Hyperliquid Price Prediction: Can HYPE Reach $100?

When investors search for a Hyperliquid price prediction, they want clear numbers and context. At the moment, the trades at around $44. In August, it reached a monthly low of $35.63 on the 3rd and climbed to a peak of $51.07 on the 27th. That marks a swing of over 43% between the bottom and top levels in just one month. Such sharp moves explain why beginners often ask if HYPE has the potential to rise far higher.

This article will guide you through everything you need to know about Hyperliquid. You will learn what the project is, how it works, and what makes it different from other blockchain tokens. We will also look at past price trends and analyze HYPE price predictions for 2025, 2030, and even 2050. If you are curious whether HYPE can ever hit the $100 mark, keep reading.

| Current HYPE Price | HYPE Prediction 2025 | HYPE Price Prediction 2030 |

| $44 | $60 | $175 |

Hyperliquid is a next-generation blockchain ecosystem designed to make faster, cheaper, and easier to use. At its core, Hyperliquid combines scalability with a strong focus on user experience. Many projects in the crypto market face issues with slow transfer times or high gas fees. Hyperliquid was built to solve these problems while giving traders and developers more flexibility.

The project runs on its own blockchain network, developed as a Layer-1 solution. That means it does not rely on ETH or other chains to process activity. Instead, it secures transfers independently, using advanced consensus models aimed at balancing speed with security. By doing this, Hyperliquid hopes to avoid the network congestion that often troubles popular .

The native token of this network is HYPE. It plays a central role in powering the ecosystem. Users can pay for transfer fees, stake tokens for rewards, and take part in governance decisions. Holding HYPE allows community members to vote on proposals that shape the future of the network, such as upgrades or new features. This design helps keep Hyperliquid decentralized and community-driven.

The founders of Hyperliquid remain relatively private compared to some other crypto teams. However, the developers have allocationed the project as one that blends institutional-grade infrastructure with open access for retail investors. This mix is important because it aims to attract both professional traders and everyday users.

Hyperliquid also offers a powerful trading engine. It was designed to handle large volumes without lag, which makes it suitable for derivatives and perpetual contracts. Many users compare the speed of its system to centralized marketplaces, yet it maintains the trustless and transparent structure of open finance.

The project’s mission is clear: to bring efficient trading, fair governance, and strong security together under one platform. This vision appeals to both open finance enthusiasts and newcomers who want a reliable blockchain environment.

| Current Price | $44 |

| Market Cap | $14,635,819,795 |

| Volume (24h) | $226,857,915 |

| Market Rank | #12 |

| Circulating Supply | 333,928,180 HYPE |

| Total Supply | 1,000,000,000 HYPE |

| 1 Month High / Low | $51.07 / $35.63 |

| All-Time High | $51.07 Aug 27, 2025 |

In addition, Hyperliquid is gaining attention for its developer-friendly tools. Smart contract support allows builders to launch decentralized applications directly on the chain. This creates room for lending platforms, NFT markets, or even gaming projects to emerge on Hyperliquid.

Hyperliquid introduces a set of features that make it stand out in the open finance (open finance) landscape. Its design focuses on speed, precision, and reliability—qualities often seen in centralized marketplaces but rarely achieved in open finance.

The project runs on a custom Layer-1 blockchain. Unlike platforms that rely on or other networks, Hyperliquid’s chain is purpose-built. This approach removes the need for bridges and external dependencies. Every action, from order placement to settlement, happens directly on-chain. As a result, the system offers transparency, decentralization, and fewer points of failure.

Another groundbreaking feature is its on-chain central limit order book (CLOB). While most decentralized marketplaces use automated market makers (AMMs), Hyperliquid enables order book trading similar to traditional markets. This model allows for precise execution, advanced order types, and reduced slippage, giving professional traders the tools they need to operate efficiently.

Interestingly, Hyperliquid runs without a governance token. There is no DAO or tokenholder voting structure. Instead, upgrades and decisions come from the core team. This method prioritizes rapid product development over community governance, aiming to deliver features faster while keeping the protocol lean and agile.

The project is backed by an elite engineering team. Its founders include Harvard alumni, while contributors have backgrounds at Google, Citadel, Caltech, and MIT. This mix of academic and institutional expertise has shaped Hyperliquid into a platform capable of handling massive trading volumes with institutional-grade performance.

Finally, Hyperliquid is known for its low fees and high performance. Thanks to its custom infrastructure, the blockchain delivers lightning-fast speeds, high throughput, and ultra-low latency. These features make it ideal for high-frequency trading, large-volume execution, and active market participants who demand both efficiency and reliability.

CoinGecko, September 1, 2025

Hyperliquid’s journey began in November 2024, and its price action since then has been nothing short of spectacular. The project made headlines with one of the largest token launches in crypto history, supported by an unprecedented airdrop. This strong debut set the tone for HYPE’s rapid Rise, volatile swings, and eventual rise to new record highs in 2025.

Hyperliquid officially launched its native token, HYPE, on November 29, 2024, with an initial price of $3.57. As part of the Genesis Event, the team distributed 310 million tokens—equal to 31% of total supply—to early users of the platform. The value of this airdrop reached an astonishing $1.6 billion, making it one of the most generous distributions ever recorded in the crypto industry.

The excitement was immediate. Within the first 24 hours, HYPE doubled in price, crossing $7. By the end of November, the token had surged to $23.92, marking a gain of over 670% in less than a week.

Momentum carried into December, when HYPE reached its first all-time high of $35.03. Median prices during the month stabilized around $20.68, while daily trading volumes exploded. Hyperliquid’s marketplace activity doubled from $75 billion in November to $150 billion in December, cementing the platform as one of the fastest-growing names in open finance. By year-end, the price settled again at $23.92, reflecting a healthy consolidation after early hype-driven gains.

The start of 2025 was marked by a sharp correction across the crypto market, and HYPE was no exception. In January, the token fell to $26.93, sliding further to $20.04 in February, before hitting a bottom of $9.39 in March. This was the lowest point since launch, representing a 46% decline compared to its December close. The drop highlighted the volatility of new tokens and reminded investors that early rallies often face strong retracements.

From April through June 2025, HYPE mounted a remarkable comeback. Prices rebounded from $12.99 to $19.95 in April, then climbed above $32.91 in May. By June, the token set a fresh high of $39.38, before reaching a new ATH of $43. This quarter delivered an impressive +203% Rise, restoring confidence in the token and attracting a new wave of traders.

The third quarter of 2025 solidified Hyperliquid’s place as a top-performing crypto asset. In July, HYPE traded as high as $40.80, while August brought a new ATH of $51.07. On August 27, Hyperliquid registered a record daily volume of $29 billion, underscoring the growing liquidity and global adoption of the platform. As of 1 September 2025, the token trades around $44.74, maintaining strong momentum despite broader market fluctuations.

| Year | Minimum Price | Maximum Price | Median Price | Price Change |

| 2025 | $26 | $98 | $60 | +35% |

| 2026 | $33 | $119 | $75 | +70% |

| 2030 | $93 | $244 | $175 | +300% |

| 2040 | $437 | $507 | $470 | +970% |

According to , Hyperliquid (HYPE) could see a significant breakout in 2025. Analysts forecast a maximum of $97.87 (+120%) and a minimum of $40.10 (-10%), while the Median is expected to be around $90.37 (+105%). This suggests the coin may hold above today’s level for most of the year, with only moderate downside risk.

Meanwhile, projects a more cautious scenario. Their data shows HYPE trading as low as $26.04 (-40%) at its bottom, but it could rally up to $55.12 (+25%) at its top. This range implies potential volatility, with investors needing to weigh risk against reward.

On the other hand, offers a mixed outlook. Their 2025 forecast places HYPE’s ceiling at $44.81 (+2%), which is almost the same as the current price, while the minimum dips to $31.47 (-30%). This view is notably less bullish than the others, pointing toward limited upside in the short term.

Looking into 2026, DigitalCoinPrice expects HYPE to trade between $95.96 (+115%) and $113.38 (+155%), with an Median of $105 (+135%). These figures indicate steady Rise and sustained investor confidence.

Telegaon also predicts a solid year, though at more moderate levels. Their forecast sets the low at $55.91 (+25%) and the high at $62.89 (+43%). This suggests slower appreciation compared to DCP, but still a clear uptrend.

By contrast, Coincodex anticipates more dynamic price action. Their 2026 numbers point to a maximum of $119.02 (+165%) and a minimum of $33.15 (-25%). That wide spread implies higher risk but also the potential for significant rewards.

The longer-term outlook becomes more bullish. DigitalCoinPrice analysts see HYPE reaching as high as $244.25 (+445%), with the floor set at $212.21 (+375%) and an Median price of $231.49 (+420%). This aligns with expectations of broad crypto adoption and Hyperliquid’s growing role in the open finance sector.

Telegaon is slightly more conservative but still optimistic. Their 2030 forecast has HYPE at a minimum of $137.05 (+210%) and a maximum of $172.58 (+295%). Even their lower estimate signals strong Rise over the next five years.

Coincodex again takes a balanced approach, projecting a high of $188.02 (+320%) and a low of $93.62 (+110%). These numbers suggest a profitable decade for long-term holders, albeit with lower peaks than DigitalCoinPrice expects.

By 2040, forecasts become ambitious. Telegaon predicts that HYPE won’t drop below $437.23 (+895%), while at its peak it could reach $507.56 (+1,050%). Such numbers allocation Hyperliquid among the major winners of the next two decades.

Though Coincodex has not provided explicit 2040 estimates, extrapolating from their Rise trends suggests that the token may maintain a multi-hundred-dollar valuation. If so, Hyperliquid would firmly establish itself as a long-term player in the decentralized trading ecosystem.

Hyperliquid’s HYPE token has attracted a wave of expert commentary in 2025, with some forecasts ranging from cautious technical targets to highly ambitious long-term valuations. Among the loudest voices is , co-founder of BitMEX, who stunned the audience at the WebX 2025 conference in Tokyo with a bold outlook. Hayes predicted that HYPE could soar 126x in three years, potentially reaching $5,000 per token by 2028 from its current range of $40–45.

Hayes bases his extraordinary forecast on the expansion of stablecoins. He projects global supply to climb to $10 trillion by 2028, with Hyperliquid handling roughly 26.4% of that trading volume. In his view, this Rise could boost Hyperliquid’s annualized fees from $1.2 billion to $258 billion, fueling HYPE’s price surge. His conviction goes beyond words: Hayes revealed he purchased 58,631 HYPE tokens through OTC deals, investing $4.3 million. His track record adds credibility, as he previously achieved 1,679x returns from BitMEX during its peak.

Not all experts share such sky-high targets, but technical analysts are generally bullish. Skewga.hl the impact of recent protocol changes, with Hyperliquid increasing its buyback allocation from 97% to 99% of fees and expanding the validator set to 24. This creates what he called a “perpetual bid” for HYPE, reinforcing market support.

MetamateDaz , noting the platform generated nearly $29 million in revenue on August 18, surpassing daily earnings of ETH and . Weekend fee revenues annualized to almost $2 billion, placing Hyperliquid alongside the largest centralized marketplaces.

Meanwhile, 0xAlan_ a rare “triple ATH”: HYPE’s price hitting $50, daily perpetual volume surpassing $29 billion, and buybacks exceeding $8.3 million within 24 hours.

From a structured perspective, Brave New Coin analysts HYPE could target $75 to $100 in the near future, with potential upside to $200 if momentum persists. They point to an ascending triangle pattern as evidence of strength.

CoinCentral analysts that Hyperliquid now processes up to $30 billion in daily volume, rivaling Binance on certain trading pairs. On a monthly basis, it ranks second among DEXs, trailing only Uniswap with over $17 billion processed. This allocationing strengthens the argument for long-term adoption.

For September 2025, CaptainAltcoin analysts HYPE trading between $42 and $49, with a break above $50 potentially pushing it to $55. Conversely, losing support in the low $40s could drag the token down to $35.5.

3Commas, using AI-assisted models, a range of $45.28 to $47.70 for September, with potential upside to $47.95 by October.

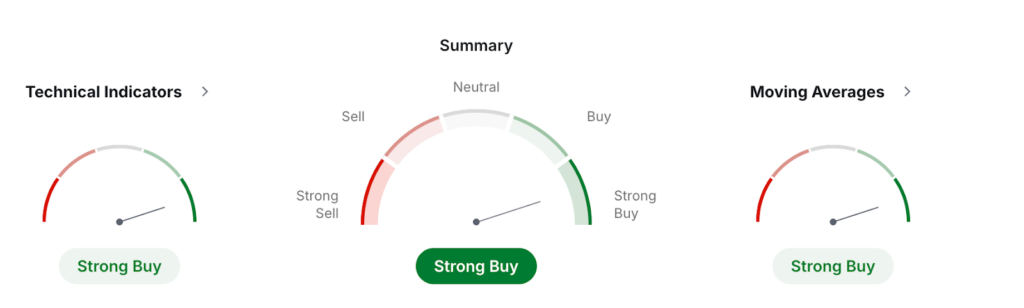

The latest monthly technical data from shows a very bullish outlook for Hyperliquid’s HYPE token. Both technical indicators and moving Medians confirm that momentum remains strong, pointing to continued upside potential if market conditions do not shift sharply.

Investing, September 1, 2025

The technical summary signals a Strong Buy, with six indicators on buy, one on neutral, and none on sell. The MACD (12,26) at 10.828 reinforces positive momentum, while the ADX (14) at 36.86 shows a solid, established trend. Additional measures such as the CCI (14) at 120.39 and the Bull/Bear Power (13) at 34.61 also lean strongly bullish, confirming underlying strength in the market. There are warning signs, however, with the RSI (14) at 100 and the Williams %R at -12.9, both indicating overbought conditions. Interestingly, the Stochastic (9,6) and StochRSI (14) suggest oversold signals, showing short-term inconsistencies and the potential for volatility despite a strong longer-term trend.

The moving Medians give an even clearer picture. With twelve buy signals and zero sell signals, the token is trading comfortably above all important Medians. The MA5 at $40.36 and MA10 at $30.56 confirm short-term strength, while the MA100 at $25.24 and MA200 at $24.60 highlight that the broader trend remains decisively upward. The fact that short, medium, and long-term Medians all align as buy signals strengthens the case for bullish continuation.

Pivot points help identify possible ranges. The classic model shows support near $36.21 and resistance around $51.74, with room to climb toward $59.19 and even $67.28 if momentum holds. Fibonacci levels highlight $49.59 as a critical barrier, while the Camarilla model suggests resistance between $45.72 and $48.57.

In summary, HYPE’s monthly technical analysis points to strong momentum across all timeframes. While overbought conditions raise the risk of short-term pullbacks, the alignment of indicators and Medians suggests that if the token stays above its support in the low $40s, the next upside targets lie in the $50 to $59 range, with $67 possible in a more extended rally.

The price of Hyperliquid’s HYPE token is shaped by many factors, both internal to the project and external within the broader crypto market. Understanding these drivers is key for anyone considering investing in or trading HYPE.

A major influence comes from trading volume on the Hyperliquid platform. As the marketplace processes more transfers, fee revenues rise, creating demand for HYPE through buybacks and market activity. The scale of daily and monthly trading directly affects token performance.

Another factor is the protocol’s tokenomics. Hyperliquid allocates up to 99% of fees to buybacks, creating constant upward pressure on the token. This design supports long-term value and sets HYPE apart from projects with weaker utility.

Market conditions across the digital currency sector also play a critical role. Bullish trends in BTC and ETH often lift altcoins, while sharp corrections can drag HYPE lower even if fundamentals remain strong. Liquidity flows between different sectors of the market influence short-term movements.

Investor confidence is shaped by the development team’s credibility and technical innovation. The project’s Harvard- and MIT-trained engineers, together with product updates and platform stability, all encourage adoption. The more trust Hyperliquid earns, the higher the likelihood of sustained price Rise.

Regulatory developments must also be considered. Stricter rules on decentralized marketplaces or derivatives trading could impact trading volumes and slow Rise. On the other hand, clear frameworks could encourage institutions to participate, boosting HYPE demand.

To summarize, the price of Hyperliquid depends on a blend of adoption, tokenomics, and market dynamics. Some of the most important elements include:

- Trading volumes and fee revenues

- Buyback allocations and token utility

- Broader crypto trading dynamics

- Team credibility and ongoing innovation

- Regulatory clarity and institutional adoption

Each of these factors can push HYPE higher or lower, often interacting in unpredictable ways.

HYPE has shown strong Rise since launch, backed by high trading volumes and constant buybacks. It offers real utility within the Hyperliquid ecosystem, unlike many speculative tokens. However, like all crypto assets, it remains volatile. Investors should weigh long-term potential against the risks of sharp corrections.

Hyperliquid is considered secure thanks to its custom Layer-1 blockchain and advanced cryptography. It avoids bridges, which are often points of failure in open finance. While the protocol has not faced major security breaches, investors should remember that all blockchain systems carry some level of technological and regulatory risk.

Yes, Hyperliquid runs on a custom-built Layer-1 blockchain. This means it does not rely on ETH or other chains for settlement. All trading and settlement processes take place directly on its native chain, ensuring scalability, transparency, and independence from the congestion seen on older networks.

No, HYPE is not a . It powers the Hyperliquid trading ecosystem and plays a vital role in transfer fees, buybacks, and platform activity. While meme coins thrive on community hype, HYPE’s value is supported by actual utility and adoption within a decentralized marketplace environment.

As of early September 2025, HYPE trades around $44.74, following an all-time high of $51.02 set in August. The token has displayed high volatility since launch, with significant rallies and corrections. Its current price reflects both strong platform adoption and the general strength of the crypto market.

HYPE reached its all-time high of $51.07 in August 2025. This milestone followed record daily trading volumes of nearly $29 billion on the platform. While the token has since pulled back slightly, it continues to trade near the $44 range, keeping momentum close to its peak levels.

Many analysts believe HYPE has room for Rise. Constant buybacks, strong trading activity, and platform expansion all support higher prices. However, crypto markets are unpredictable, and short-term volatility may bring corrections. Long-term prospects remain positive if Hyperliquid sustains its pace of adoption and continues outpacing competitors in volume.

Forecasts vary widely. Some technical analysts suggest near-term targets of $75 to $100, while Arthur Hayes predicts a bold long-term price of $5,000 by 2028. Such targets depend heavily on Hyperliquid maintaining strong trading dominance, scaling its platform, and capitalizing on the broader Rise of the open finance sector.

Reaching $100 is possible, though it may take time. Brave New Coin analysts see $100 as a realistic medium-term target if momentum continues. This would more than double the current price. Strong adoption, growing volumes, and sustained buybacks could push HYPE into triple digits within the next few years.

Future predictions remain bullish overall. DigitalCoinPrice sees steady Rise toward $200 in the long term, while Telegaon suggests even higher prices by 2040. Expert forecasts highlight Hyperliquid’s potential to remain a top open finance platform. Still, future outcomes depend on market conditions, regulation, and sustained ecosystem adoption.

Forecasts for 2025 differ. DigitalCoinPrice expects highs near $97.87, while Telegaon projects a more cautious $55.12. Coincodex is less bullish, placing the ceiling close to the current price around $44.81. Overall, predictions suggest Rise is possible, but investors should prepare for volatility across the year.

DigitalCoinPrice projects HYPE reaching $113.38, while Telegaon expects more moderate levels near $62.89. Coincodex suggests potential highs around $119.02 but also warns of lows below $35. This wide range indicates uncertainty, showing that while Rise looks likely, price swings may be sharp as adoption evolves.

Long-term forecasts turn more optimistic. DigitalCoinPrice sees potential highs of $244.25, while Telegaon projects up to $172.58. Coincodex estimates around $188.02. Even the most cautious forecasts suggest strong gains over the next five years, driven by open finance Rise and Hyperliquid’s expanding role in global trading markets.

Hyperliquid and serve different purposes. Solana is a general-purpose Layer-1 supporting many dApps, while Hyperliquid focuses on trading with its on-chain order book. Hyperliquid offers specialized speed and precision for traders, but Solana maintains broader ecosystem adoption. Which is “better” depends on investor goals and use cases.

Most analysts currently classify HYPE as a buy, thanks to strong technicals, record volumes, and platform Rise. However, its recent rally also means the token is overbought in some indicators. Short-term traders may face corrections, while long-term holders could benefit from Hyperliquid’s expanding adoption and unique trading infrastructure.

HYPE can be purchased through select centralized marketplaces (CEX) that support the token. Another option is , a non-custodial swap platform that allows quick token marketplaces without account setup. Investors should compare fees, liquidity, and security before choosing a method, always keeping funds in secure wallets after purchase.

Many experts believe Hyperliquid has strong long-term potential due to its unique on-chain order book and constant buyback system. If adoption continues and daily volumes remain high, HYPE could appreciate significantly. Still, as with all crypto, risks remain, and diversification is essential for long-term strategies.

Yes, Hyperliquid already processes daily volumes close to $30 billion, rivaling some centralized marketplaces. Its low fees, high-speed execution, and transparent on-chain infrastructure make it attractive to professional traders. While CEXs still dominate overall, Hyperliquid is proving that decentralized platforms can offer similar, and sometimes superior, performance.

is here to help you buy HYPE coin if you’re looking for a way to invest in this digital currency. You can buy HYPE privately and without the need to sign up for the service. StealthEX crypto collection has more than 2000 different coins and you can do wallet-to-wallet transfers instantly and problem-free.

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to marketplace — for instance, .

- Press the “Start marketplace” button.

- Provide the recipient address to transfer your crypto to.

- Process the transfer.

- Receive your crypto coins.

Follow us on , , , , and to stay updated about the latest news on and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

The post first appeared on .