party aggregators, Pyth sources its information straight from trading firms, marketplaces, and financial institutions. This design improves both accuracy and trustworthiness, which are critical for open finance platforms that cannot afford errors in pricing.

One of its strongest technical advantages is speed. Pyth provides high-frequency, low-latency data feeds, updating prices roughly every 400 milliseconds. This level of responsiveness allows latency-sensitive applications—like decentralized marketplaces, lending platforms, and algorithmic trading systems—to access market prices almost instantly.

Another key feature is broad asset coverage. The network supplies data for more than 500 instruments, including cryptocurrencies, equities, commodities, ETFs, and forex pairs. It now operates across over 70 blockchains, offering developers and enterprises the ability to build applications with global market data in one place.

To handle this flow efficiently, Pyth uses a pull-based data model. Instead of sending constant updates, smart contracts request the most recent data only when needed. This approach cuts down on unnecessary costs and makes the system more scalable.

At the core of Pyth is Pythnet, a proof-of-authority blockchain forked from Solana. Here, raw submissions from data providers are aggregated, including confidence intervals, before distribution. This step ensures consistency and reliability of feeds.

Through the Wormhole protocol, Pyth achieves full cross-chain compatibility. Price feeds are available instantly on every supported chain, simplifying multi-chain open finance deployment and removing friction for developers.

The PYTH token drives governance and incentives. Token holders can vote on upgrades and policies, while data providers are rewarded for accuracy. This structure aligns the interests of the network and its participants.

Beyond live prices, Pyth also offers historical price archives called benchmarks. These provide verifiable timestamps for past data, enabling backtesting, accounting, and auditing directly on-chain.

Pyth has also integrated secure randomness through its feature called Pyth Entropy. It supports fair use cases such as gaming, lotteries, and randomized reward distribution without external dependencies.

Finally, Pyth protects users from MEV (Maximal Extractable Value) attacks with its optional Express Relay, which lets price submissions go directly to block builders. With institutional-grade providers like Binance, Cboe, and Jump Trading, the data quality remains robust and enterprise-ready.

CoinGecko, September 2, 2025

The history of the Pyth Network (PYTH) token has been short but already full of ups and downs. The token was officially launched on November 20, 2023, through an airdrop. At first, PYTH served mainly as a governance token, giving holders a voice in the future of the network. From the very beginning, its price showed high volatility.

- In the final weeks of 2023, PYTH opened trading at $0.54. It reached an early peak of $0.65, before dropping to a low of $0.28. By the end of December, the price had stabilized at $0.32. This meant an overall decline of more than 40% in just six weeks after launch, a common pattern for new tokens as the market searches for a fair value.

- The year 2024 brought a sharp rebound. PYTH started January at $0.32 and soon began climbing. In that year it recorded its all-time high (ATH) of $1.15, a level that placed the project among the stronger performers in the oracle sector. The lowest point in 2024 was $0.22, showing the token remained volatile throughout the year. By December 31, it closed at $0.35, marking an annual increase of 8.49%. Despite the ups and downs, 2024 stands out as the most successful year for PYTH so far.

- The situation shifted again in 2025. Starting the year at $0.35, the token briefly touched a local maximum of $0.4. However, heavy selling pressure soon followed. By mid-year, PYTH hit a dramatic low of $0.08, reflecting a significant correction. On September 1, 2025, the token traded at just $0.1. This represents a loss of more than 52% since January, signaling that investor confidence has weakened compared to the strong performance of 2024.

In summary, PYTH has already shown the characteristics of a highly volatile asset. The explosive rally in 2024 was followed by deep corrections in 2023 and 2025. As of September 2025, the token remains well below its all-time high, with the market searching for a new balance point.

| Year | Minimum Price | Maximum Price | Median Price | Price Change |

| 2025 | $0.14 | $3.05 | $1.5 | +820% |

| 2026 | $0.28 | $4.12 | $2.2 | +1,250% |

| 2030 | $0.79 | $16.25 | $8.5 | +5,000% |

| 2040 | $84.27 | $126 | $100 | +61,000% |

| 2050 | $139 | $180 | $160 | +98,000% |

predicts that Pyth Network (PYTH) could reach a maximum of $0.37 (+125%), while its lowest estimate stands at $0.14 (-15%) in 2025.

According to , PYTH’s price could range between $0.192 (+17%) and $0.212 (+30%) during the same year.

analysts take a far more bullish stance, suggesting PYTH could surge to $3.05 (+1,770%) at its peak, though it might still fall to $2.26 (+1,285%) at the minimum.

For 2026, DigitalCoinPrice expects PYTH to trade as high as $0.43 (+165%) and as low as $0.36 (+120%).

PricePrediction.net provides a similar but slightly wider range, with a maximum of $0.334 (+105%) and a minimum of $0.279 (+70%).

Telegaon’s outlook again leans strongly bullish, forecasting PYTH could climb to $4.12 (+2,430%), with a possible low around $3.08 (+1,800%).

By 2030, DigitalCoinPrice forecasts a maximum value of $0.9 (+450%) and a minimum near $0.79 (+385%).

PricePrediction.net projects much stronger Rise, with estimates between $1.17 (+620%) and $1.39 (+750%).

Telegaon is the most optimistic, expecting PYTH to potentially soar to $16.25 (+9,900%), with a floor price of $12.28 (+7,400%).

Looking at long-term forecasts, PricePrediction.net estimates PYTH could reach between $106 (+65,000%) and $126 (+77,000%) by 2040.

Telegaon also provides a very bullish outlook, predicting a minimum of $84.27 (+51,500%) and a maximum of $89.1 (+54,500%).

By 2050, PricePrediction.net expects PYTH to trade between $157 (+96,000%) and $180 (+110,000%).

Telegaon offers a similar projection, with prices ranging from $139 (+85,000%) at the low end to $155 (+95,000%) at the high end.

Different analysts have presented contrasting views on the future of Pyth Network (PYTH). Their perspectives show how both technical signals and fundamental factors influence expectations.

Jacob Crypto Bury, writing for on August 31, 2025, emphasizes the risk of supply dilution. He recalls that in December 2024, PYTH reached a market cap of $1.9 billion at a token price of $0.51. Since then, the number of circulating tokens has increased by 43%. This means that to return to the same $0.51 price, the market cap would now need to reach $5.74 billion—around five times its current value.

Bury warns that investors often focus on reclaiming old all-time highs while ignoring the impact of token emissions. In his view, without steady demand to absorb this growing supply, the market is prone to short-term pullbacks. He also points to overbought technical indicators, suggesting that the recent rally may be fragile. His advice to traders is to monitor market cap closely, rather than being guided only by unit price movements.

In contrast, analysts from (August 28, 2025) take a more bullish view, focusing on technical breakout potential. They highlight how PYTH gained more than 100% in 24 hours following news of its collaboration with the U.S. Department of Commerce. This announcement drove a staggering 9,836% increase in trading volume, creating conditions for a short squeeze.

According to FXEmpire, this surge confirms a breakout above long-term resistance, marking a transition from bearish compression to bullish expansion. They see strong support in the $0.17–$0.19 range, providing a safety net if profit-taking begins. Importantly, they note that recent volume spikes point to institutional involvement, rather than retail speculation alone.

FXEmpire analysts conclude that PYTH’s unique role as a government-linked oracle for on-chain GDP data gives it a clear use case even in a weak crypto market. Their forecast calls for a potential move to $0.3 within days if the momentum continues.

Together, these views show two sides of the market: one cautious about fundamentals, and another focused on technical momentum.

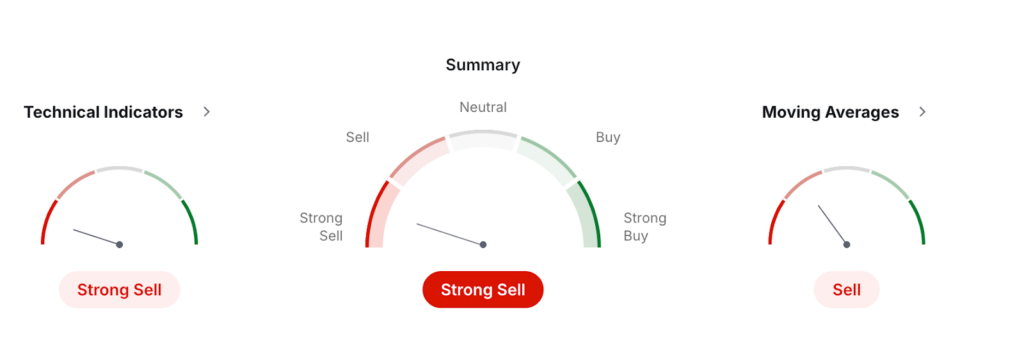

The monthly technical picture for Pyth Network shows clear weakness, with indicators from pointing to a strong sell signal. Both the technical indicators and moving Medians confirm bearish pressure, suggesting that the token may struggle to hold its ground in the near term.

Investing, September 2, 2025

Looking at the momentum indicators, the RSI (14) sits at 46.8, which is neutral and does not show overbought or oversold conditions. However, the Stochastic (9,6) at 13.7 signals that PYTH is oversold, pointing to potential exhaustion of selling. At the same time, the Stochastic RSI (14) at 98.6 flashes an overbought reading, creating a conflict in short-term momentum signals. The MACD (12,26) is negative at -0.002, reinforcing a sell bias. The Williams %R at -81.8 also indicates oversold territory, while the CCI (14) at -54 leans bearish.

The ADX (14) at 21.3 suggests a weak trend, neither strongly bullish nor bearish, which means the market could remain range-bound. Supporting the bearish case are additional signals: the Ultimate Oscillator at 39.4, the ROC at -52.7, and Bull/Bear Power at -0.0694, all of which point to downward momentum.

From a moving Medians perspective, the picture remains mixed but tilts bearish overall. Out of twelve tracked Medians, seven show sell signals, while five suggest buying. Short-term Medians like the MA5 are bullish, with values at 0.1377 (simple) and 0.1593 (exponential) showing buy pressure. However, longer-term Medians such as MA20, MA50, MA100, and MA200 reflect strong sell conditions, highlighting that broader trends remain negative.

Pivot point analysis shows that $0.179–$0.18 is a critical level. If PYTH fails to hold this zone, the next support lies around $0.109–$0.112. On the upside, resistance sits near $0.254–$0.256, followed by $0.324–$0.325, where selling pressure may intensify.

In summary, the technical outlook is still bearish. Most indicators confirm downward momentum, while pivot levels highlight the importance of defending support at $0.17. Without strong buying interest, PYTH risks revisiting lower levels, though oversold signals hint at the possibility of a short-term rebound if volume returns.

The price of Pyth Network (PYTH), like any crypto asset, is shaped by a mix of technical, market, and project-specific factors. Understanding these influences helps investors see why PYTH can be so volatile and what might drive it higher or lower in the future.

One of the most important elements is token supply dynamics. The circulating supply of PYTH continues to expand as tokens are unlocked and distributed. If demand does not grow at the same pace, the extra supply can push prices down. Analysts often stress the need to watch market cap rather than just unit price for this reason.

Adoption is another key driver. Pyth’s value increases when more projects, especially decentralized marketplaces and lending protocols, integrate its real-time oracle feeds. Each new partnership signals stronger utility, which can attract both developers and investors.

Market sentiment also plays a crucial role. When traders view PYTH as a promising oracle competitor, prices tend to rise. However, during downturns in the broader crypto market, PYTH usually follows the same negative trend, regardless of its fundamentals.

Technical factors matter as well. Support and resistance levels, volume surges, and breakout patterns can spark rallies or accelerate sell-offs. For short-term traders, these signals often guide entry and exit points.

Other influences include:

- Competition from other oracle providers like Chainlink can affect Pyth’s share of integrations.

- Macroeconomic conditions, such as interest rates and regulatory news, impact risk appetite for crypto as a whole.

- Utility expansion, for example, the introduction of features like Pyth Entropy or government-related data feeds, which add unique value.

In the end, PYTH’s price depends on a balance between supply Rise and sustained demand. If adoption keeps rising and new use cases emerge, the token can strengthen. If not, downward pressure from emissions may dominate.

Pyth Network could be a good Funding for those who believe in the Rise of open finance. Its oracle feeds are widely adopted, but risks remain due to strong competition and high volatility. Beginners should invest carefully, only with amounts they can afford to lose.

The PYTH token is mainly used for governance and network security. Holders can vote on upgrades, while data providers are rewarded for accuracy. It also helps align incentives between developers and publishers. In short, PYTH powers the ecosystem and ensures price feeds remain reliable and decentralized.

PYTH’s future price is uncertain and depends on adoption, market sentiment, and supply Rise. Analysts provide a wide range of forecasts, from modest gains to extremely bullish long-term projections. While short-term fluctuations are likely, strong adoption across multiple blockchains could support steady Rise in the future.

For 2025, analyst forecasts vary widely. Some expect PYTH to trade close to $0.2–$0.4, reflecting moderate Rise. Others, like Telegaon, predict values above $3 if adoption accelerates. The gap shows how uncertain crypto forecasting can be, especially with tokens that still expand supply.

In 2026, predictions remain mixed. Conservative models point to values under $0.50, while more optimistic forecasts suggest several dollars. Much will depend on market cycles, token unlock schedules, and new partnerships. Investors should expect both risks and opportunities, with volatility continuing to shape the token’s outlook.

By 2030, forecasts show wide differences. Conservative estimates suggest PYTH might stay under $1, while bullish outlooks expect prices above $1. Such long-term predictions depend on global crypto adoption and Pyth’s ability to remain a leading oracle provider. The risk and reward are both high.

Pyth competes mainly with , the largest oracle provider. Other smaller competitors include and . Each project aims to deliver secure and reliable data to blockchains. Competition matters, since developers often choose one oracle over another, which can directly influence token demand.

Yes, Pyth Network was originally launched on and still has deep ties to that ecosystem. However, thanks to Wormhole, Pyth’s price feeds are now available across dozens of other blockchains. This multi-chain compatibility makes PYTH flexible and useful beyond Solana alone.

Pyth and Chainlink serve similar purposes as , but they differ in design. Chainlink gathers data from external APIs and aggregators, while Pyth sources data directly from institutions like marketplaces and trading firms. Both aim to provide accurate pricing, but Pyth emphasizes speed and direct publishing.

Staking PYTH allows holders to support network security and governance while earning potential rewards. For long-term investors, it can be a way to participate in the ecosystem. Still, rewards depend on supply dynamics, and risks remain, so staking should be part of a diversified strategy.

You can buy PYTH on major digital currency marketplaces that support the token. Popular platforms include , Bybit, and OKX. Another option is , a non-custodial instant marketplace that lets users swap crypto without creating an account. It is designed for beginners who want fast and private trades.

The safest way is to use trusted marketplaces, enable two-factor authentication, and store tokens in a secure wallet. It is also wise to diversify Fundings instead of going all-in on one coin. Careful research, risk management, and long-term planning are key when investing in volatile assets like PYTH.

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to marketplace — for instance, .

- Press the “Start marketplace” button.

- Provide the recipient address to transfer your crypto to.

- Process the transfer.

- Receive your crypto coins.

Follow us on , , , , and to stay updated about the latest news on and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

The post first appeared on .